8 Western Energy Imbalance Market

On November 1, 2014, the California Independent System Operator Corporation (CAISO) and Portland based PacifiCorp fully activated the Western Energy Imbalance Market (WEIM). This real-time market is the first of its kind in the West. The WEIM allows balancing authorities outside of the CAISO balancing authority area to voluntarily take part in the imbalance energy portion of the CAISO locational marginal price-based real-time market. PacifiCorp, the CAISO, and market participants participated in market simulations prior to the start of the Energy Imbalance Market on November 1, including parallel production from October 1 to November 1.

The WEIM uses state-of-the-art software to analyze regional grid needs and make available low-cost generation to meet demand every five minutes. It can bring many benefits to the West such as cost savings, improving the efficiency of dispatching resources, facilitating the renewable integration, more reliability, etc.

On December 1, 2015, NV Energy (NVE), the Nevada-based utility successfully began participating in the WEIM. With the addition of NV Energy (NVE), the WEIM expanded into Nevada, where the utility serves 2.4 million customers.

On October 1, 2016, Phoenix-based Arizona Public Service (AZPS) and Puget Sound Energy (PSEI) of Washington State successfully began full participation in the WEIM. With the addition of AZPS and PSEI, the WEIM footprint grew to over 5 million consumers in California, Washington, Oregon, Arizona, Idaho, Wyoming, Nevada and Utah.

On October 1, 2017, Portland General Electric Company (PGE) became the fifth western utility to successfully begin full participation in the WEIM. PGE joined AZPS, PSEI, NVE, PacifiCorp and the ISO, together serving over 38 million consumers in eight states: California, Arizona, Oregon, Washington, Utah, Idaho, Wyoming and Nevada.

On April 4, 2018, Boise-based Idaho Power (IPCO) and Powerex of Vancouver (BCHA), British Columbia successfully entered the WEIM, allowing the ISO’s real-time power market to serve energy imbalances occurring within about 55 percent of the electric load in the Western Interconnection. The eight WEIM participants serve more than 42 million consumers in the power grid stretching from the border with Canada south to Arizona, and eastward to Wyoming.

On April 3, 2019, Sacramento Municipal Utility District (SMUD), part of the Balancing Authority of Northern California (BANC), successfully began full participation in the WEIM, becoming the first publicly owned agency to become a WEIM entity.

On April 1, 2020, Seattle City Light (SCL) and Salt River Project (SRP) successfully joined the WEIM. The two utilities serve about 1.5 million customers in the West’s first real-time energy market. Together with SRP and SCL, the WEIM participants represent 61 percent of the load in the Western Electric Coordinating Council (WECC).

On March 25, 2021, the Turlock Irrigation District (TIDC) and the Balancing Area of Northern California (BANC) Phase 2, comprised of the Modesto Irrigation District (MID), the City of Redding, the City of Roseville, and the Western Area Power Administration – Sierra Nevada Region, began participating in the West’s first real-time energy market.

On April 1, 2021, Los Angeles Department of Water and Power (LADWP) and the Public Service Company of New Mexico (PNM) joined the WEIM. PNM’s entrance expanded the real-time energy market into New Mexico.

On June 16, 2021, NorthWestern Energy (NWMT) began participating in the WEIM. With the addition of NWMT, the WEIM footprint extended into Montana, serving consumers across ten states, including portions of Arizona, California, Idaho, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming, and Montana.

On March 2, 2022, Avista Utilities (AVA) and Tacoma Power (TPWR) became the new members of the WEIM, with both utilities serving a combined 600,000 electric customers in the Pacific Northwest.

On May 3, 2022, the Bonneville Power Administration (BPAT) and Tucson Electric Power (TEPC) both formally joined the WEIM, becoming the new participants in the WEIM. With a total of 19 participants, the WEIM serves 77% of the demand for electricity in the Western United States.

On April 5, 2023, Western Area Power Administration (WAPA) Desert Southwest region, El Paso Electric (EPE) and AVANGRID formally began participating in the WEIM, which now represents nearly 80% of the demand for electricity in the Western Interconnection.

