3 Market Performance Metrics

Day-Ahead Prices

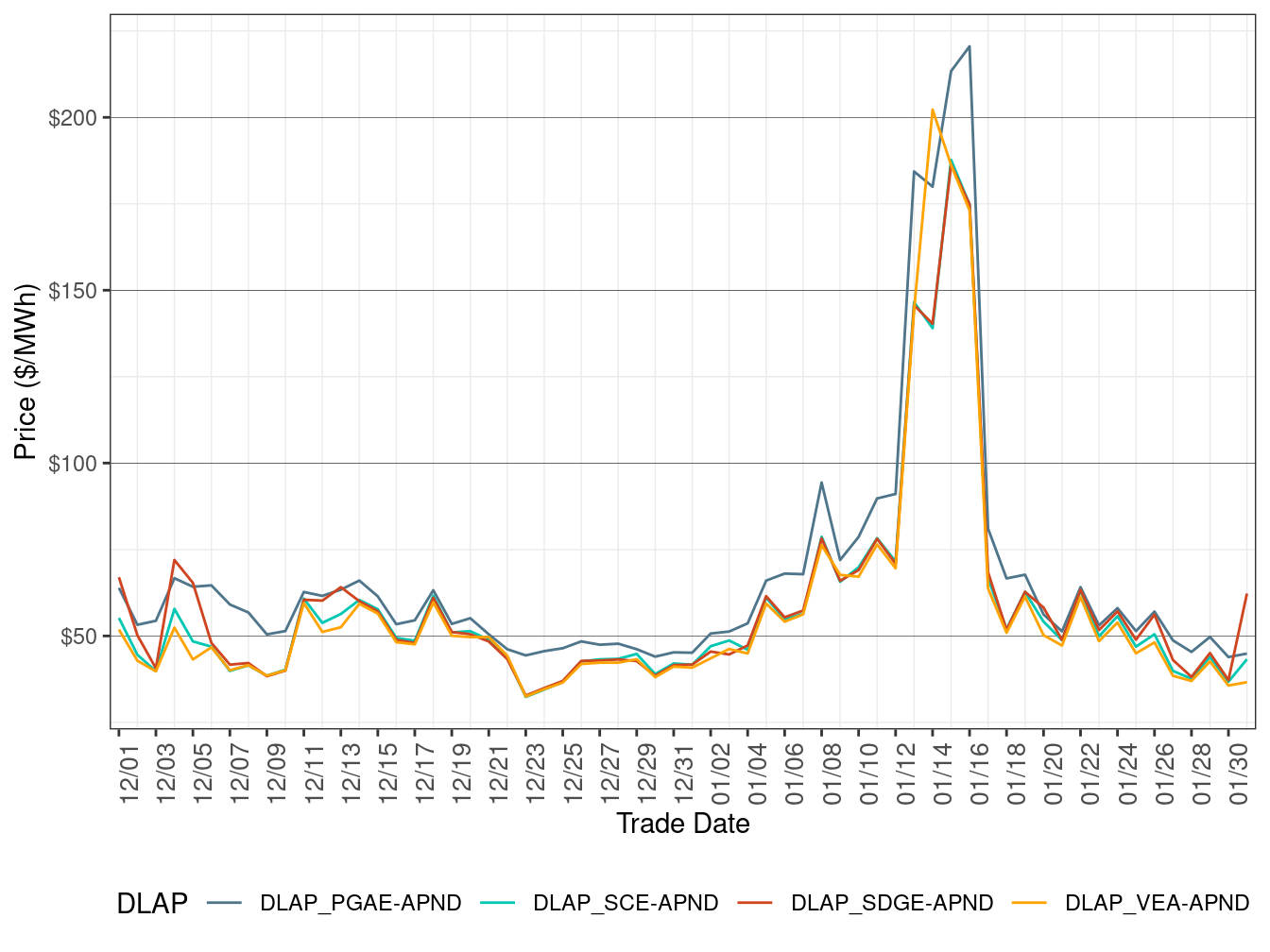

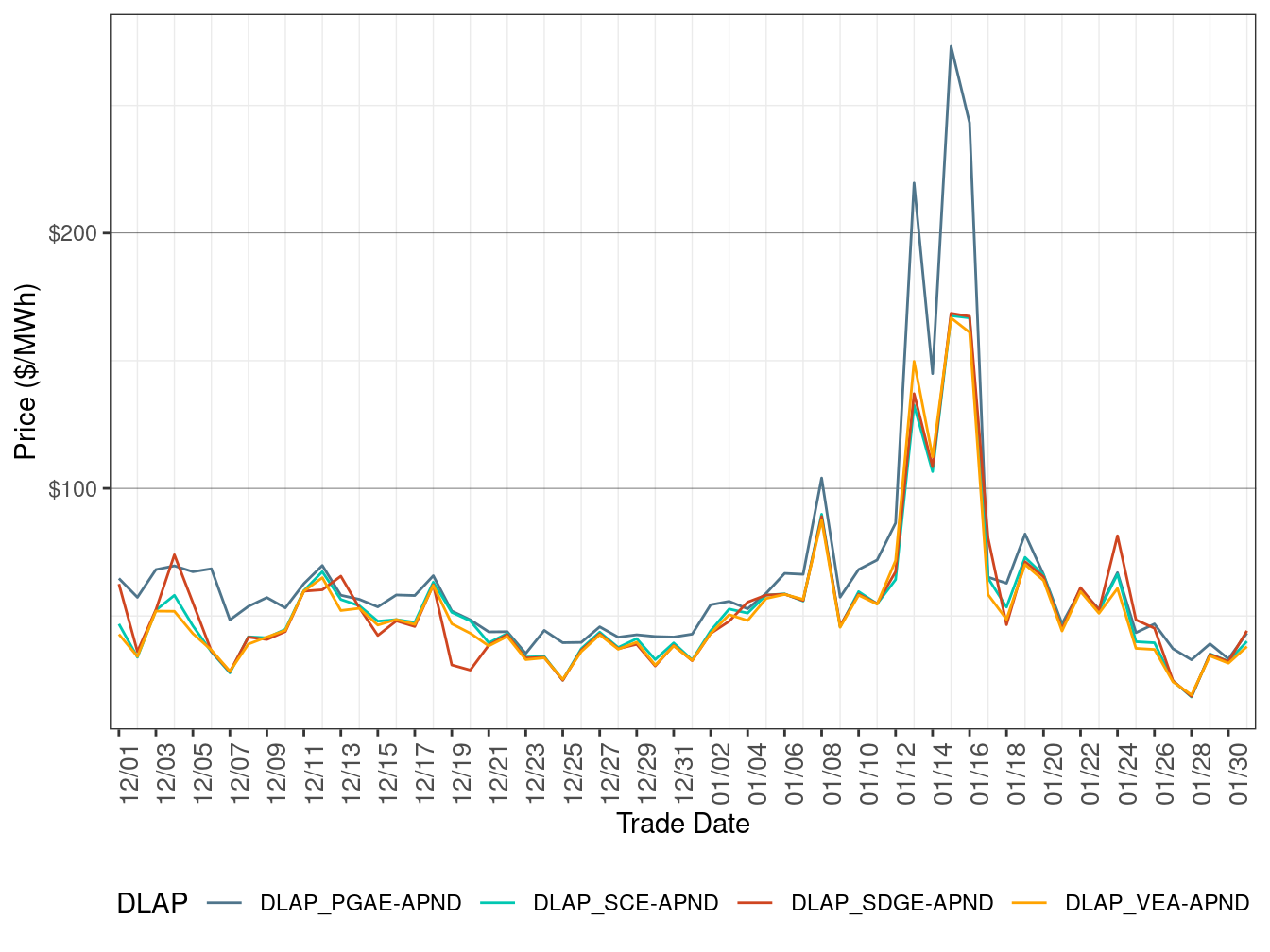

Figure 2 shows the daily simple average prices for all hours in IFM for each of the four default load-aggregation points (DLAP): PG&E, SCE, SDG&E, and VEA.

Day-Ahead DLAP prices on average increased compared to the previous month, correlated with rising natural gas prices and due to the winter storm over the MLK Day holiday weekend. Prices were also more volatile compared to the previous month. Prices were lower than the same month in the previous year.

TABLE 3 below lists the binding constraints that resulted in relatively high or low DLAP prices on certain dates.

