5 Congestion Revenue Rights

Congestion revenue rights auction efficiency 1B became effective on January 1, 2019. It includes key changes related to the congestion revenue rights settlements process:

- Targeted reduction of congestion revenue rights payouts on a constraint by constraint basis.

- Distribute congestion revenues to the extent that CAISO collected the requisite revenue on the constraint over the month. That is, implement a pro-rata funding for CRRs.

- Allow surpluses on one constraint in one hour to offset deficits on the same constraint in another hour over the course of the month.

- Only distribute surpluses to congestion revenue rights if the surplus is collected on a constraint that the congestion revenue right accrued a deficit, and only up to the full target payment value of the congestion revenue right.

- Distribute remaining surplus revenue at the end of the month, which are associated with constraints that collect more surplus over the month than deficits, to measured demand.

Monthly CRR Revenue

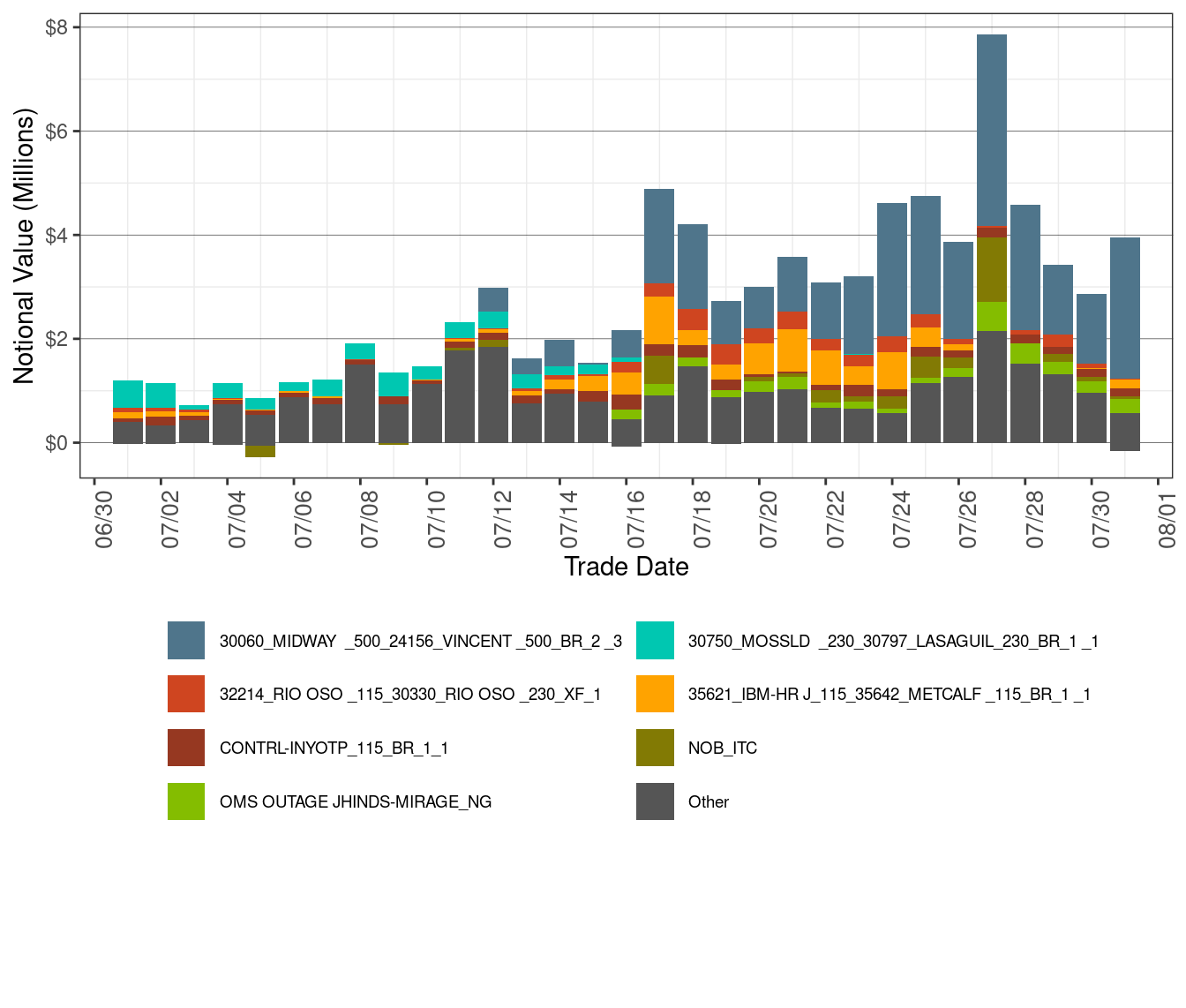

Figure 11 illustrates the daily CRR notional value in the corresponding month for the various transmission elements that experienced congestion during the month. CRR notional value is calculated as the product of CRR implied flow (MW) and constraint shadow price ($/MWh) in each hour per constraint and CRR.

