5 Congestion Revenue Rights

Congestion revenue rights auction efficiency 1B became in effect on January 1, 2019. It includes key changes related to the congestion revenue rights settlements process:

- Targeted reduction of congestion revenue rights payouts on a constraint by constraint basis.

- Distribute congestion revenues to the extent that CAISO collected the requisite revenue on the constraint over the month. That is, implement a pro-rata funding for CRRs.

- Allow surpluses on one constraint in one hour to offset deficits on the same constraint in another hour over the course of the month.

- Only distribute surpluses to congestion revenue rights if the surplus is collected on a constraint that the congestion revenue right accrued a deficit, and only up to the full target payment value of the congestion revenue right.

- Distribute remaining surplus revenue at the end of the month, which are associated with constraints that collect more surplus over the month than deficits, to measured demand.

Monthly CRR Revenue

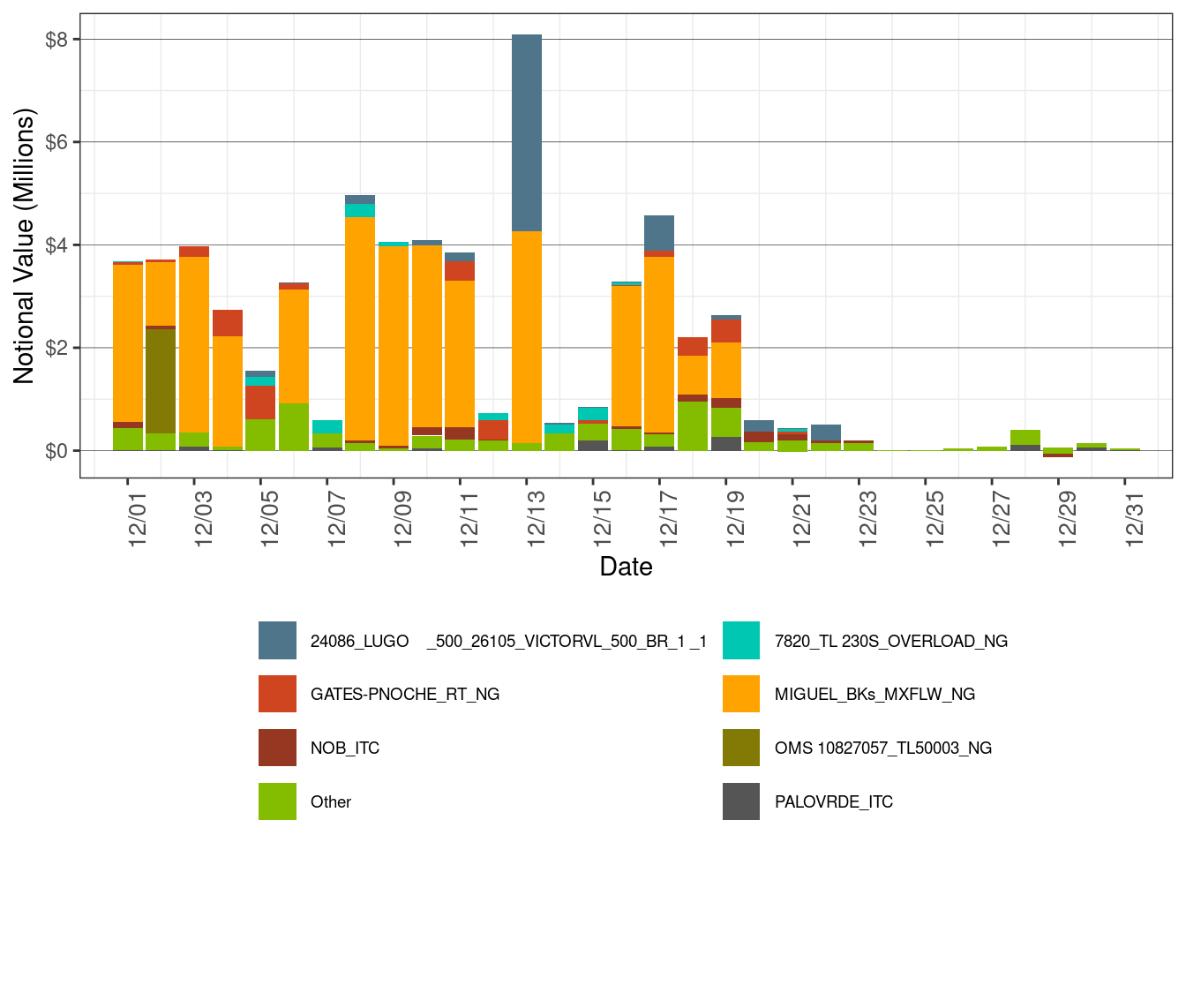

Figure 11 illustrates the daily CRR notional value in the corresponding month for the various transmission elements that experienced congestion during the month. CRR notional value is calculated as the product of CRR implied flow and constraint shadow price in each hour per constraint and CRR.

