3 Market Performance Metrics

Day-Ahead Prices

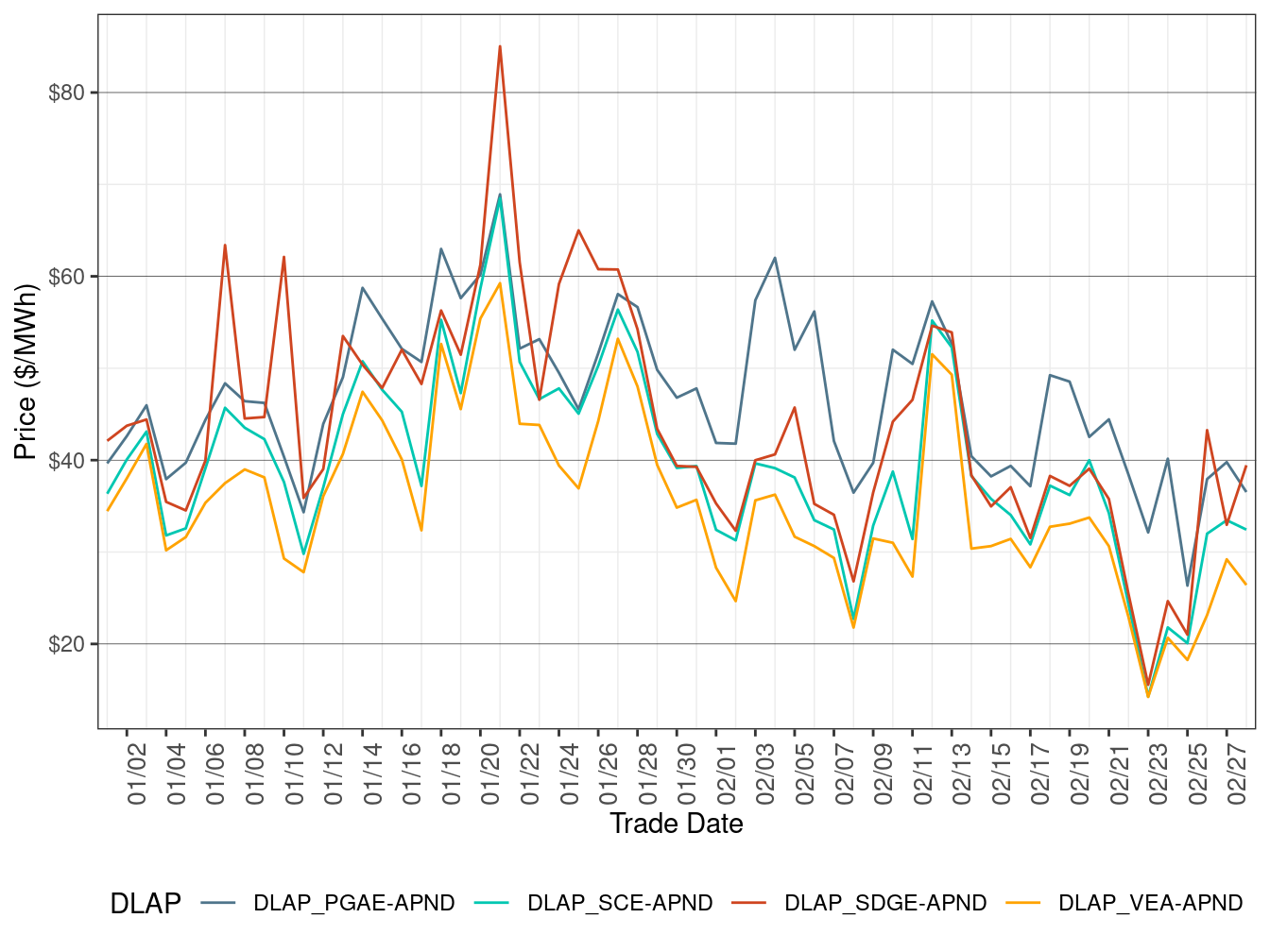

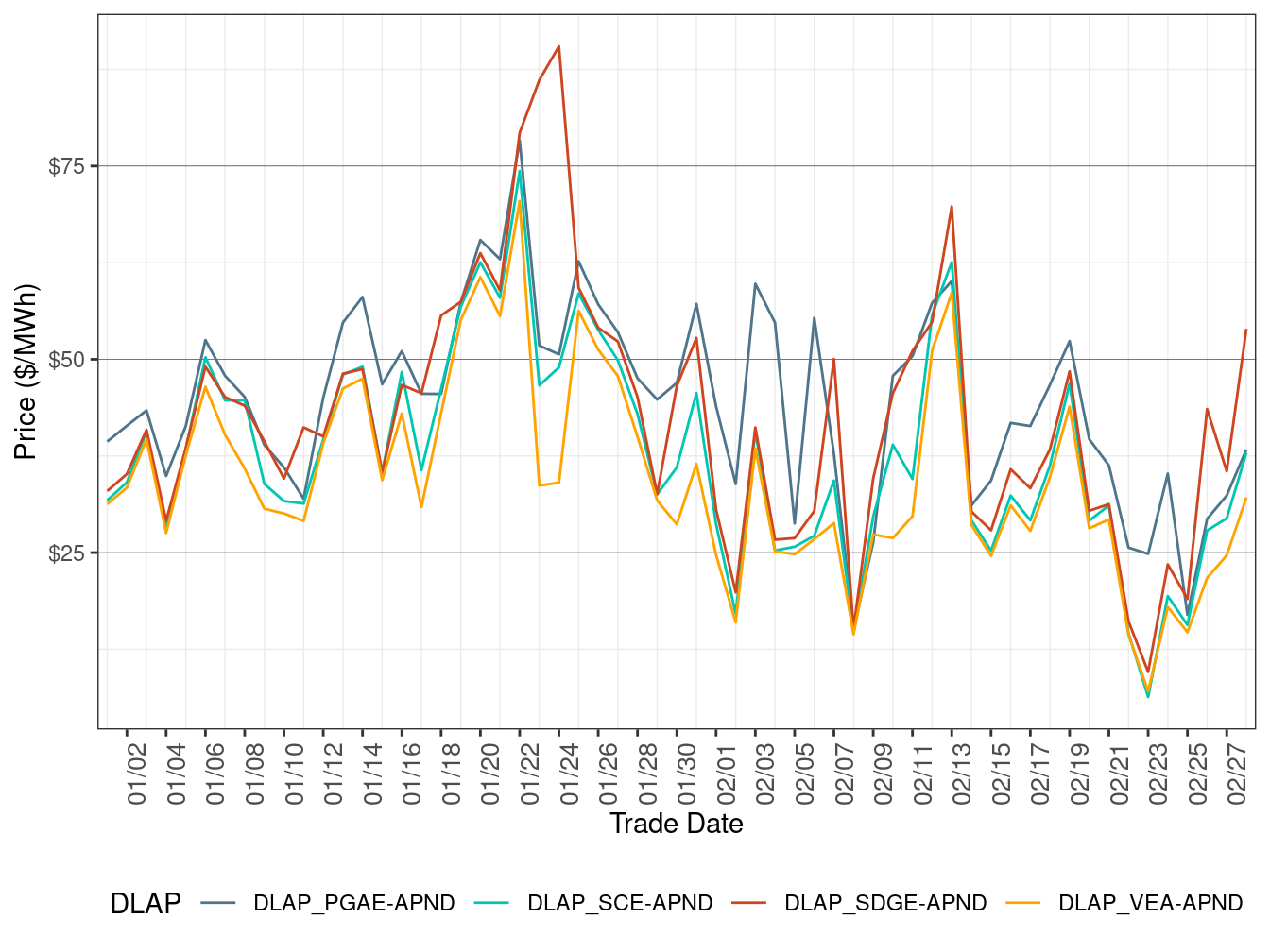

Figure 2 shows the daily simple average prices for all hours in IFM for each of the four default load-aggregation points (DLAP): PG&E, SCE, SDG&E, and VEA.

Day-Ahead DLAP prices on average decreased this month compared to the previous month.

TABLE 3 below lists the binding constraints that resulted in relatively high or low DLAP prices on certain dates.

Figure 2: IFM (Day-Ahead) Simple Average DLAP Prices (All Hours)