Figure 2: IFM (Day-Ahead) Simple Average DLAP Prices (All Hours)

| DLAP LMPs Affected | Dates | Transmission Constraint |

|---|---|---|

| All | January 5 | GATES1-MIDWAY-500kV line |

| PGAE | January 6-7 | GATES1-MIDWAY-500kV line; TESLA-LOSBANOS-500kV line |

| All | January 8 | TESLA-LOSBANOS-500kV line; DEVERS-DEVERS-500 XFMR |

| All | January 11 | TESLA-LOSBANOS-500kV line; DEVERS-DEVERS-500 XFMR |

| PGAE | January 12 | TESLA-LOSBANOS-500kV line; DEVERS-DEVERS-500 XFMR |

| All | January 14-16 | GATES1-MIDWAY-500kV line; DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line |

| PGAE | January 17-18 | GATES1-MIDWAY-500kV line; DEVERS-DEVERS-500 XFMR |

| All | January 19 | GATES1-MIDWAY-500kV line |

| All | January 22 | DUMBARTN-NEWARK D-115kV line |

| All | January 24 | OMS-14862147_ML_BK81_NG nomogram |

| All | January 26 | GATES1-MIDWAY-500kV line |

| PGAE | January 27-28 | GATES1-MIDWAY-500kV line; LOSBANOS-GATES1-500kV line |

| All | January 29 | TESLA-LOSBANOS-500kV line; MOSSLD-LASAGUIL-230kV line |

| SDGE | January 31 | OMS_14830999_IV-SX-Outage_NG nomogram |

Real-Time Price

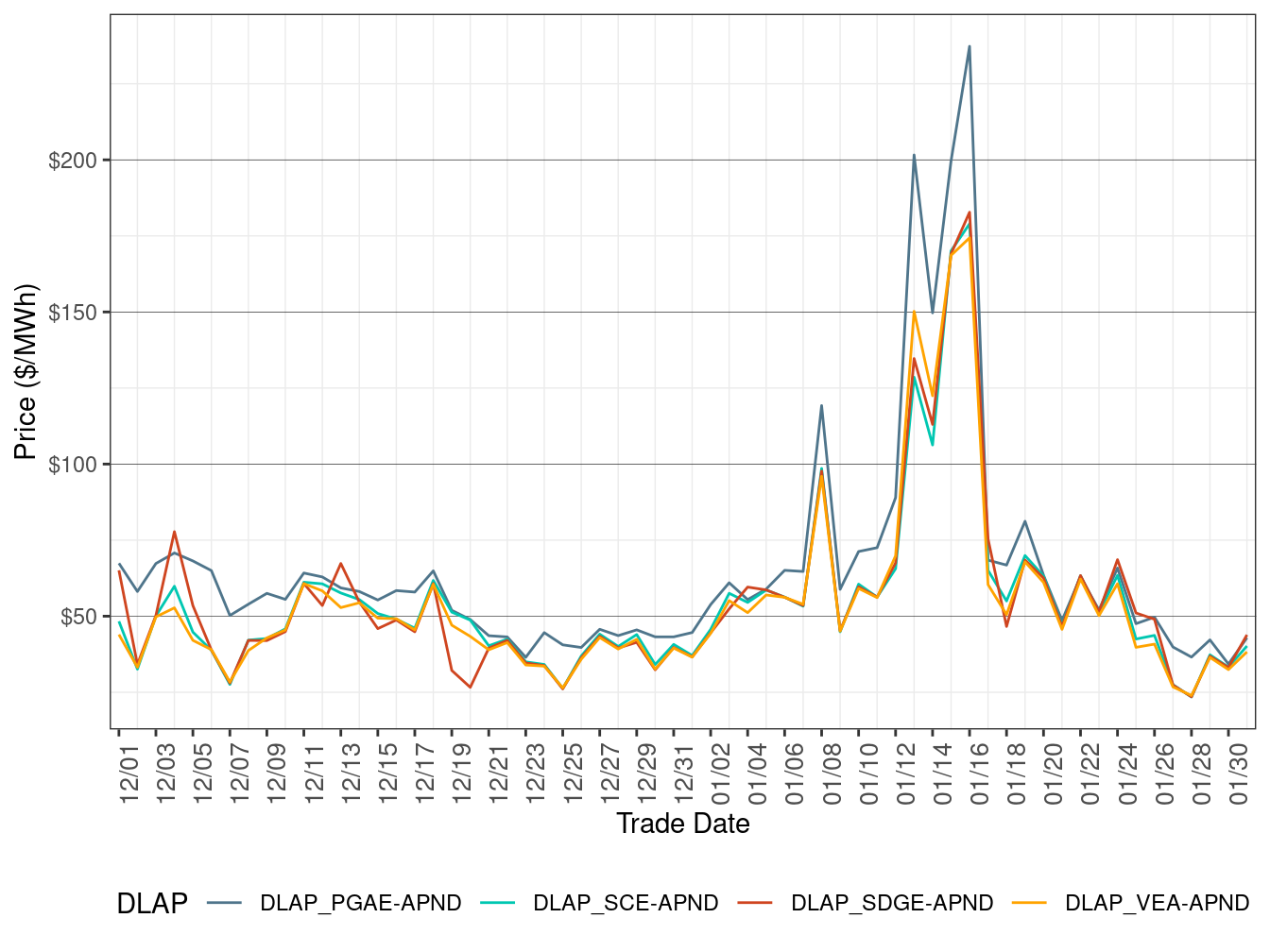

Figure 3 shows daily simple average prices for all four DLAPs (PG&E, SCE, SDG&E, and VEA) for all hours respectively in FMM.

FMM DLAP prices on average increased compared to the previous month, correlated with rising natural gas prices and due to the winter storm over the MLK Day holiday weekend. Prices were also more volatile compared to the previous month. Prices were lower than the same month in the previous year.

TABLE 4 below lists the binding constraints that resulted in relatively high or low DLAP prices on certain dates.

Figure 3: FMM Simple Average DLAP Prices (All Hours)

| DLAP LMPs Affected | Dates | Transmission Constraint |

|---|---|---|

| PGAE | January 6 | GATES1-MIDWAY-500kV line |

| All | January 8 | DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line |

| PGAE | January 10-12 | DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line; GATES1-MIDWAY-500kV line |

| All | January 13-16 | DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line; GATES1-MIDWAY-500kV line |

| PGAE | January 18 | DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line |

| All | January 19 | DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line |

| All | January 22 | GATES-MIDWAY-230kV line |

| All | January 24 | OMS-14862147_ML_BK81_NG nomogram |

| PGAE | January 27-29 | PANOCHE-GATES-230kV line; TESLA-LOSBANOS-500kV line; GATES1-MIDWAY-500kV line; MOSSLD-LASAGUIL-230kV line |