WEIM Prices

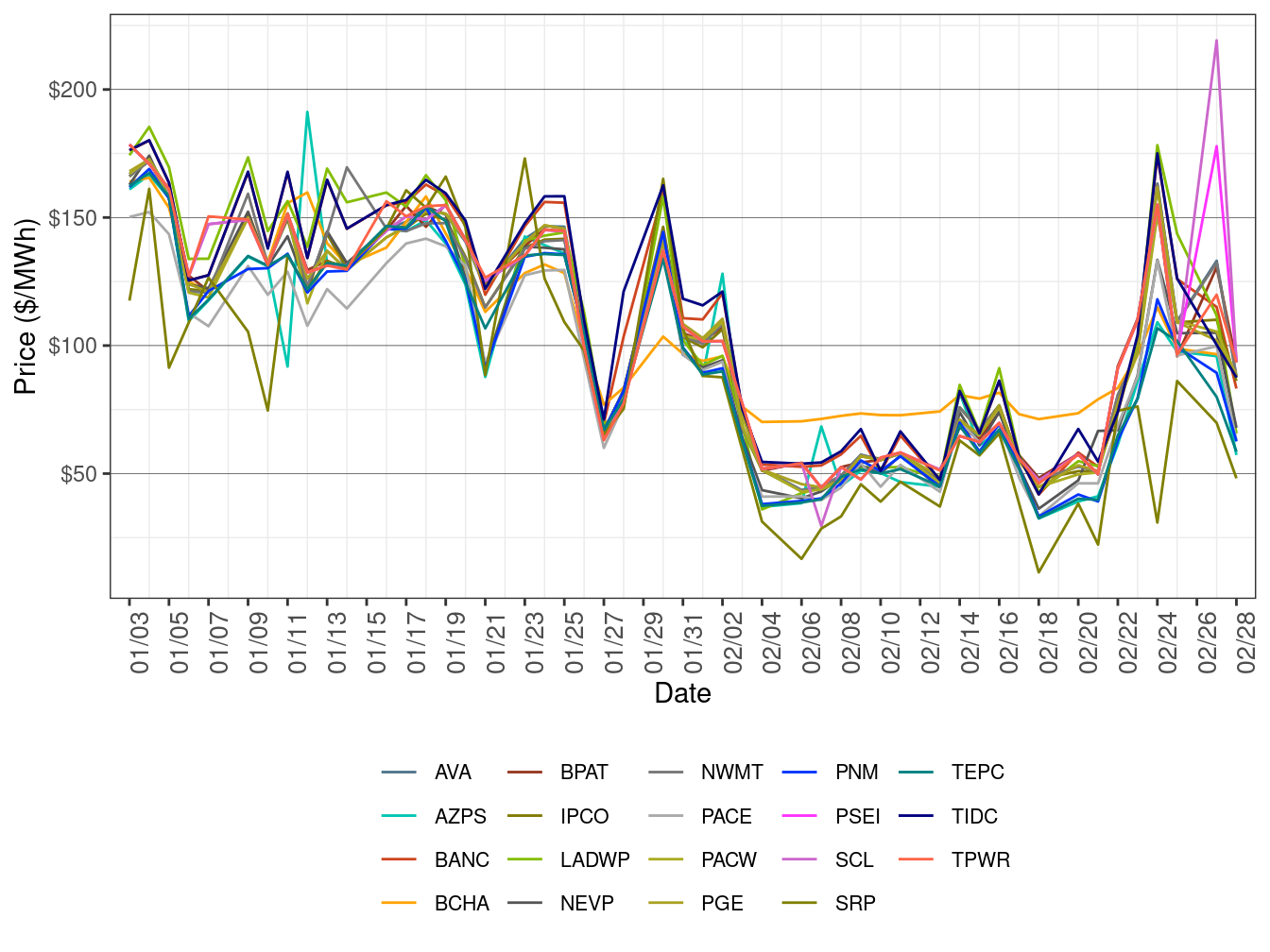

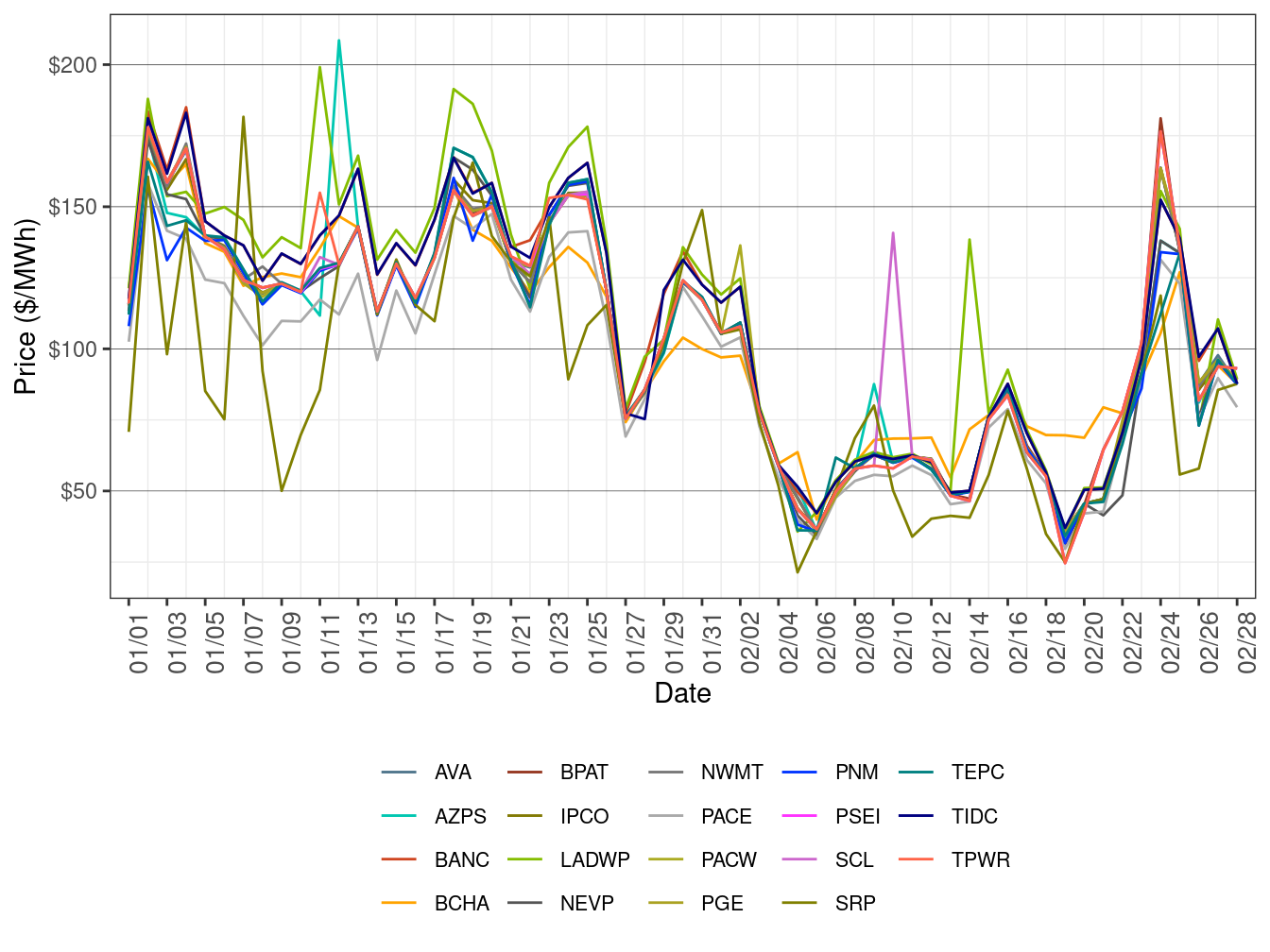

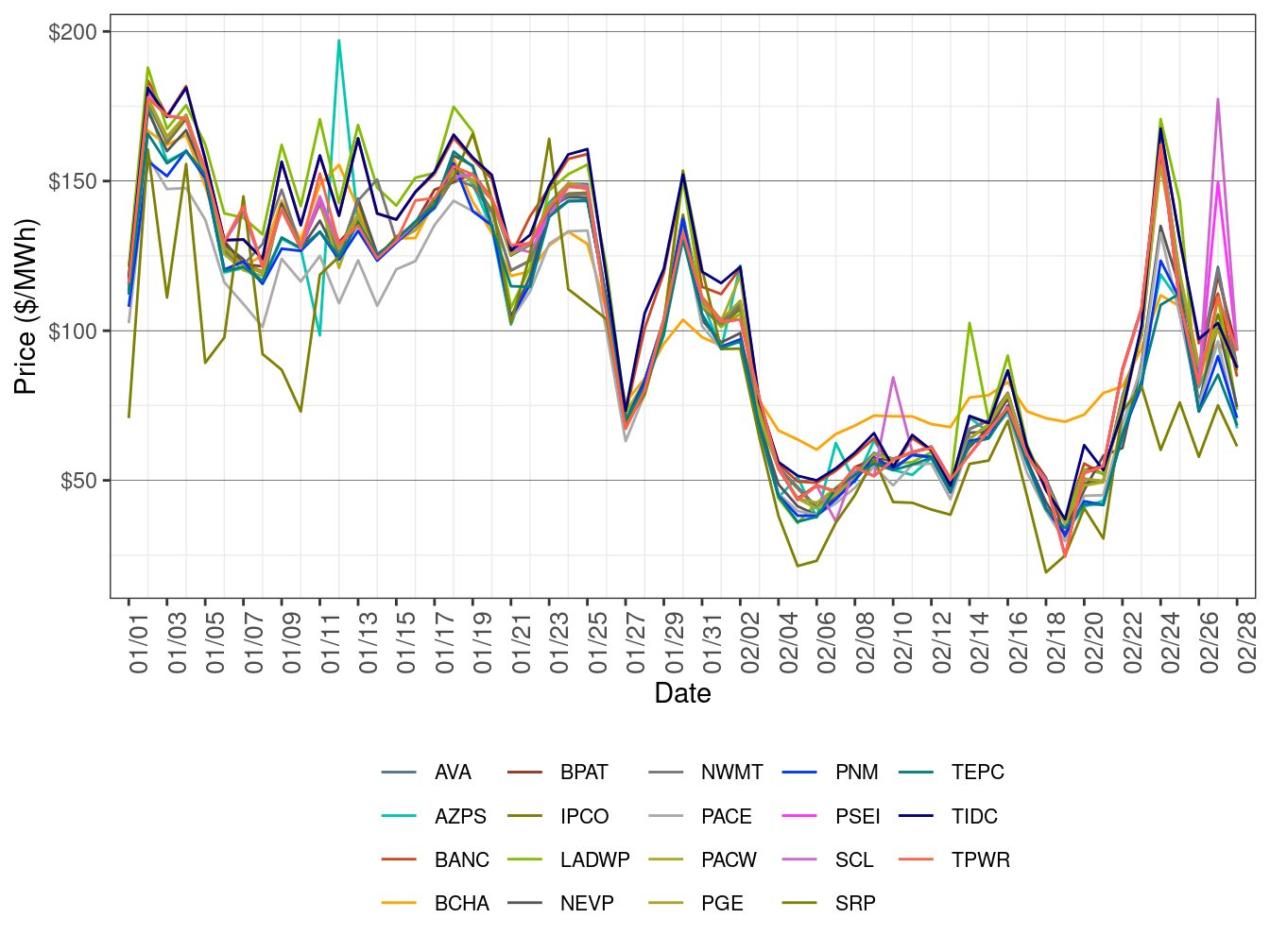

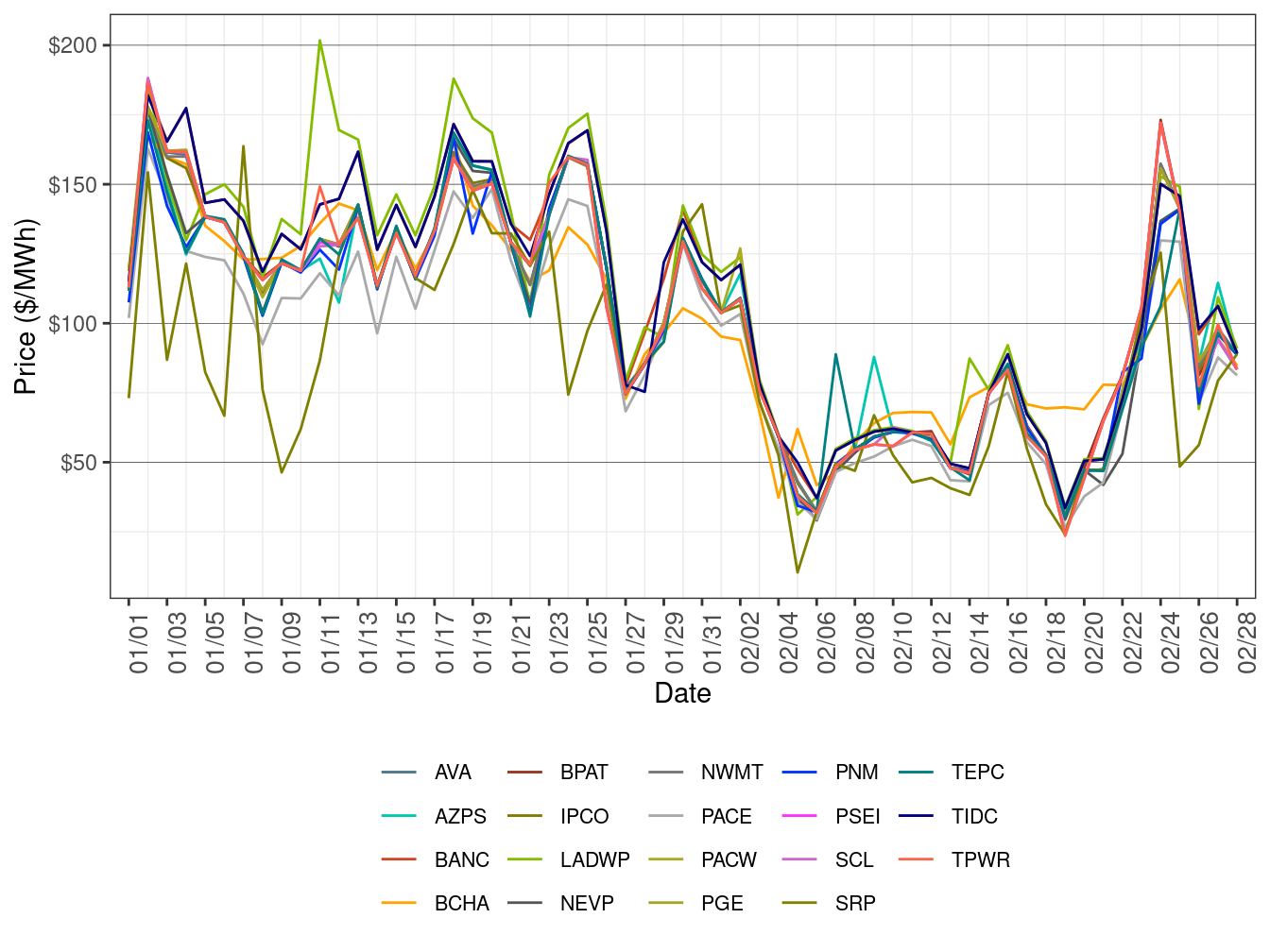

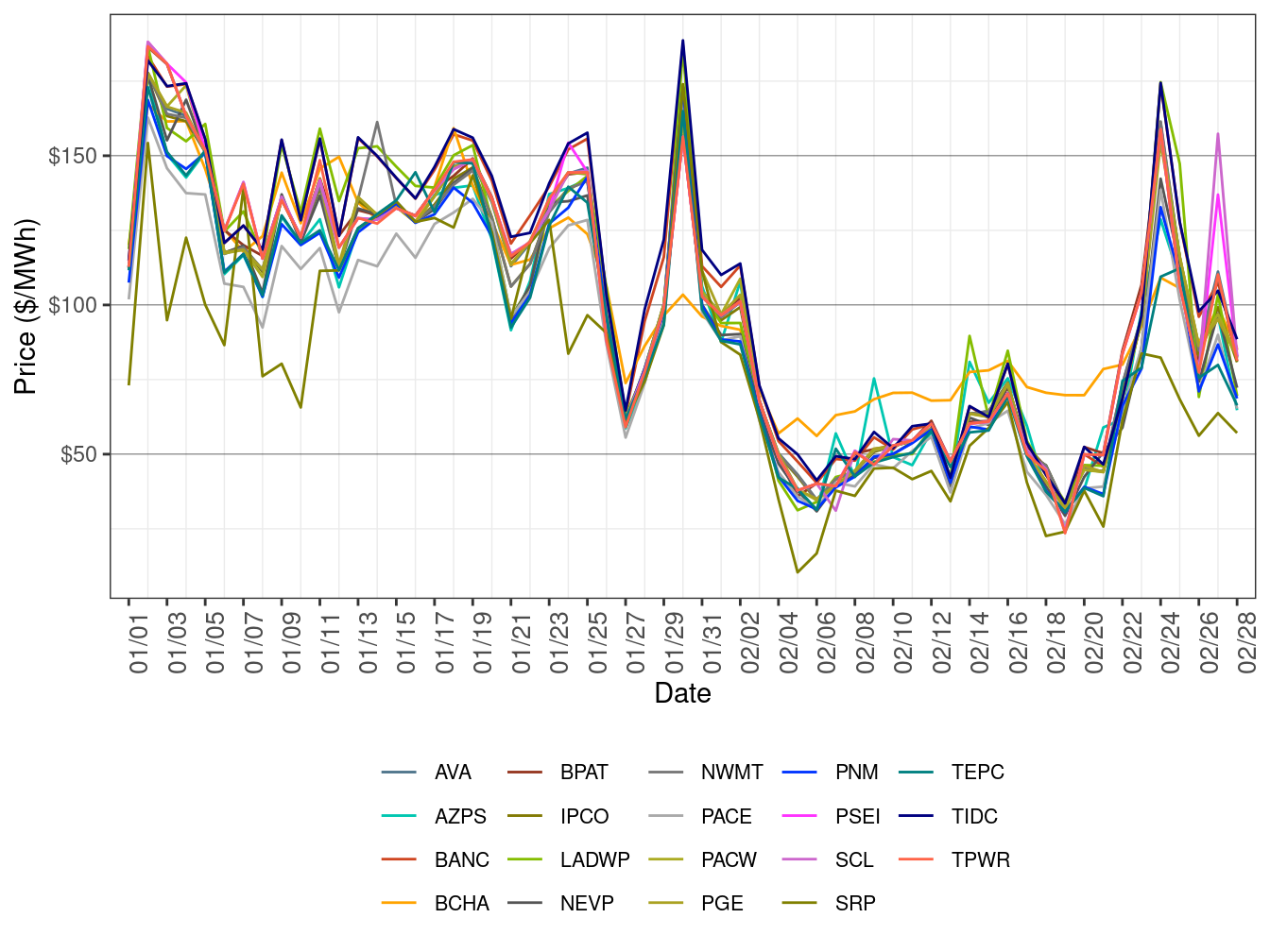

Figure 36, Figure 37 and Figure 38 show daily simple average prices for WEIM Load Aggregation Points (ELAP) for on-peak hours, off-peak hours and all hours, respectively, in FMM.

The FMM ELAP prices declined from January and stayed low for most of February, but were volatile in the last days of the month.

Figure 36: WEIM Simple Average LAP Prices (On-Peak Hours) in FMM

Figure 37: WEIM Simple Average LAP Prices (Off-Peak Hours) in FMM

Figure 38: WEIM Simple Average LAP Prices (All Hours) in FMM

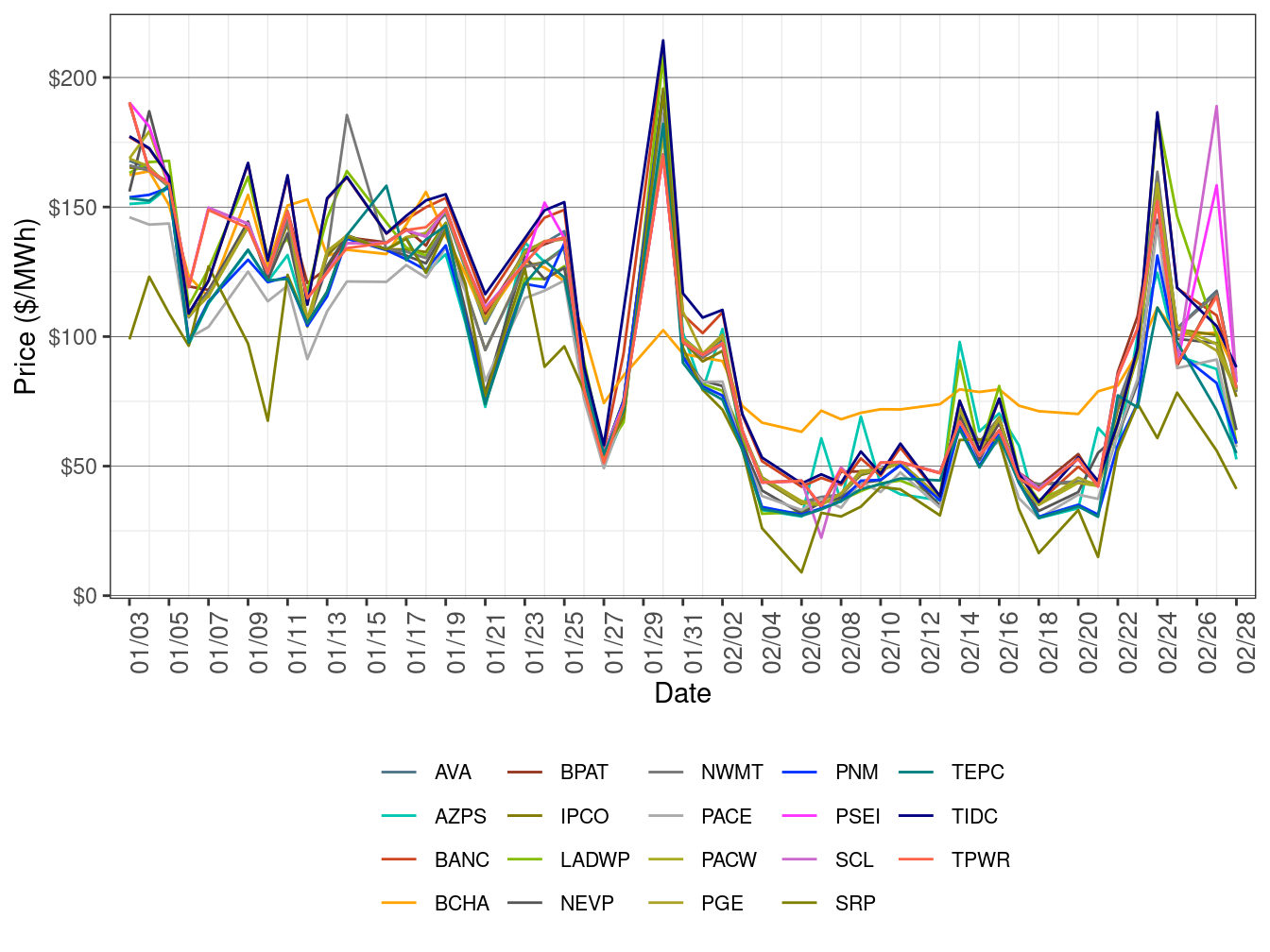