Figure 11: Daily CRR Notional Value by Transmission Element

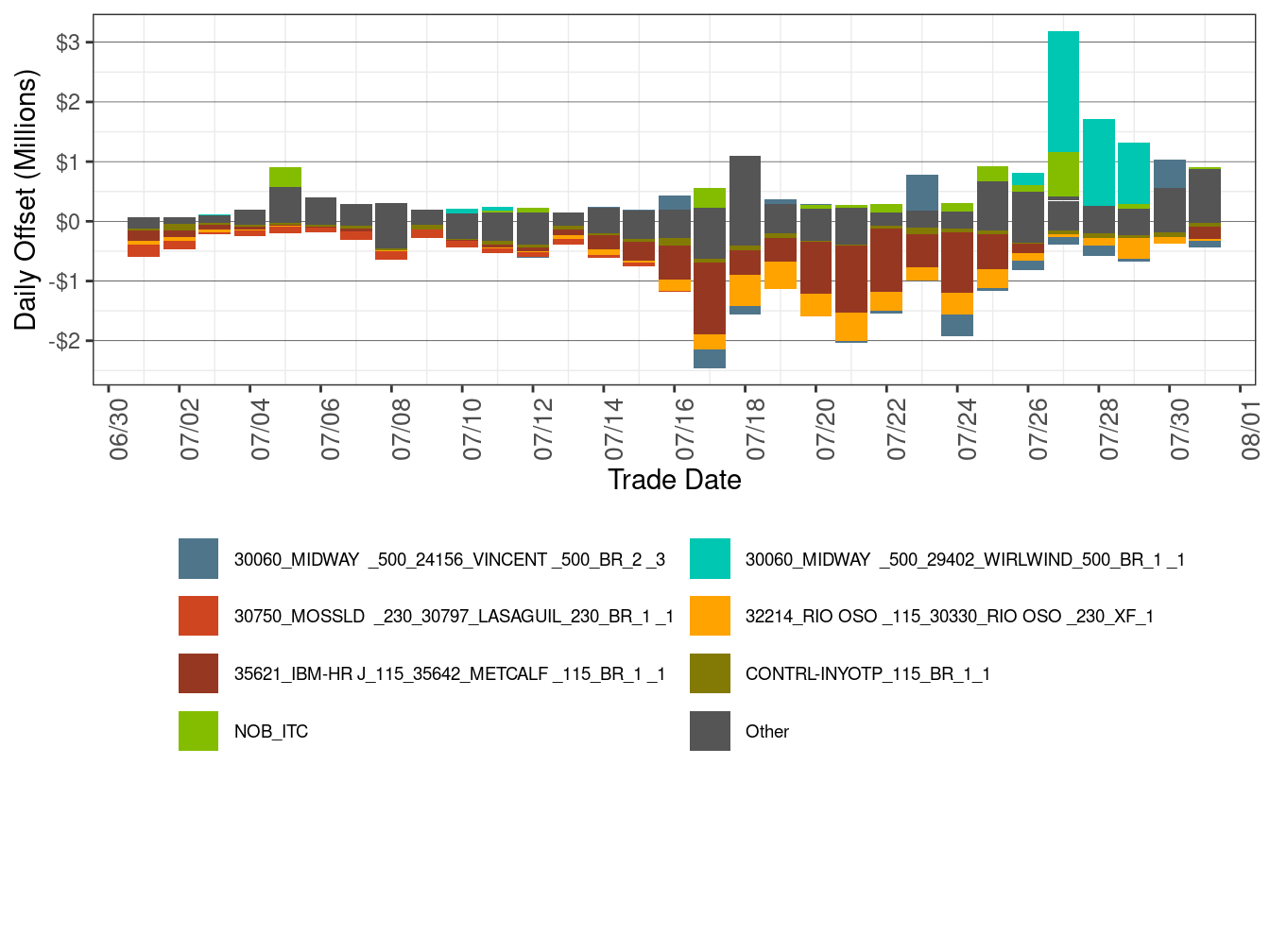

Figure 12 illustrates the daily CRR offset value in the corresponding month for the transmission elements that experienced congestion during the month. CRR offset value is the difference between the revenue collected from the congestion and the CRR notional value. A positive CRR offset value represents surplus and a negative CRR offset value represents shortfall.

As shown below, table 6 shows the percentage of monthly CRR deficit by transmission element and Table 7 shows the percentage of monthly CRR surplus by transmission element.