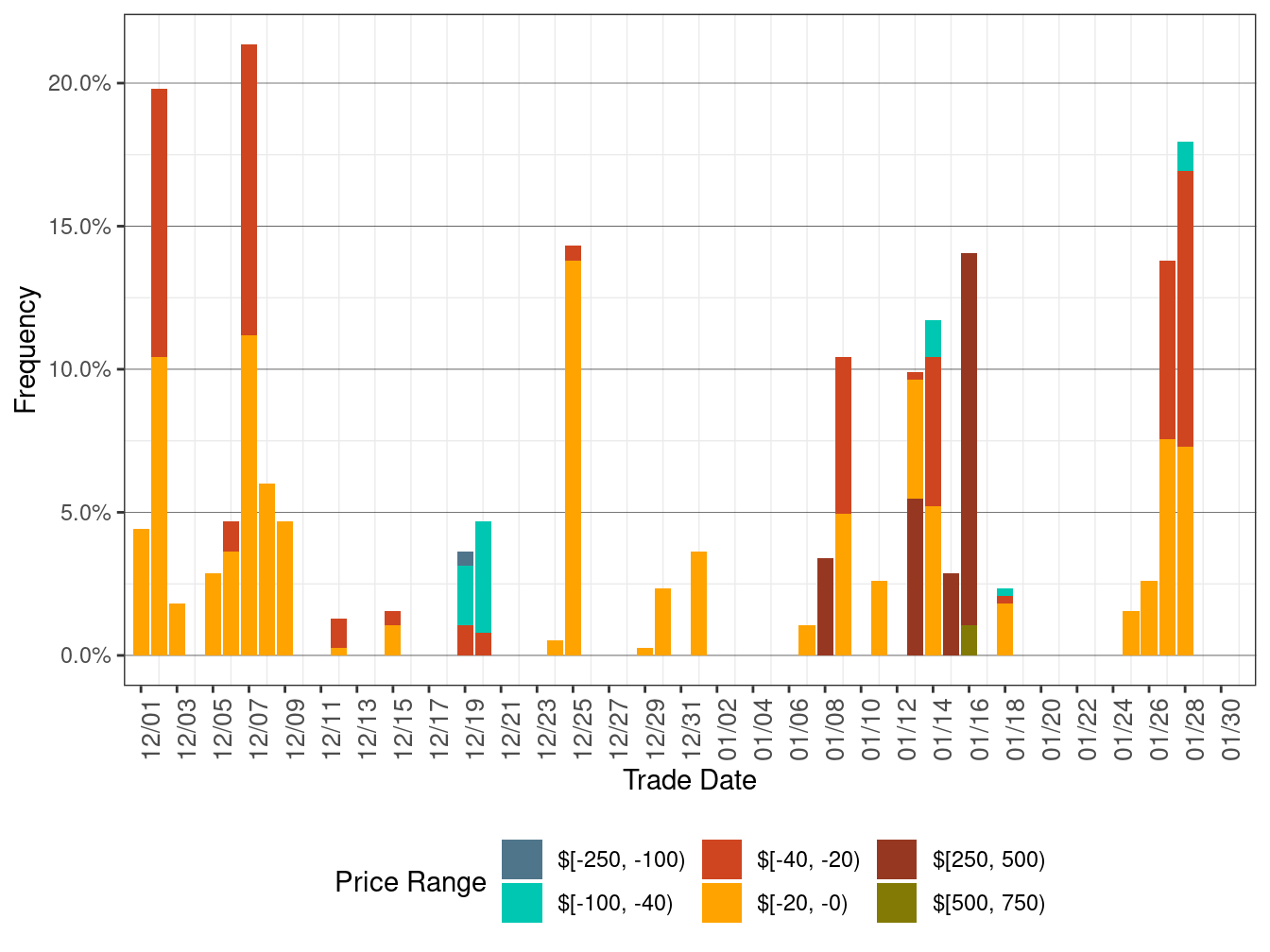

Figure 4 below shows the daily frequency of positive price spikes and negative prices by price range for the DLAPs in the FMM.

The cumulative frequency of prices in FMM above $250/MWh increased to 0.83 percent in January from 0 percent in the previous month, while the cumulative frequency of negative prices decreased to 2.33 percent in January from 3.04 percent in the previous month, despite an increase in renewable generation curtailment.

Figure 4: Daily Frequency of FMM DLAP Positive Price Spikes and Negative Prices

Figure 5 shows daily simple average prices for all the DLAPs (PG&E, SCE, SDG&E, and VEA) for all hours respectively in RTD.

RTD DLAP prices on average increased compared to the previous month, correlated with rising natural gas prices and due to the winter storm over the MLK Day holiday weekend. Prices were also more volatile compared to the previous month. Prices were lower than the same month in the previous year.

TABLE 5 below lists the binding constraints that resulted in relatively high or low DLAP prices on certain dates.

Figure 5: RTD Simple Average DLAP Prices (All Hours)

| DLAP LMPs Affected | Dates | Transmission Constraint |

|---|---|---|

| PGAE | January 1-2 | GATES1-MIDWAY-500kV line; TESLA-LOSBANOS-500kV line |

| All | January 8 | DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line |

| PGAE | January 9-12 | GATES1-MIDWAY-500kV line; TESLA-LOSBANOS-500kV line; DEVERS-DEVERS-500 XFMR |

| All | January 13-16 | GATES1-MIDWAY-500kV line; TESLA-LOSBANOS-500kV line; DEVERS-DEVERS-500 XFMR |

| All | January 19 | DEVERS-DEVERS-500 XFMR; TESLA-LOSBANOS-500kV line |

| All | January 22 | GATES-MIDWAY-230kV line |

| All | January 24 | OMS-14862147_ML_BK81_NG nomogram |

| PGAE | January 27-28 | PANOCHE-GATES-230kV line; TESLA-LOSBANOS-500kV line; GATES1-MIDWAY-500kV line |