Figure 39, Figure 40 and Figure 41 show daily simple average prices for WEIM LAPs (ELAP) for on-peak Hours, off-peak hours and all hours, respectively, in RTD.

The RTD ELAP prices stayed comparatively low for most of February, but were volatile in the last days of the month.

Figure 39: WEIM Simple Average LAP Prices (On-Peak Hours) in RTD

Figure 40: WEIM Simple Average LAP Prices (Off-Peak Hours) in RTD

Figure 41: WEIM Simple Average LAP Prices (All Hours) in RTD

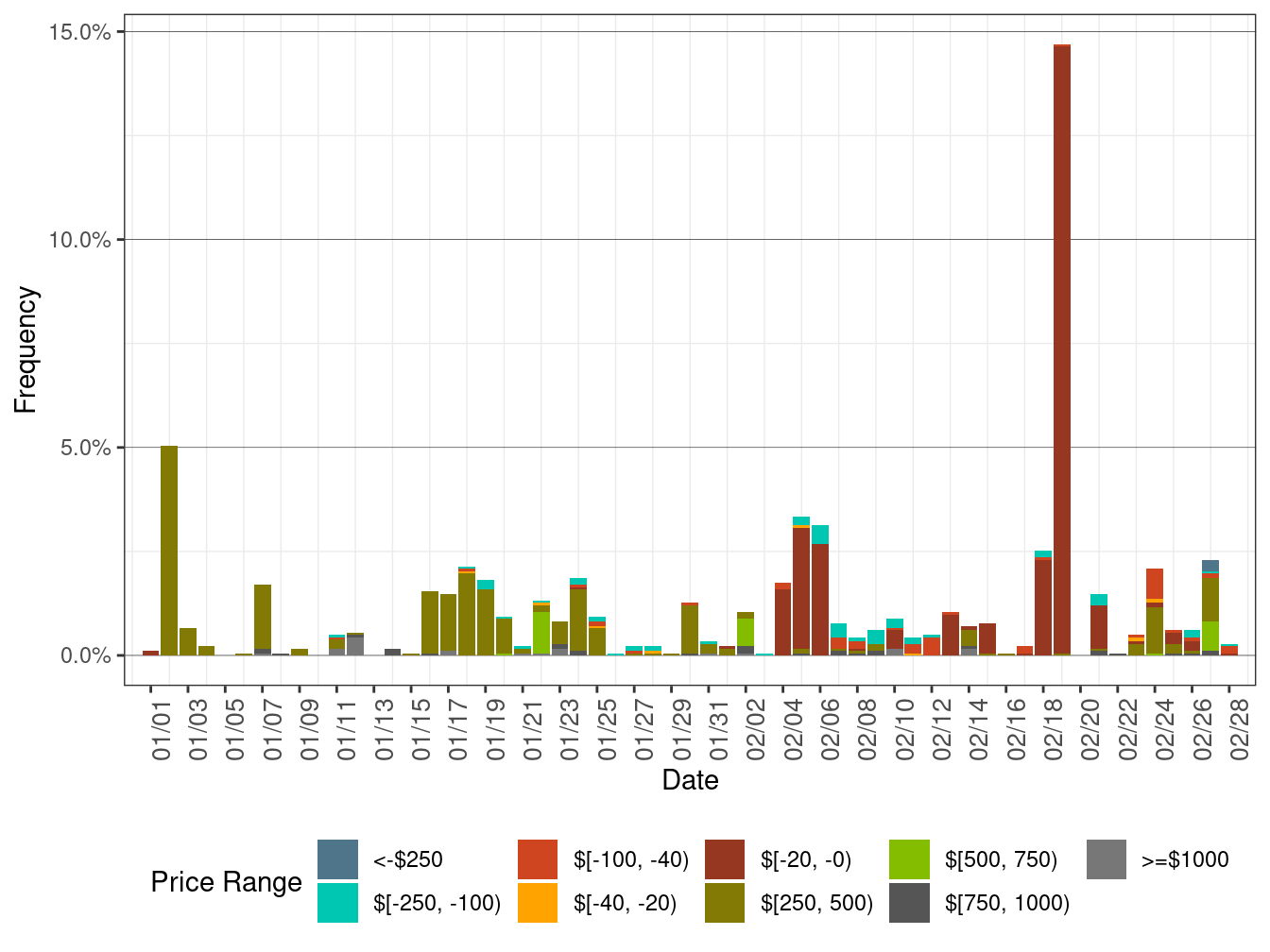

Figure 42 shows the daily price frequency for ELAP prices above $250/MWh and below $0/MWh in FMM.

The cumulative frequency of FMM ELAP prices above $250/MWh decreased to 0.24 percent in February from 0.73 percent in January. The cumulative frequency of negative prices jumped to 5.82 percent in February from 0.29 percent in January.