| DLAP LMPs Affected | Dates | Transmission Constraint |

|---|---|---|

| PGAE | February 4 | GATES2-MIDWAY-500kV line |

Real-Time Price

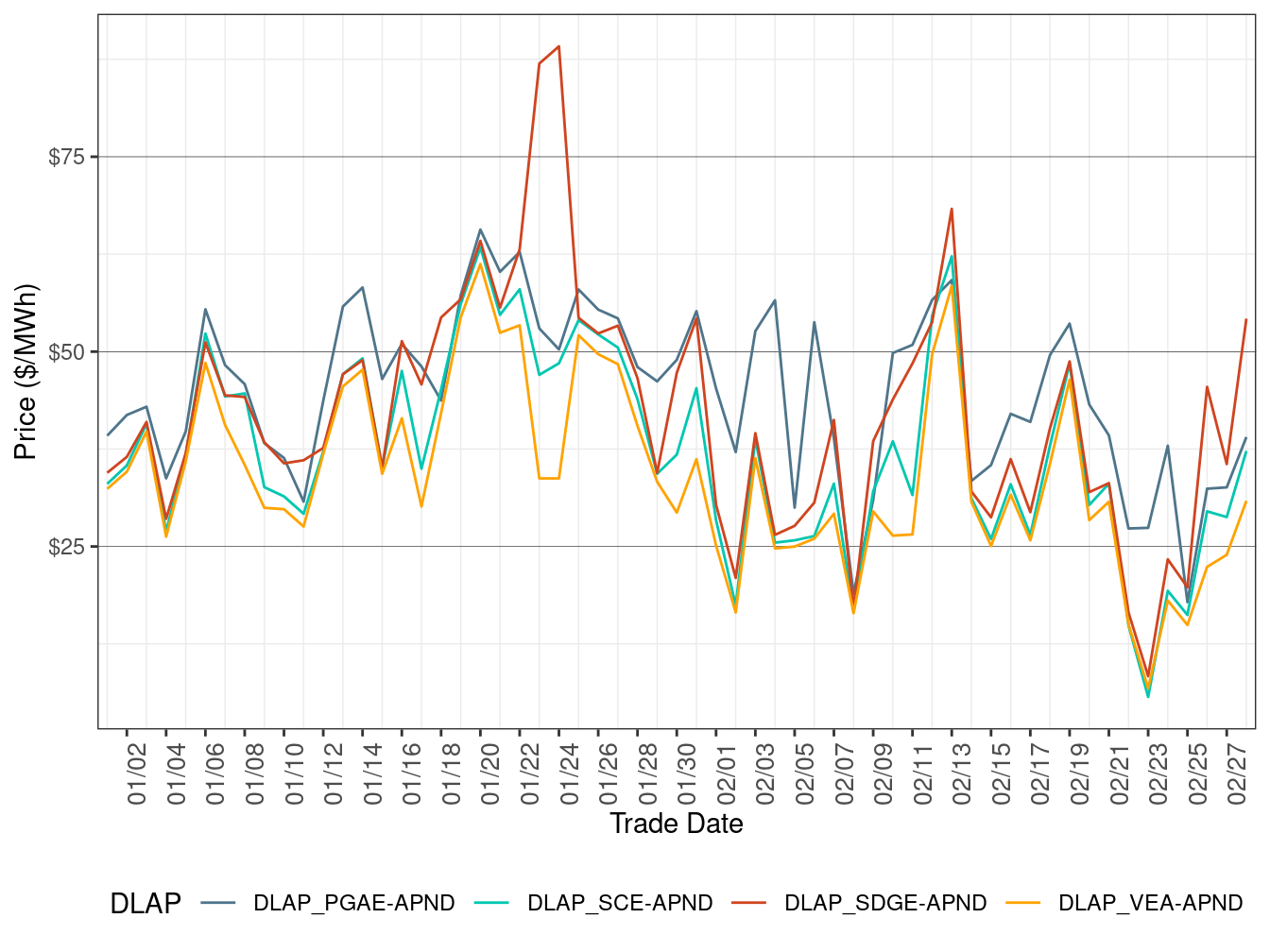

Figure 3 shows daily simple average prices for all four DLAPs (PG&E, SCE, SDG&E, and VEA) for all hours respectively in FMM.

FMM DLAP prices on average decreased this month compared to the previous month.

TABLE 4 below lists the binding constraints that resulted in relatively high or low DLAP prices on certain dates.