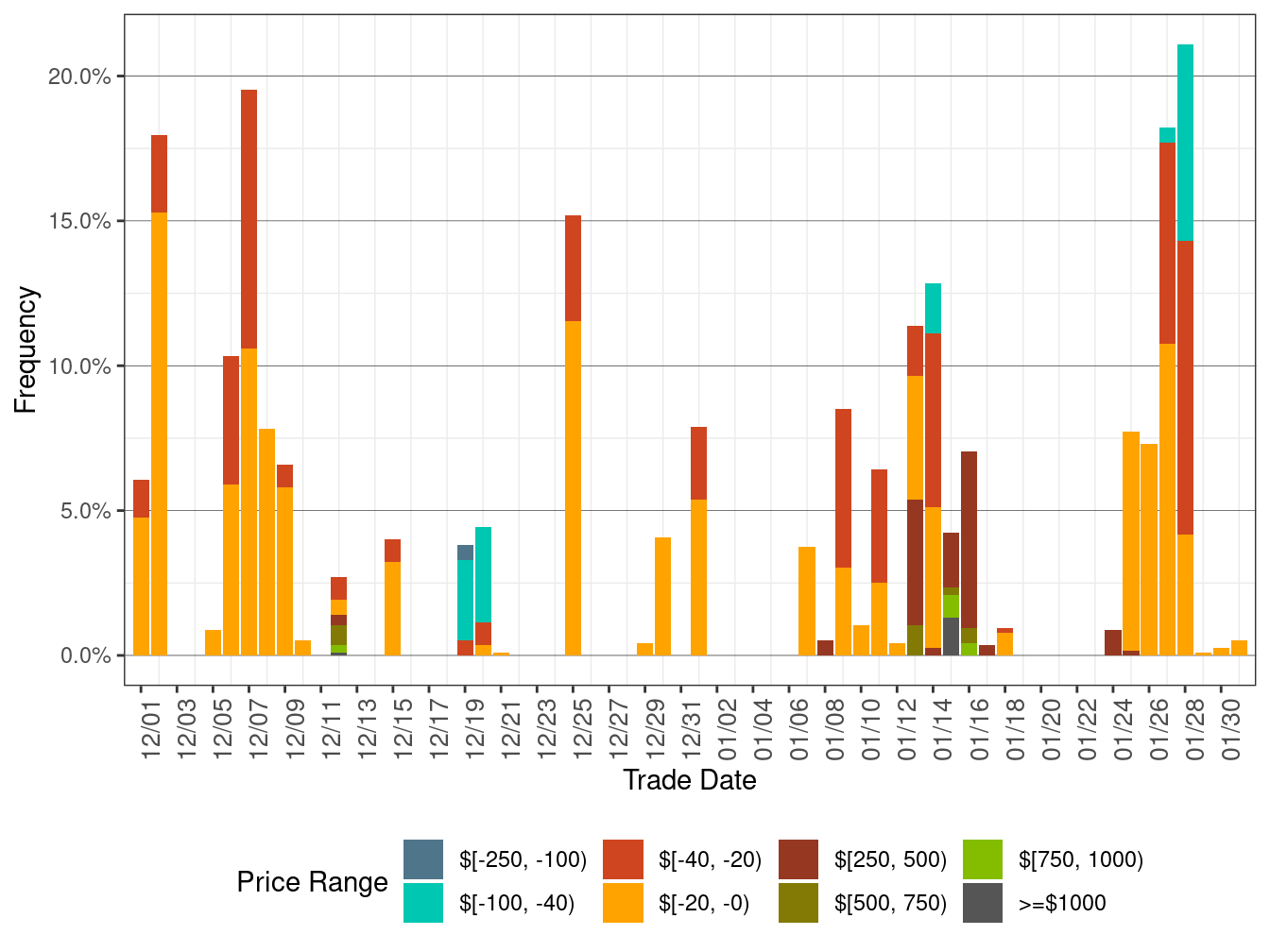

Figure 6 below shows the daily frequency of positive price spikes and negative prices by price range for the DLAPs in RTD.

The cumulative frequency of prices in RTD above $250/MWh increased to 0.61 percent in January from 0.04 percent in the previous month, while the cumulative frequency of negative prices decreased slightly to 3.31 percent in January from 3.32 percent in the previous month, despite an increase in renewable generation curtailment.

Figure 6: Daily Frequency of RTD DLAP Positive Price Spikes and Negative Prices