Figure 42: Daily Frequency of WEIM LAP Positive Price Spikes and Negative Prices in FMM

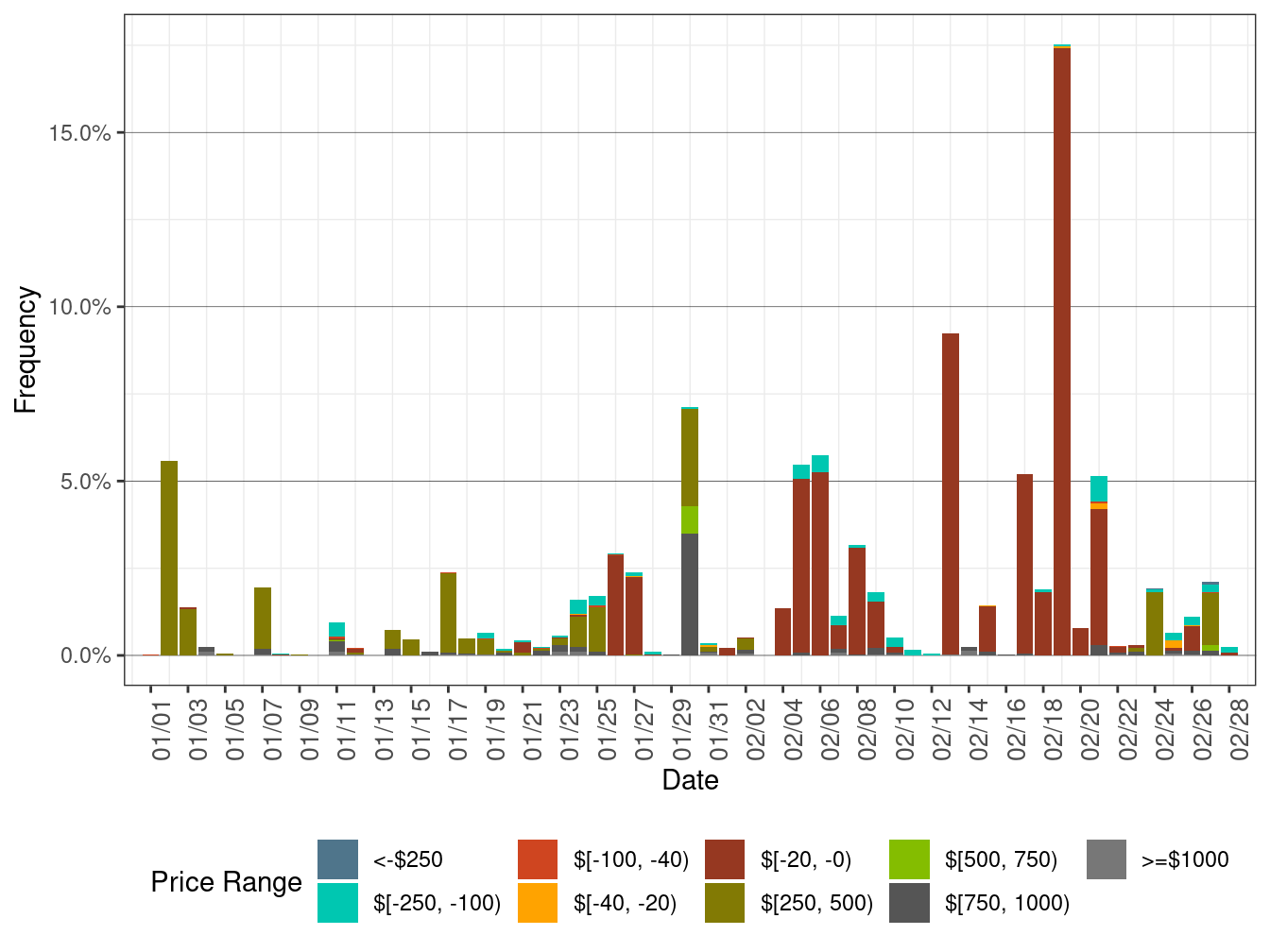

Figure 43 shows the daily price frequency for ELAP prices above $250/MWh and below $0/MWh in RTD.

The cumulative frequency of RTD ELAP prices above $250/MWh dropped to 0.21 percent in February from 0.81 percent in January. The cumulative frequency of negative prices jumped to 10.56 percent in February from 1.21 percent in January.

Figure 43: Daily Frequency of WEIM LAP Positive Price Spikes and Negative Prices in RTD