Figure 3: FMM Simple Average DLAP Prices (All Hours)

| DLAP LMPs Affected | Dates | Transmission Constraint |

|---|---|---|

| SDGE | February 13 | MIGUEL_MIGUEL 230kV transformer, OMS_17417611_ML_BK80_OOS nomogram |

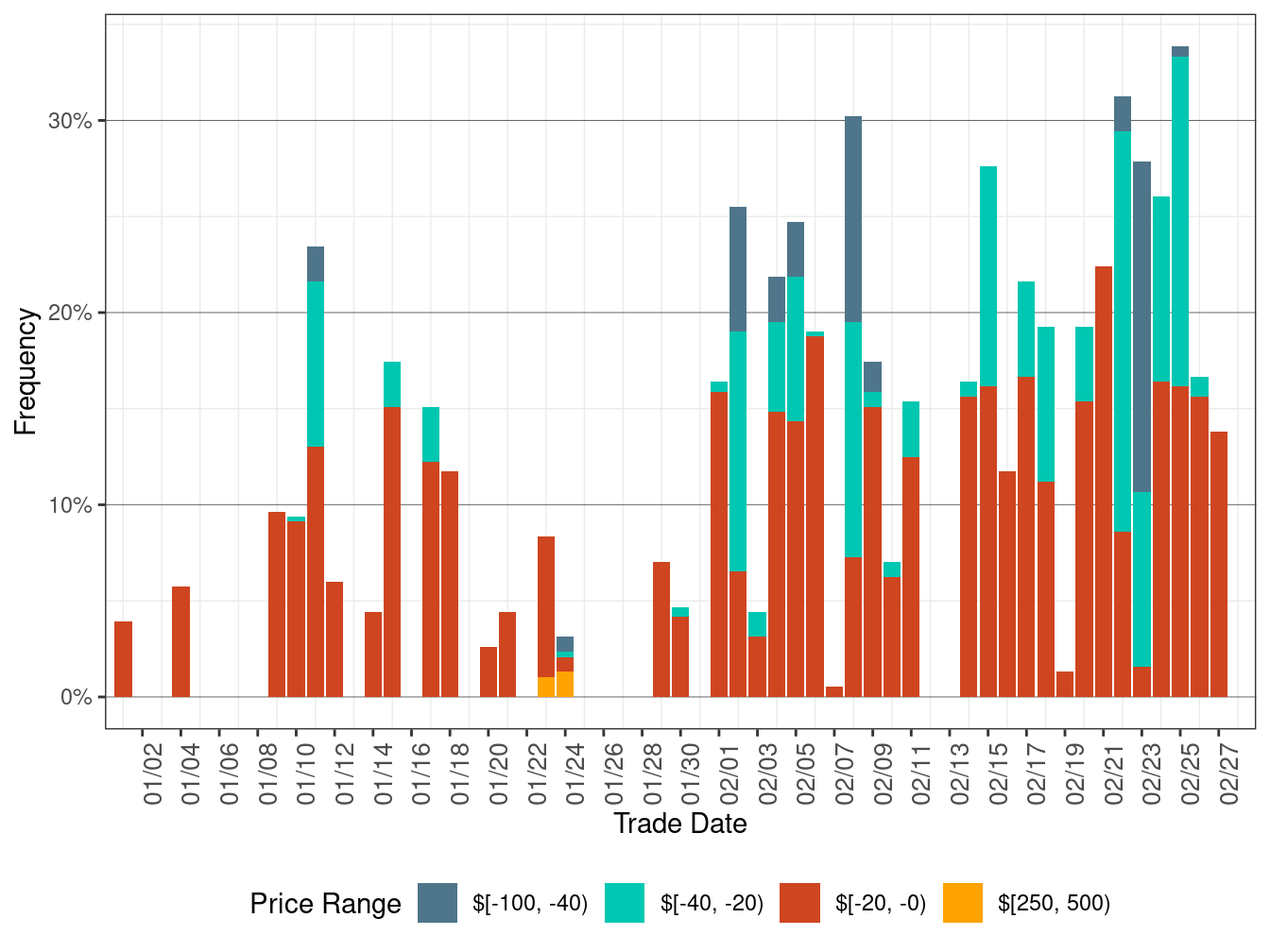

Figure 4 below shows the daily frequency of positive price spikes and negative prices by price range for the DLAPs in the FMM.

The cumulative frequency of prices in FMM above $250/MWh edged down to 0 percent in February from 0.08 percent in the previous month, while the cumulative frequency of negative prices rose to 16.84 percent in February from 4.34 percent in the previous month.

Figure 4: Daily Frequency of FMM DLAP Positive Price Spikes and Negative Prices

Figure 5 shows daily simple average prices for all the DLAPs (PG&E, SCE, SDG&E, and VEA) for all hours respectively in RTD.

RTD DLAP prices on average decreased this month compared to the previous month.

TABLE 5 below lists the binding constraints that resulted in relatively high or low DLAP prices on certain dates.