Figure 11: Daily CRR Notional Value by Transmission Element

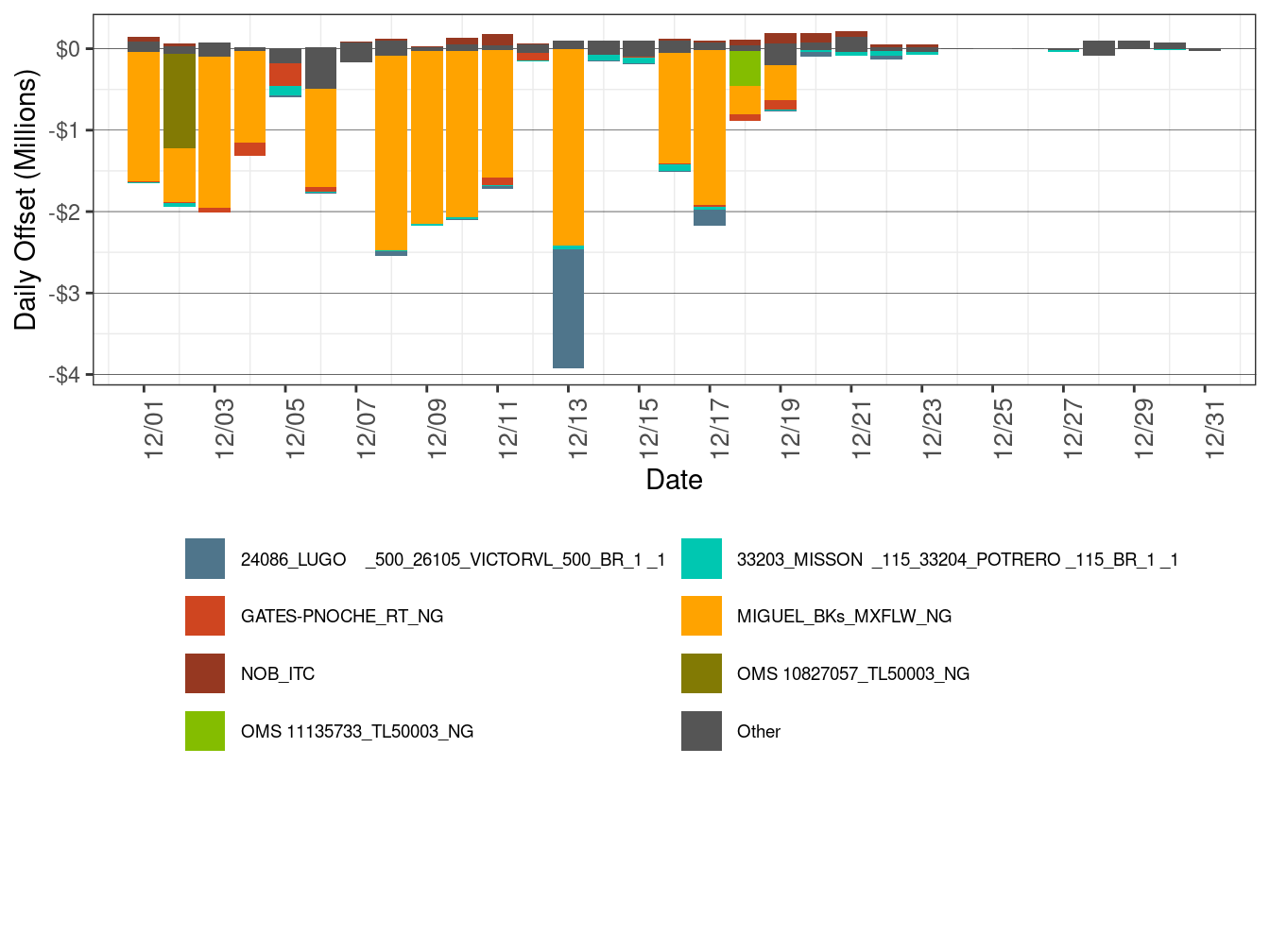

Figure 12 illustrates the daily CRR offset value in the corresponding month for the transmission elements that experienced congestion during the month. CRR offset value is the difference between the revenue collected from the congestion CRR. A positive CRR offset value represents surplus and a negative CRR offset value represents shortfall.