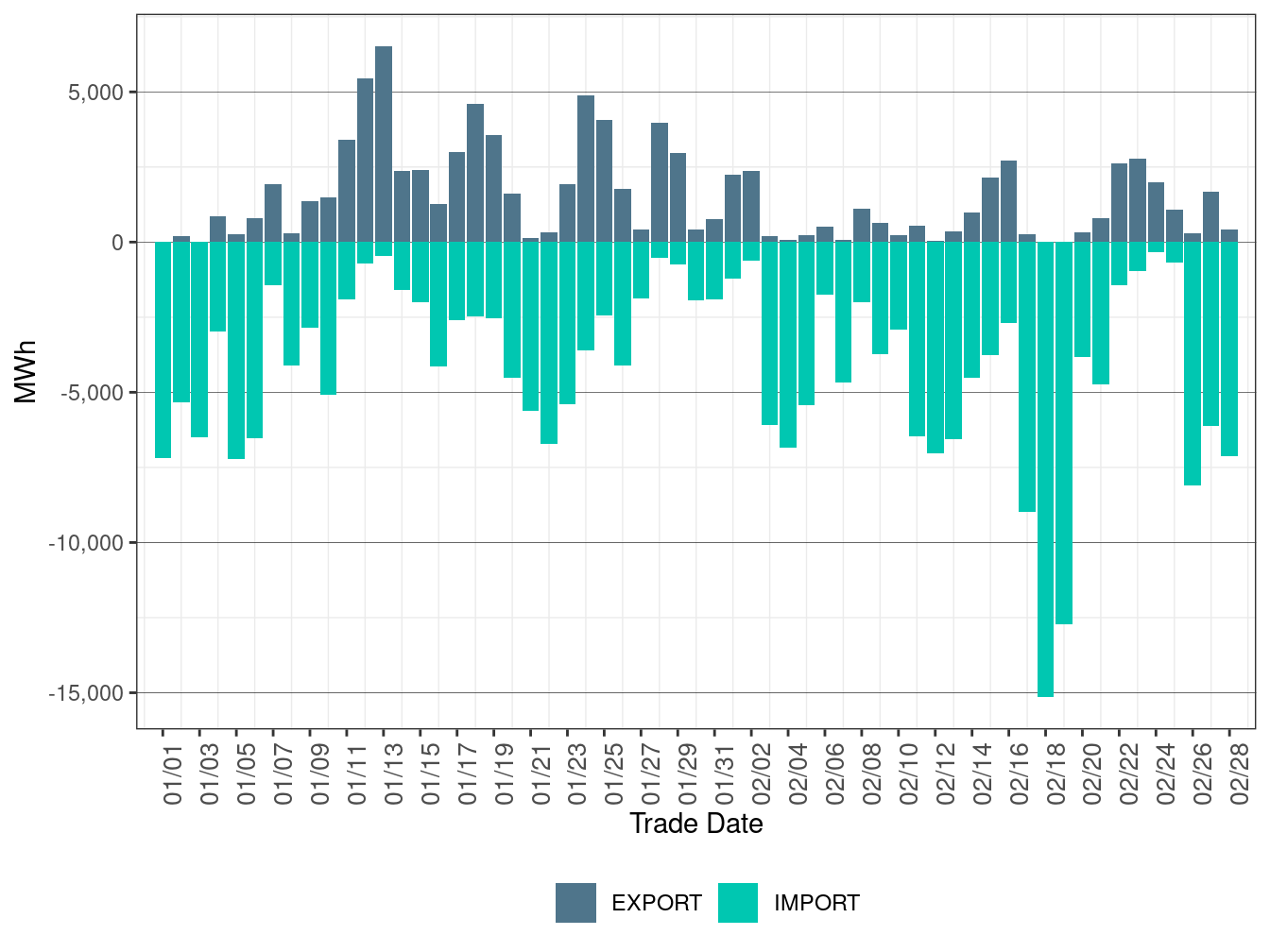

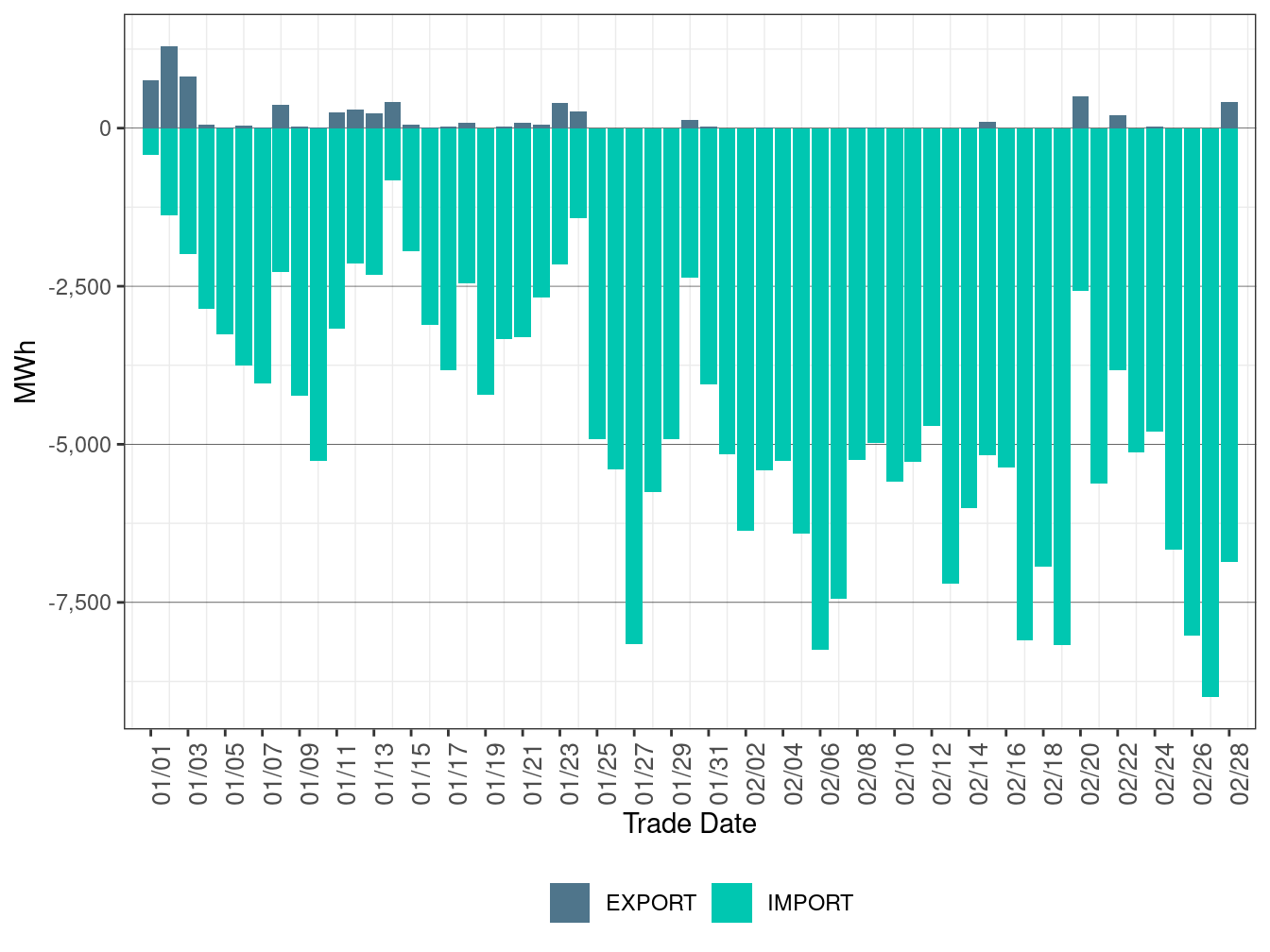

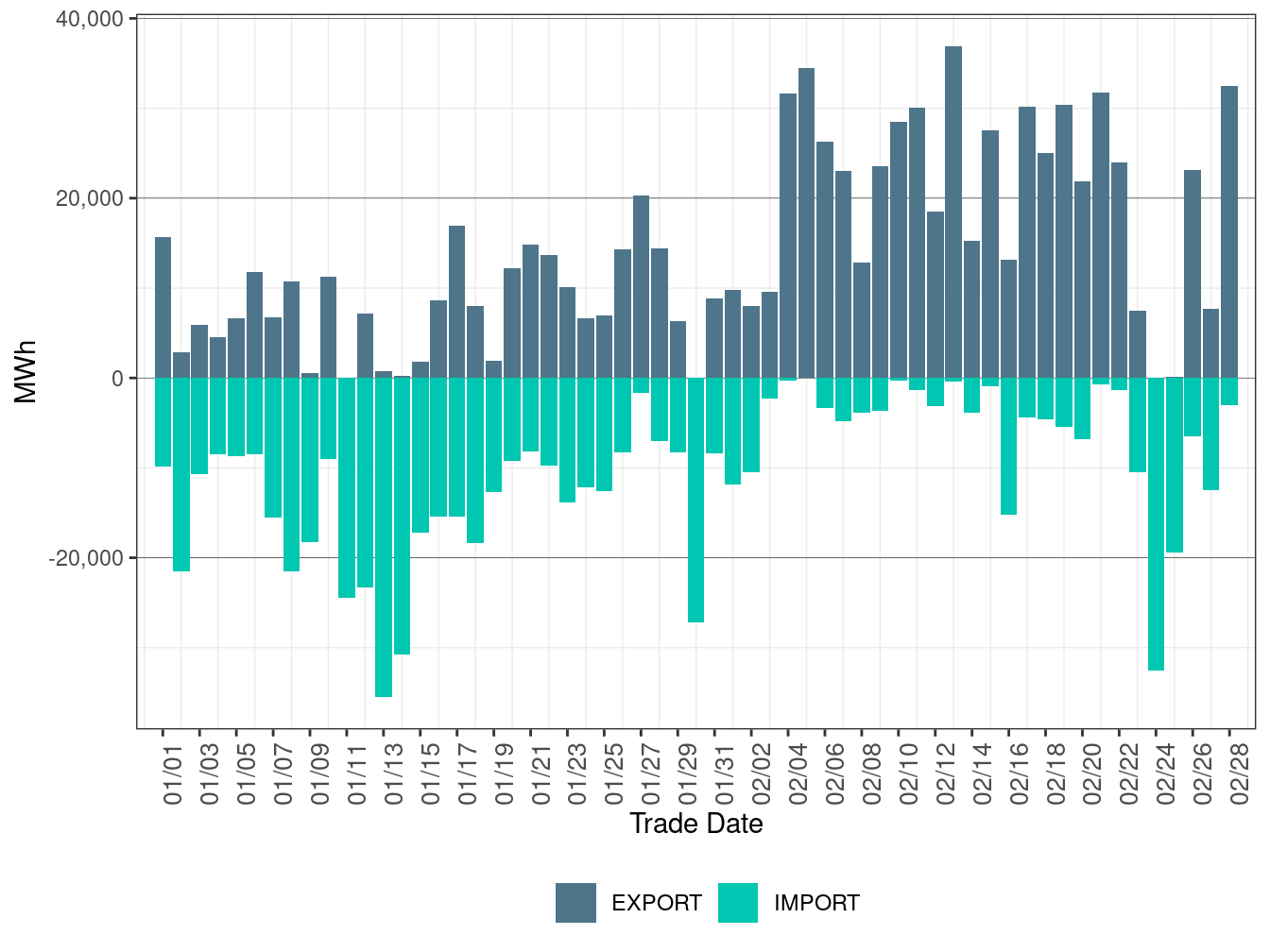