Figure 5: RTD Simple Average DLAP Prices (All Hours)

| DLAP LMPs Affected | Dates | Transmission Constraint |

|---|---|---|

| SDGE | February 13 | MIGUEL_MIGUEL 230kV transformer, OMS_17417611_ML_BK80_OOS nomogram |

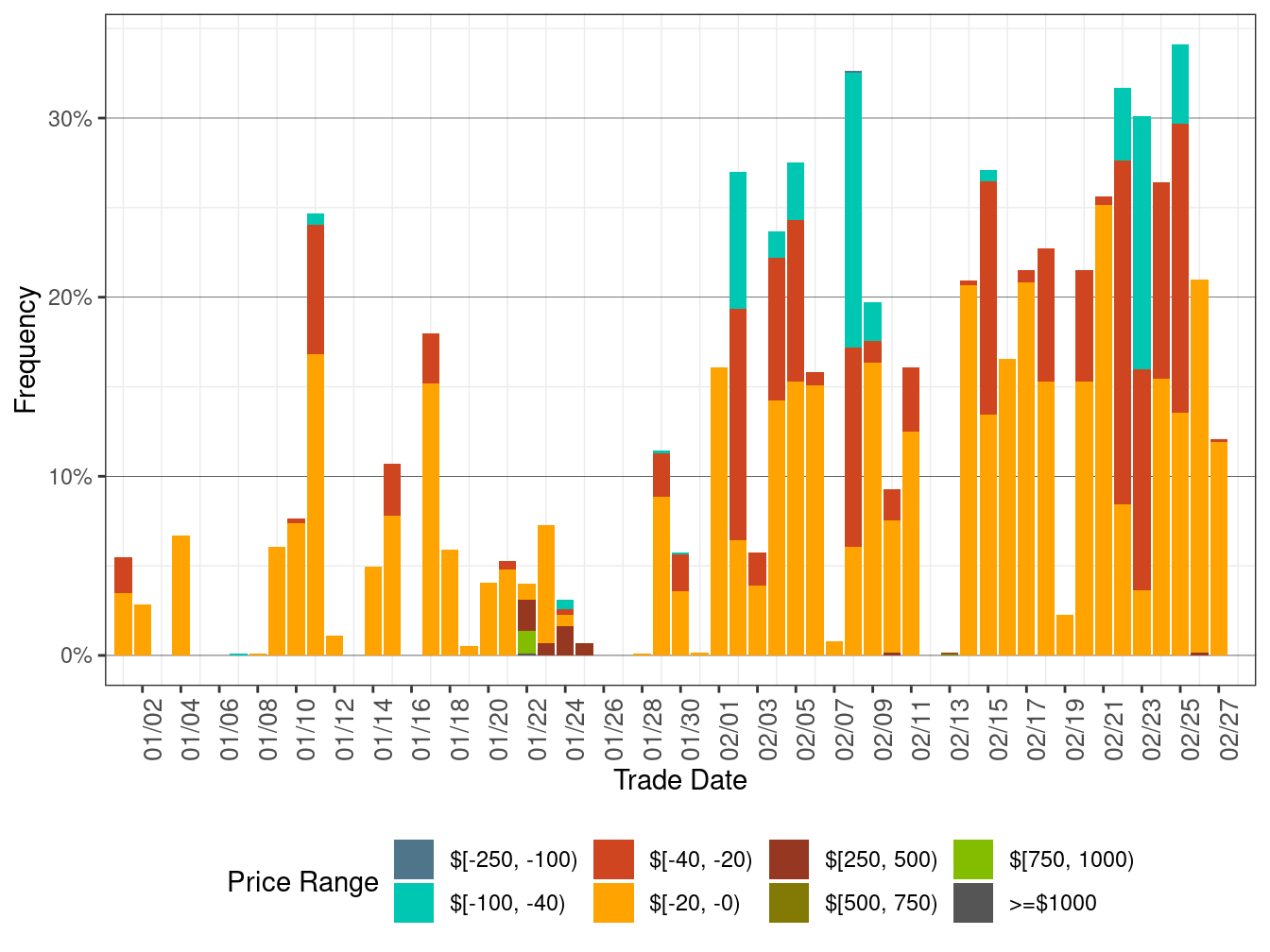

Figure 6 below shows the daily frequency of positive price spikes and negative prices by price range for the DLAPs in RTD.

The cumulative frequency of prices in RTD above $250/MWh declined to 0.02 percent in February from 0.20 percent in the previous month, while the cumulative frequency of negative prices increased to 18.13 percent in February from 4.21 percent in the previous month.

Figure 6: Daily Frequency of RTD DLAP Positive Price Spikes and Negative Prices