The main reason for CRR offset shortfall is

- MIGUEL_BKs_MXFLW_NG was binding in 14 days of this month, resulting in offset shortfall of $21.02 million. This nomogram was enforced for the operating procedure 7820.

The main reason for CRR offset surplus is

- NOB_ITC was binding in 17 days of this month, resulting in offset surplus of $0.86 million.

Figure 12: Daily CRR Offset Value by Transmission Element

Furthermore, Table 5 shows the monthly CRR deficit in the month broken out by transmission elements and Table 6 shows the monthly CRR surplus in the month broken out by transmission elements.

| Constraint | Percent |

|---|---|

| MIGUEL_BKs_MXFLW_NG | 74.30 |

| 24086_LUGO _500_26105_VICTORVL_500_BR_1 _1 | 6.86 |

| OMS 10827057_TL50003_NG | 4.11 |

| GATES-PNOCHE_RT_NG | 3.49 |

| Other | 2.95 |

| 33203_MISSON _115_33204_POTRERO _115_BR_1 _1 | 2.69 |

| OMS 11135733_TL50003_NG | 1.55 |

| OMS 10827084_TL50003_NG | 1.54 |

| 7820_TL 230S_OVERLOAD_NG | 1.41 |

| 33724_LOCKEFRD_60.0_33736_LODI JCT_60.0_BR_1 _1 | 0.56 |

| OMS 11140689_TL50003_NG | 0.54 |

| Constraint | Percent |

|---|---|

| NOB_ITC | 34.00 |

| Other | 32.11 |

| MALIN500_ISL | 6.44 |

| NdGrp: 34604_HELMS 3 _18.0_B1 | 4.77 |

| NdGrp: 34600_HELMS 1 _18.0_B1 | 4.21 |

| NdGrp: 25431_BKBLVDG1_16.0_B1 | 3.38 |

| NdGrp: 25432_BKBLVDG2_16.0_B1 | 3.38 |

| NdGrp: 25433_BKBLVDST_16.0_B1 | 3.33 |

| 7690-CONTRL-INYOKN_EXP_NG | 2.93 |

| 35618_SN JSE A_115_35620_EL PATIO_115_BR_1 _1 | 2.80 |

| NdGrp: 34602_HELMS 2 _18.0_B1 | 2.67 |

Table 7 shows the monthly CRR payment in the month broken out by transmission elements

| Constraint | Percent |

|---|---|

| MIGUEL_BKs_MXFLW_NG | 53.34 |

| 24086_LUGO _500_26105_VICTORVL_500_BR_1 _1 | 11.67 |

| Other | 10.12 |

| GATES-PNOCHE_RT_NG | 7.18 |

| NOB_ITC | 4.37 |

| 7820_TL 230S_OVERLOAD_NG | 3.07 |

| PALOVRDE_ITC | 2.82 |

| OMS 10827057_TL50003_NG | 2.55 |

| MALIN500_ISL | 2.47 |

| 33724_LOCKEFRD_60.0_33736_LODI JCT_60.0_BR_1 _1 | 1.26 |

| OMS 11135733_TL50003_NG | 1.13 |

Table 8 shows the monthly CRR payments. Net monthly balancing surplus in December was $1.14 million. The auction revenues credited to the balancing account for December was $4.54 million. As a result, the balancing account for December had a surplus of approximately $5.68 million, which was allocated to measured demand. The Net Monthly Balancing Surplus is calculated as sum of CRR surplus plus CRR daily Balancing account minus total auction revenue. The Total Auction revenue is sum of monthly and annual auction revenue. The Allocation to Measured demand is calculated as sum of Total Auction revenue plus Net Monthly Balancing Surplus.

| Description | DECEMBER -2021 | NOVEMBER -2021 |

|---|---|---|

| CRR Notional Value | $61,657,231 | $37,828,976 |

| CRR Deficit | -$28,089,857 | -$16,405,829 |

| CRR Settlement Rule | -$183 | -$99,983 |

| CRR Adjusted Payment | $33,567,191 | $21,323,164 |

| CRR Surplus | $2,530,910 | $3,755,642 |

| Monthly Auction Revenue | $1,464,763 | $3,628,216 |

| Annual Auction Revenue | $3,080,092 | $2,968,353 |

| CRR Daily Balancing Account | $3,151,212 | $879,919 |

| Net Monthly Balancing Surplus | $1,137,266 | -$1,961,009 |

| Allocation to Measured Demand | $5,682,122 | $4,635,561 |