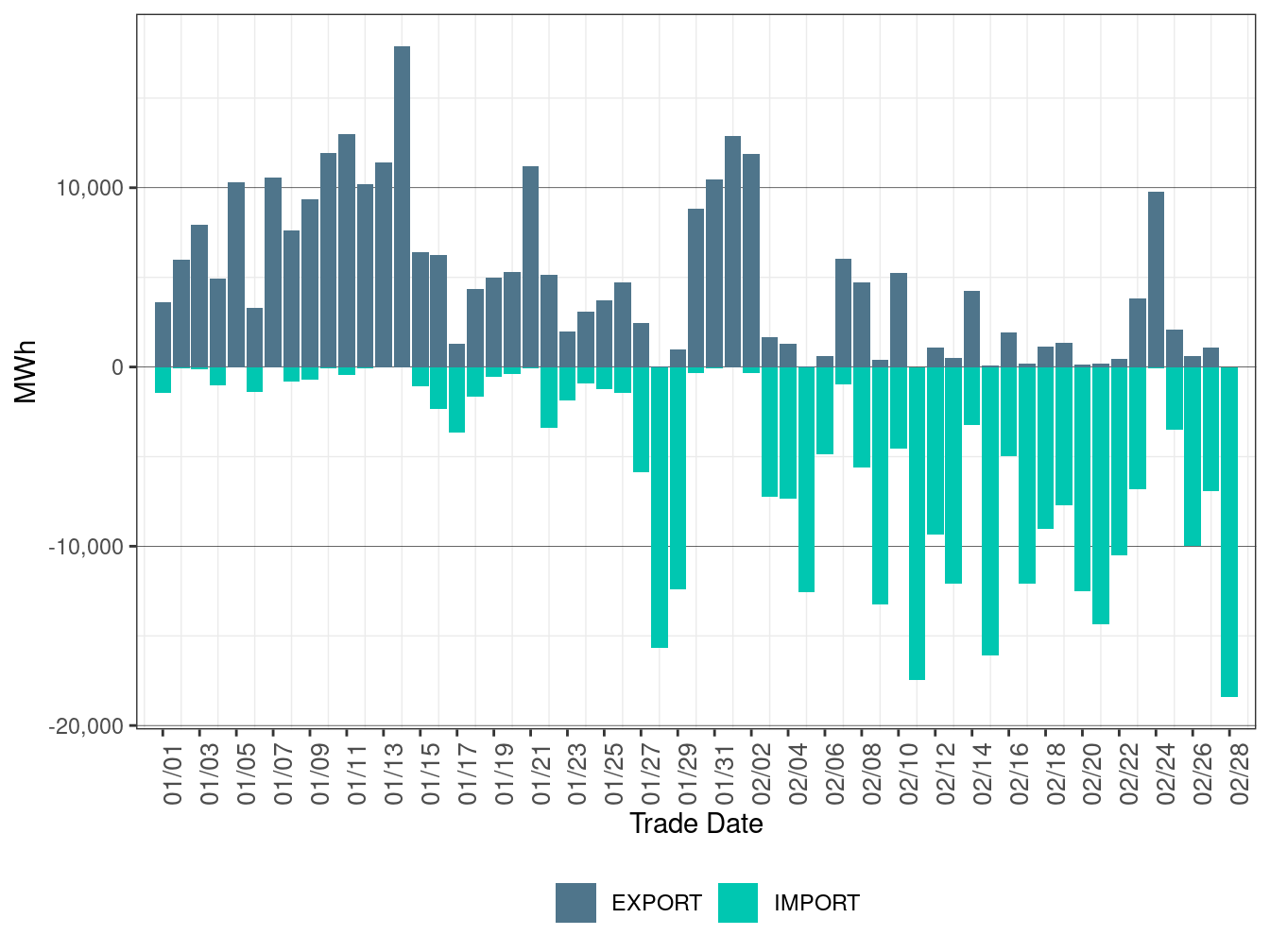

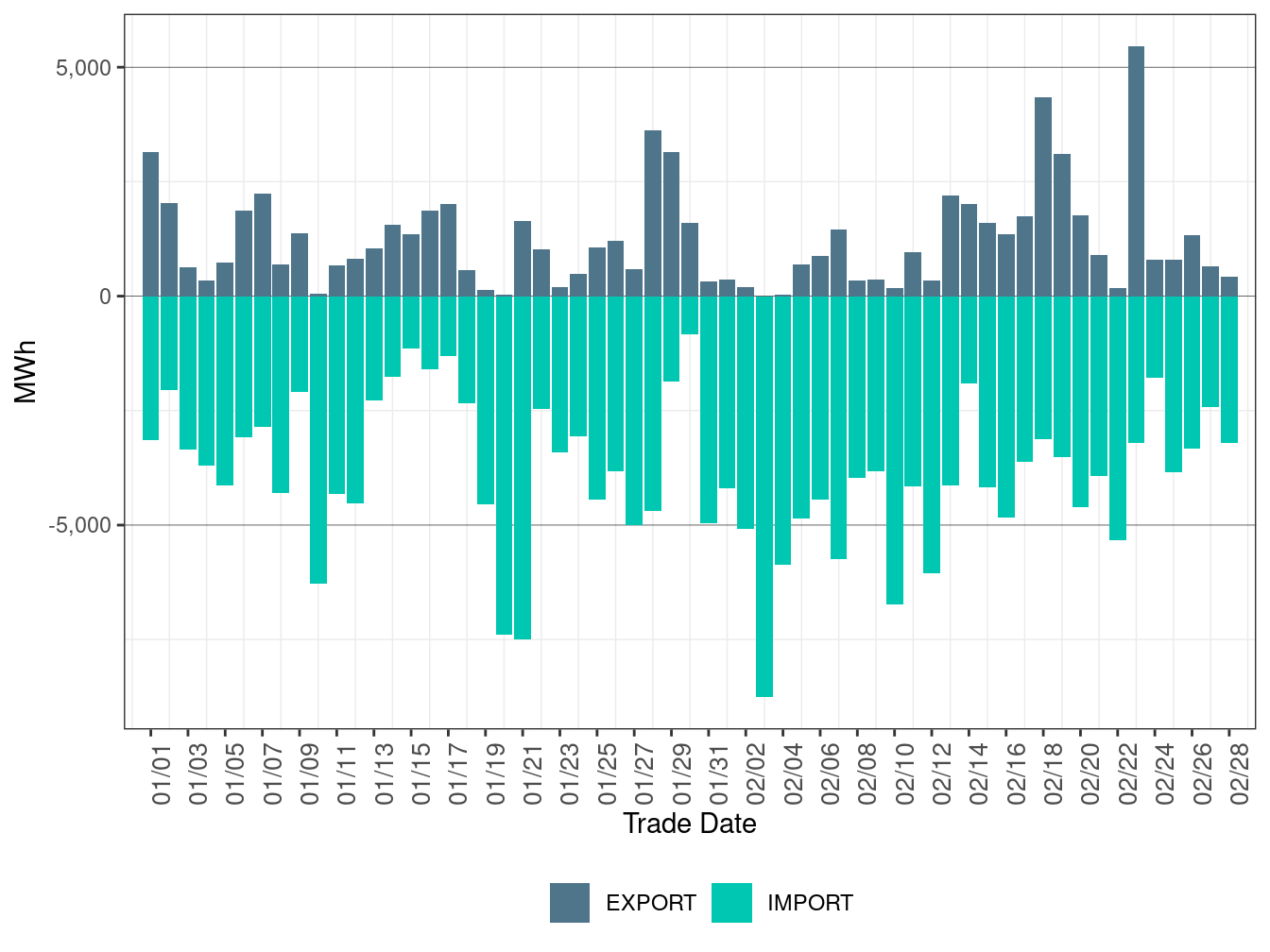

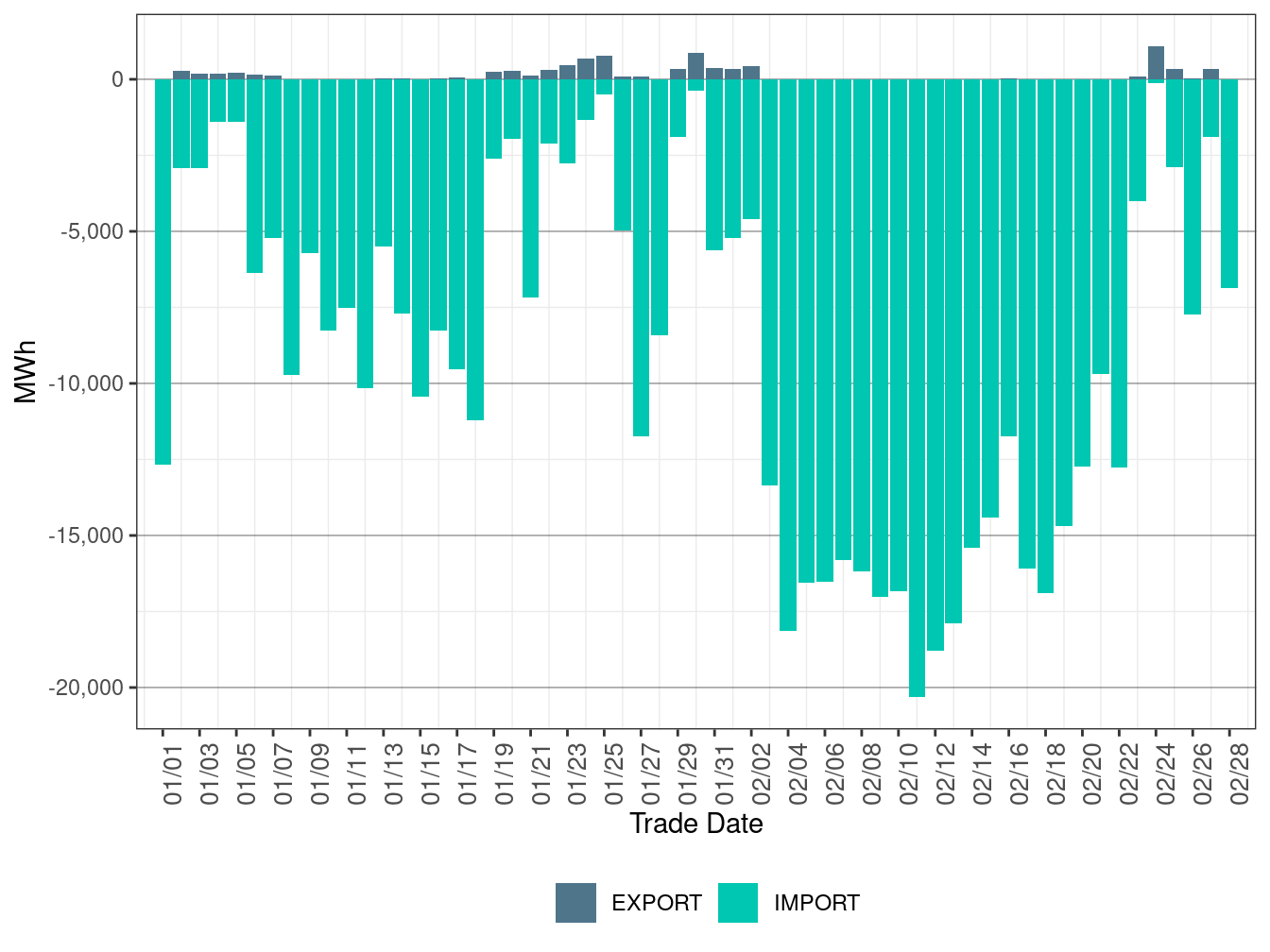

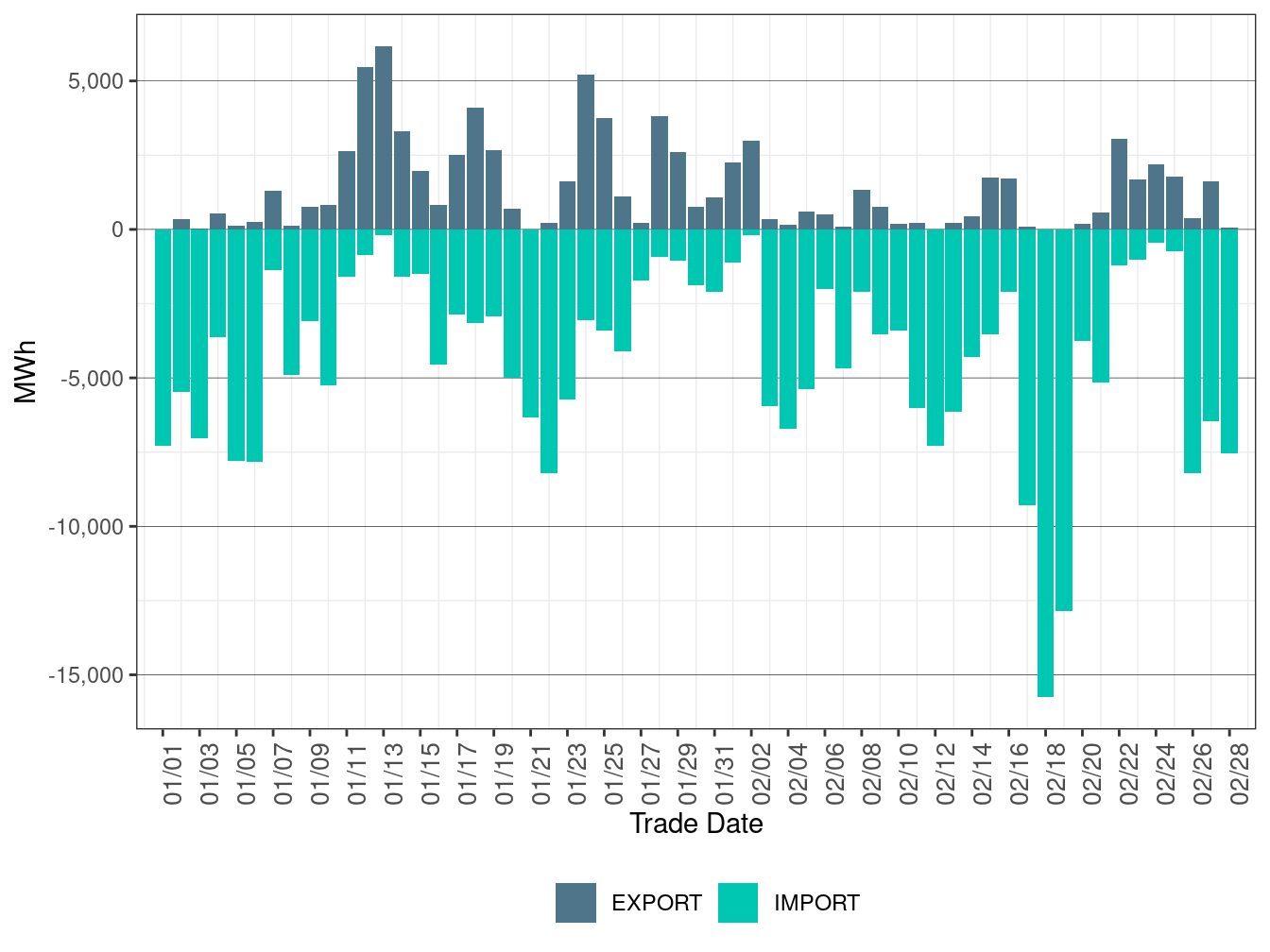