Figure 12: Daily CRR Offset Value by Transmission Element

| Constraint | Percent |

|---|---|

| 35621_IBM-HR J_115_35642_METCALF _115_BR_1 _1 | 38.68 |

| 32214_RIO OSO _115_30330_RIO OSO _230_XF_1 | 19.45 |

| Other | 10.07 |

| CONTRL-INYOTP_115_BR_1_1 | 6.88 |

| 30750_MOSSLD _230_30797_LASAGUIL_230_BR_1 _1 | 6.55 |

| 32056_CORTINA 60.0_30451_CRTNA M 1.0_XF_1 | 5.39 |

| 33533_OWENSTP2_115_33526_KASSONJ1_115_BR_1 _1 | 3.51 |

| 30060_MIDWAY _500_24156_VINCENT _500_BR_2 _3 | 3.29 |

| 34724_KRN OL J_115_34736_MAGUNDEN_115_BR_1 _1 | 2.37 |

| 35642_METCALF _115_35651_BAILY J3_115_BR_2 _1 | 1.93 |

| 22886_SUNCREST_230_22885_SUNCREST_500_XF_2 _P | 1.89 |

| Constraint | Percent |

|---|---|

| 30060_MIDWAY _500_29402_WIRLWIND_500_BR_1 _1 | 28.54 |

| Other | 18.73 |

| NOB_ITC | 14.04 |

| MEAD_ITC | 8.96 |

| 6410_CP1_NG | 7.04 |

| 30050_LOSBANOS_500_30055_GATES1 _500_BR_1 _2 | 5.73 |

| 31486_CARIBOU 115_30255_CARBOU M 1.0_XF_11 | 4.17 |

| 30060_MIDWAY _500_24156_VINCENT _500_BR_2 _3 | 3.89 |

| 22356_IMPRLVLY_230_21025_ELCENTRO_230_BR_1 _1 | 3.70 |

| 33500_MELNS JA_115_33509_AVENATP1_115_BR_1 _1 | 2.83 |

| MALIN500_ISL | 2.36 |

The main reasons for CRR offset shortfall were

- The line 35621_IBM-HR J_115_35642_METCALF _115_BR_1 _1 was binding on 26 days of this month, resulting in offset shortfall of $9.43 million.

- The transmission element 32214_RIO OSO _115_30330_RIO OSO _230_XF_1 was binding on 29 days of this month, resulting in offset shortfall of $4.74 million.

The main reasons for CRR offset surplus were

- The line 30060_MIDWAY _500_29402_WIRLWIND_500_BR_1 _1 was binding on 9 days of this month, resulting in offset surplus of $4.90 million.

- The intertie NOB_ITC was binding on 15 days of this month, resulting in offset surplus of $2.41 million.

Table 8 shows the percentage of monthly CRR payment by transmission element.

| Constraint | Percent |

|---|---|

| 30060_MIDWAY _500_24156_VINCENT _500_BR_2 _3 | 46.48 |

| Other | 15.32 |

| OMS OUTAGE JHINDS-MIRAGE_NG | 5.70 |

| NOB_ITC | 5.52 |

| 34116_LE GRAND_115_34115_ADRA TAP_115_BR_1 _1 | 5.20 |

| 30060_MIDWAY _500_29402_WIRLWIND_500_BR_1 _1 | 4.88 |

| 30750_MOSSLD _230_30797_LASAGUIL_230_BR_1 _1 | 4.76 |

| CONTRL-INYOTP_115_BR_1_1 | 4.43 |

| 30050_LOSBANOS_500_30055_GATES1 _500_BR_1 _2 | 2.85 |

| 31486_CARIBOU 115_30255_CARBOU M 1.0_XF_11 | 2.43 |

| 7430_KTTLM_GATES_70_1 | 2.42 |

Table 9 shows the monthly CRR statistics. The Net Monthly Balancing Surplus calculates as CRR Surplus plus CRR Daily Balancing Account minus total auction revenue. The total auction revenue is the sum of Monthly Auction Revenue and Annual Auction Revenue. The Allocation to Measured demand is calculated as sum of total auction revenue and Net Monthly Balancing Surplus.

Net Monthly Balancing Surplus in July was $13.36 million. The auction revenues credited to the balancing account for July were $7.66 million. As a result, the balancing account had a surplus of approximately $21.02 million compared to $10.28 million in the previous month, which was allocated to measured demand.

| Description | JULY -2023 | JUNE -2023 |

|---|---|---|

| CRR Notional Value | $84,732,419 | $51,313,085 |

| CRR Deficit | -$24,371,862 | -$13,417,641 |

| CRR Settlement Rule | -$45,357 | -$3,898 |

| CRR Adjusted Payment | $60,315,200 | $37,891,546 |

| CRR Surplus | $17,167,874 | $3,122,719 |

| Monthly Auction Revenue | $2,787,580 | $3,337,542 |

| Annual Auction Revenue | $4,868,577 | $5,047,605 |

| CRR Daily Balancing Account | $3,848,993 | $7,164,462 |

| Net Monthly Balancing Surplus | $13,360,709 | $1,902,035 |

| Allocation to Measured Demand | $21,016,866 | $10,287,182 |