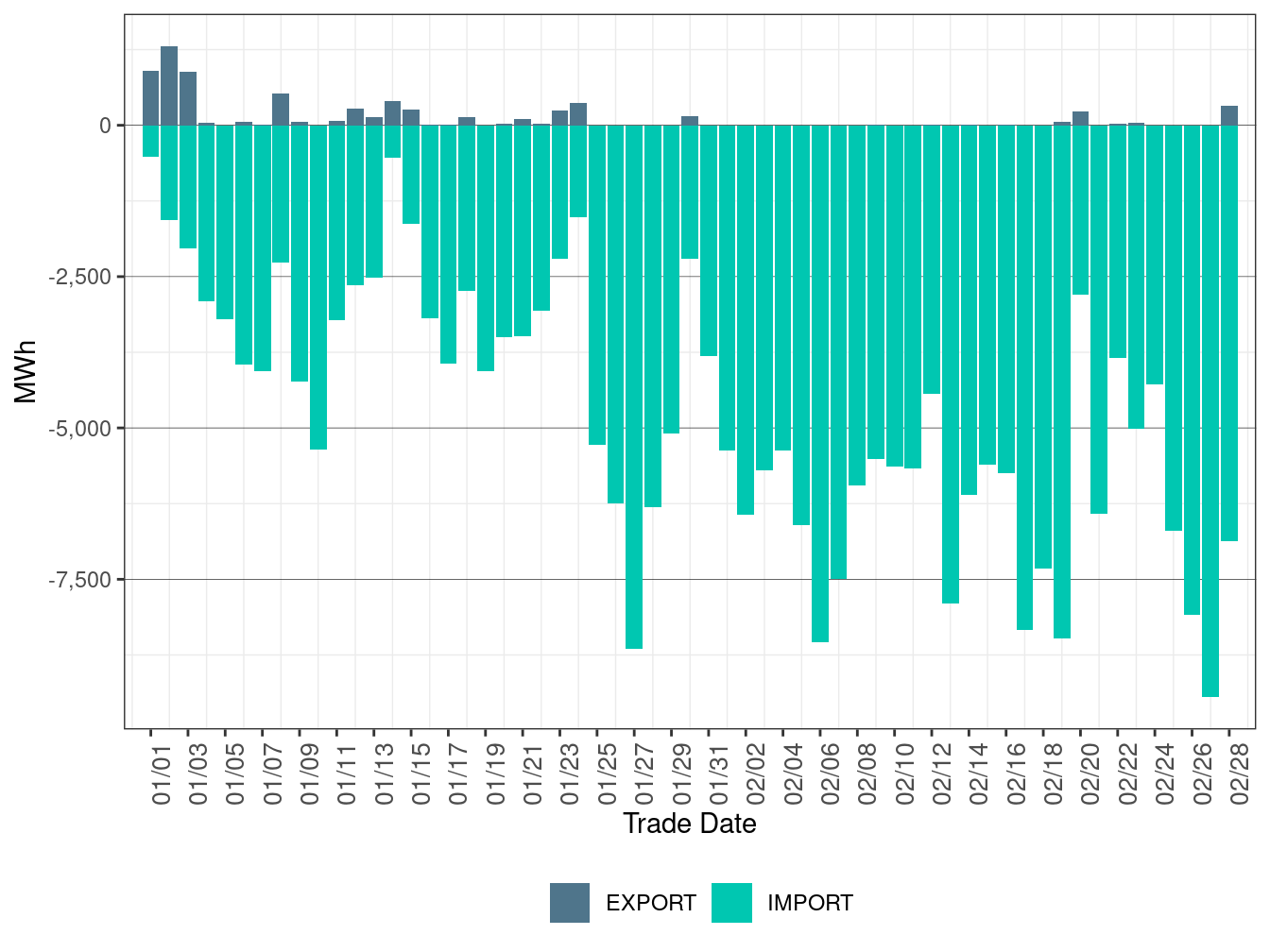

WEIM Transfers

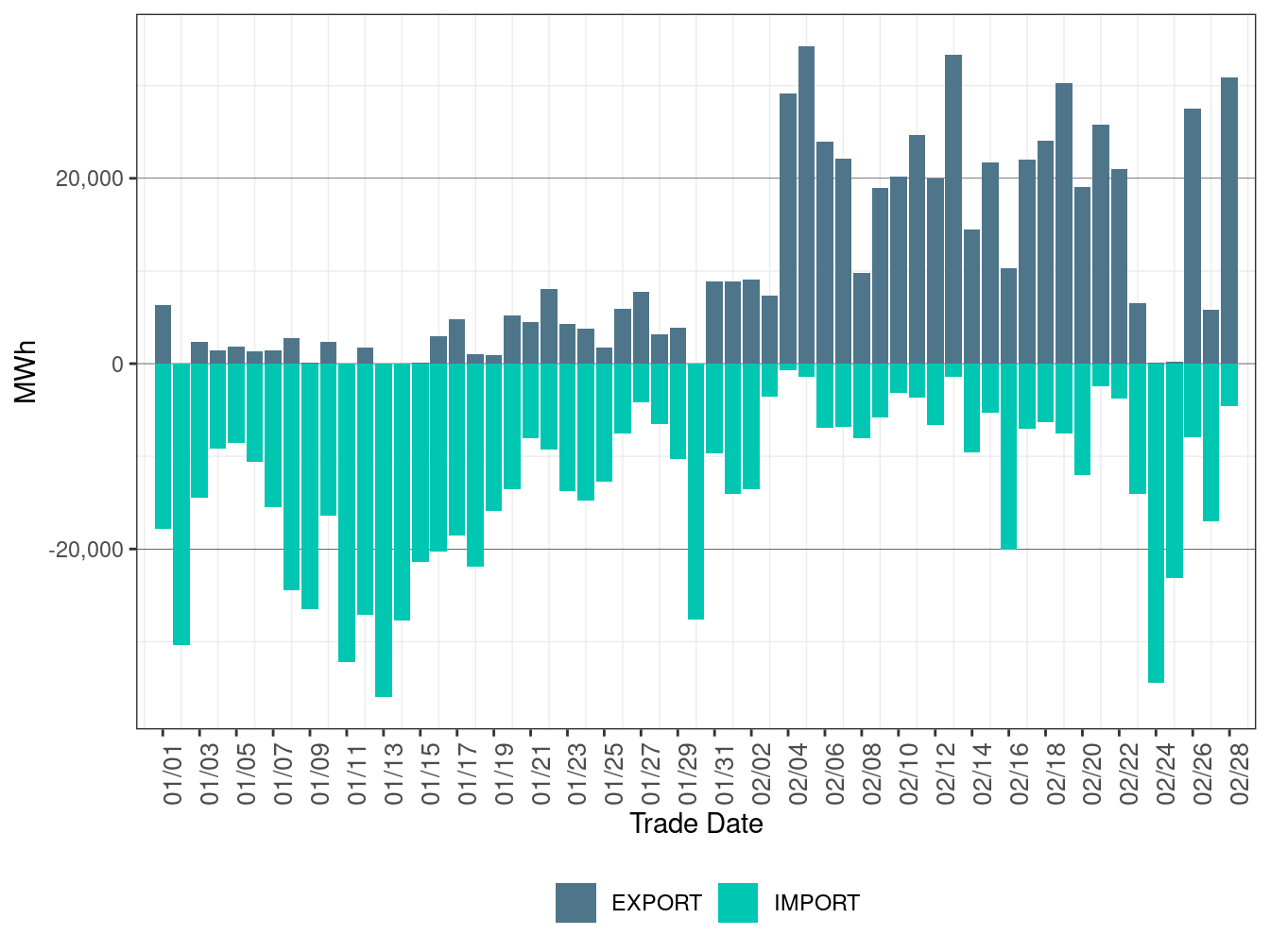

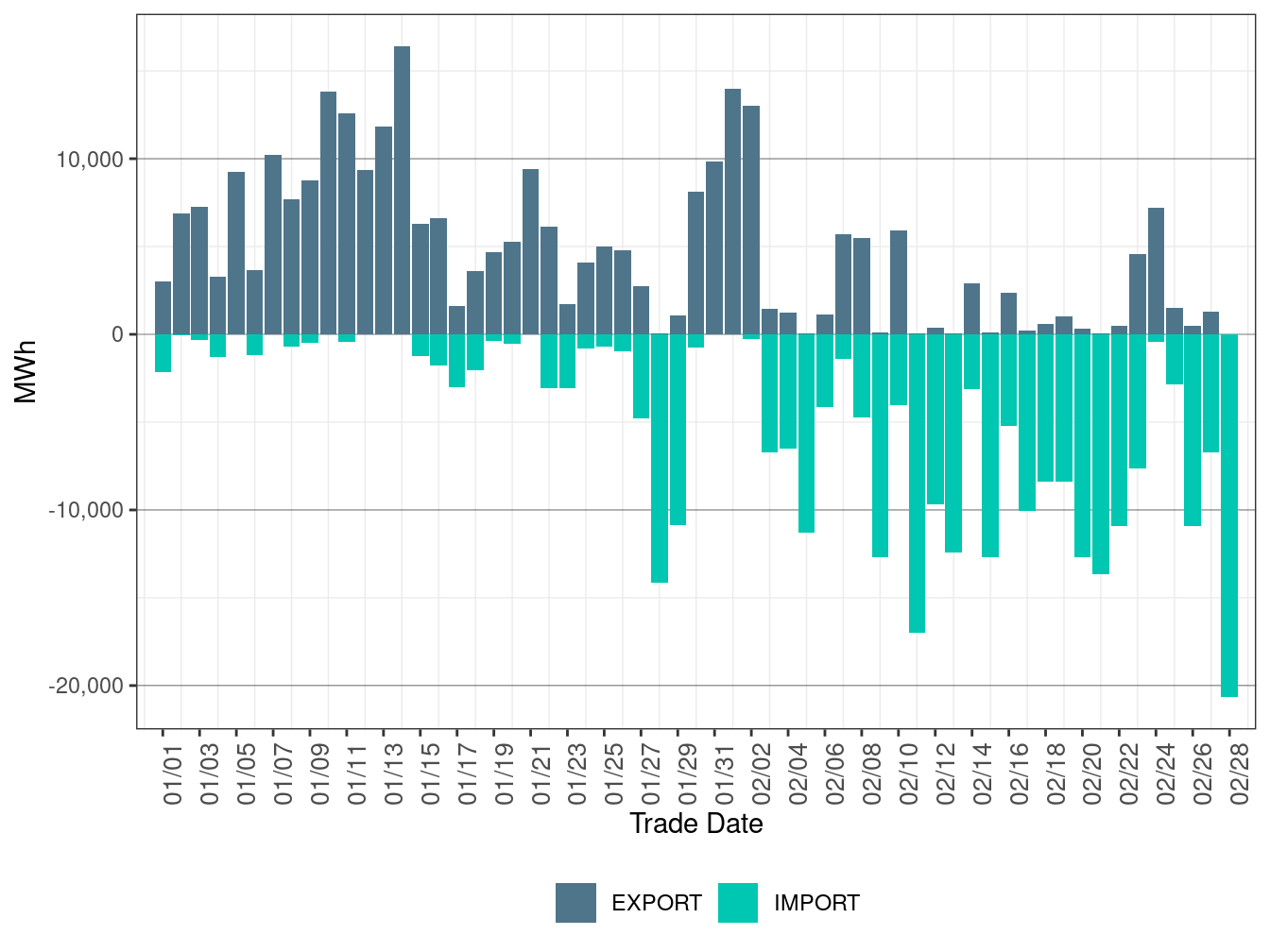

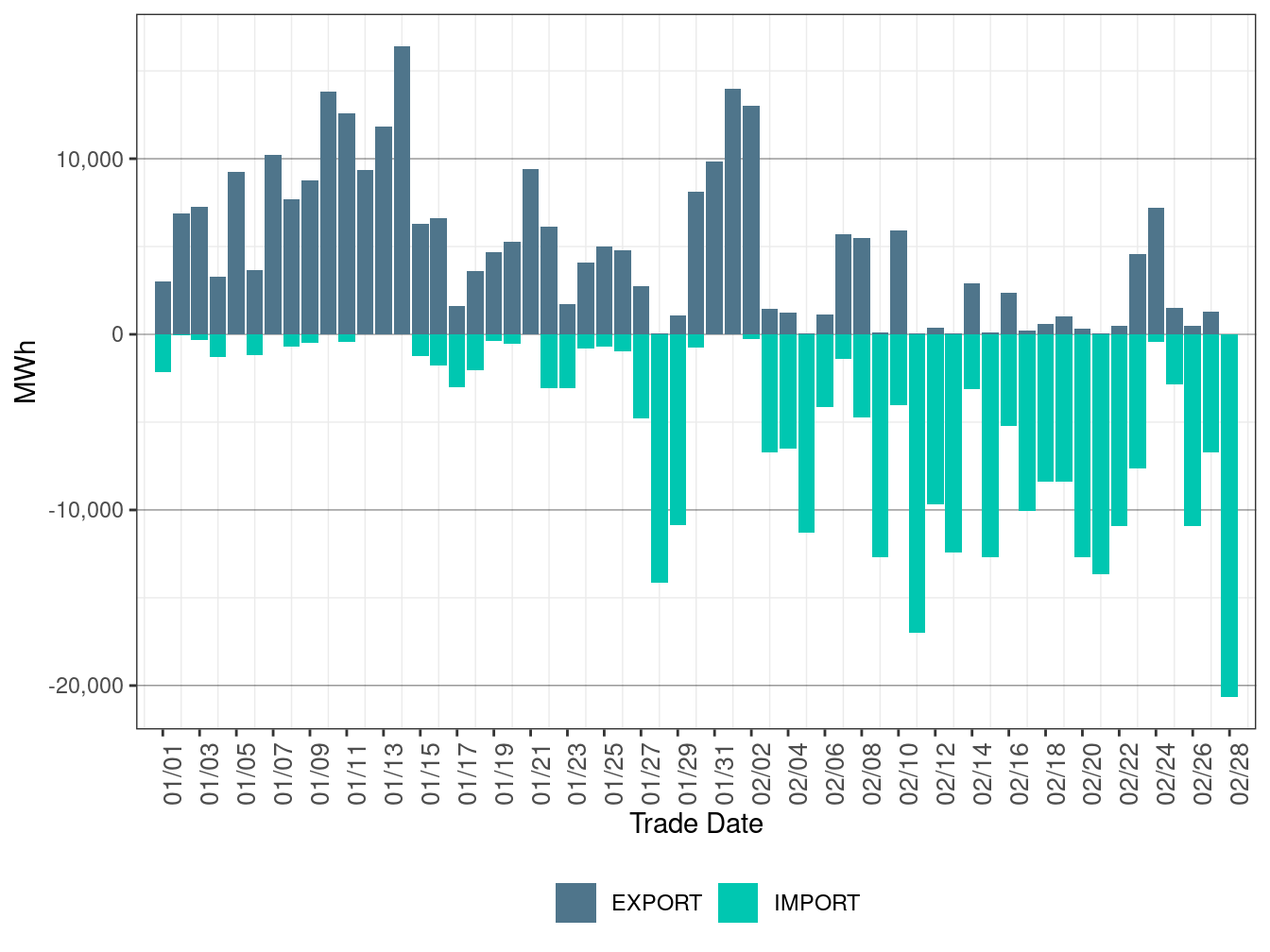

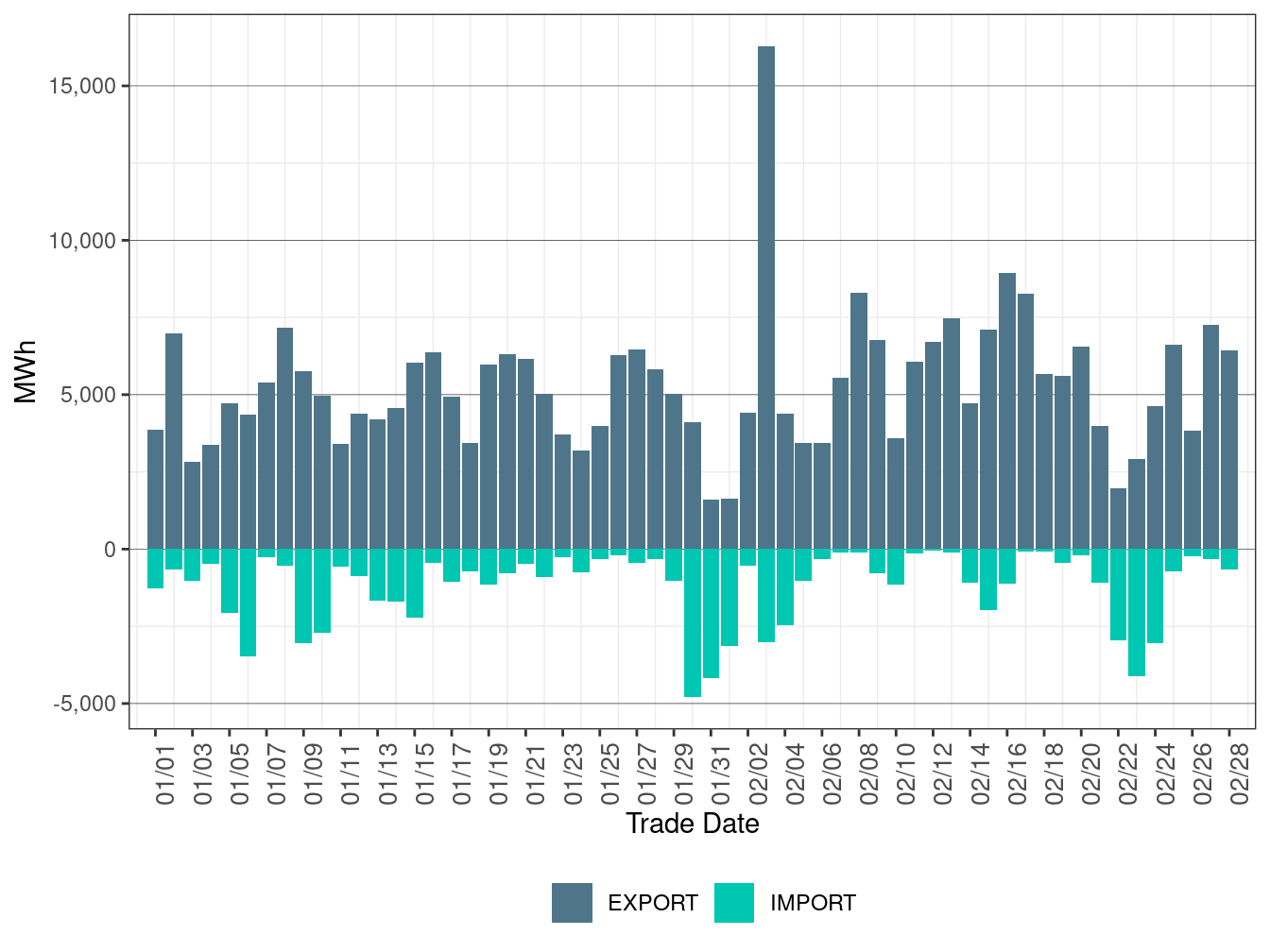

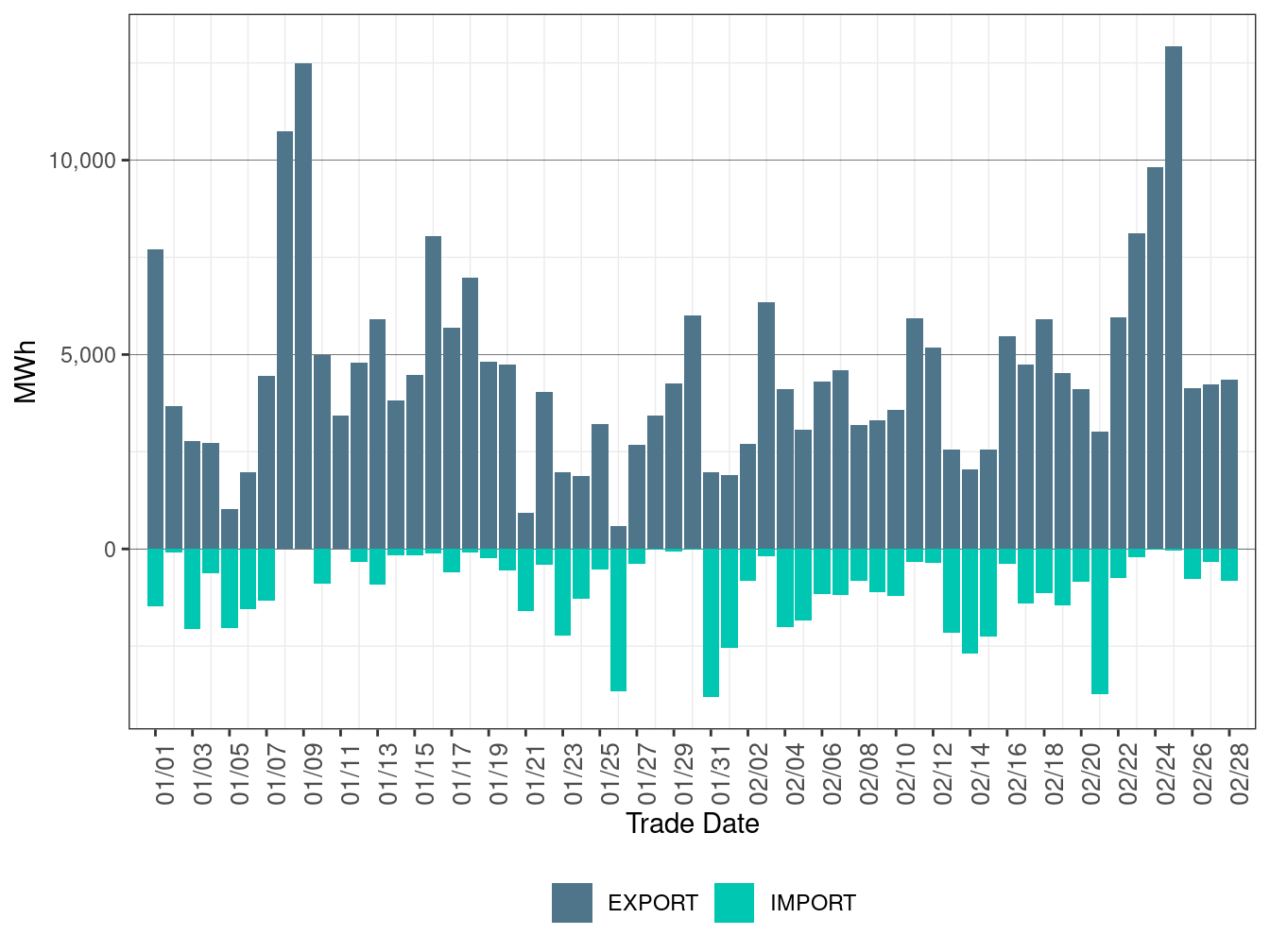

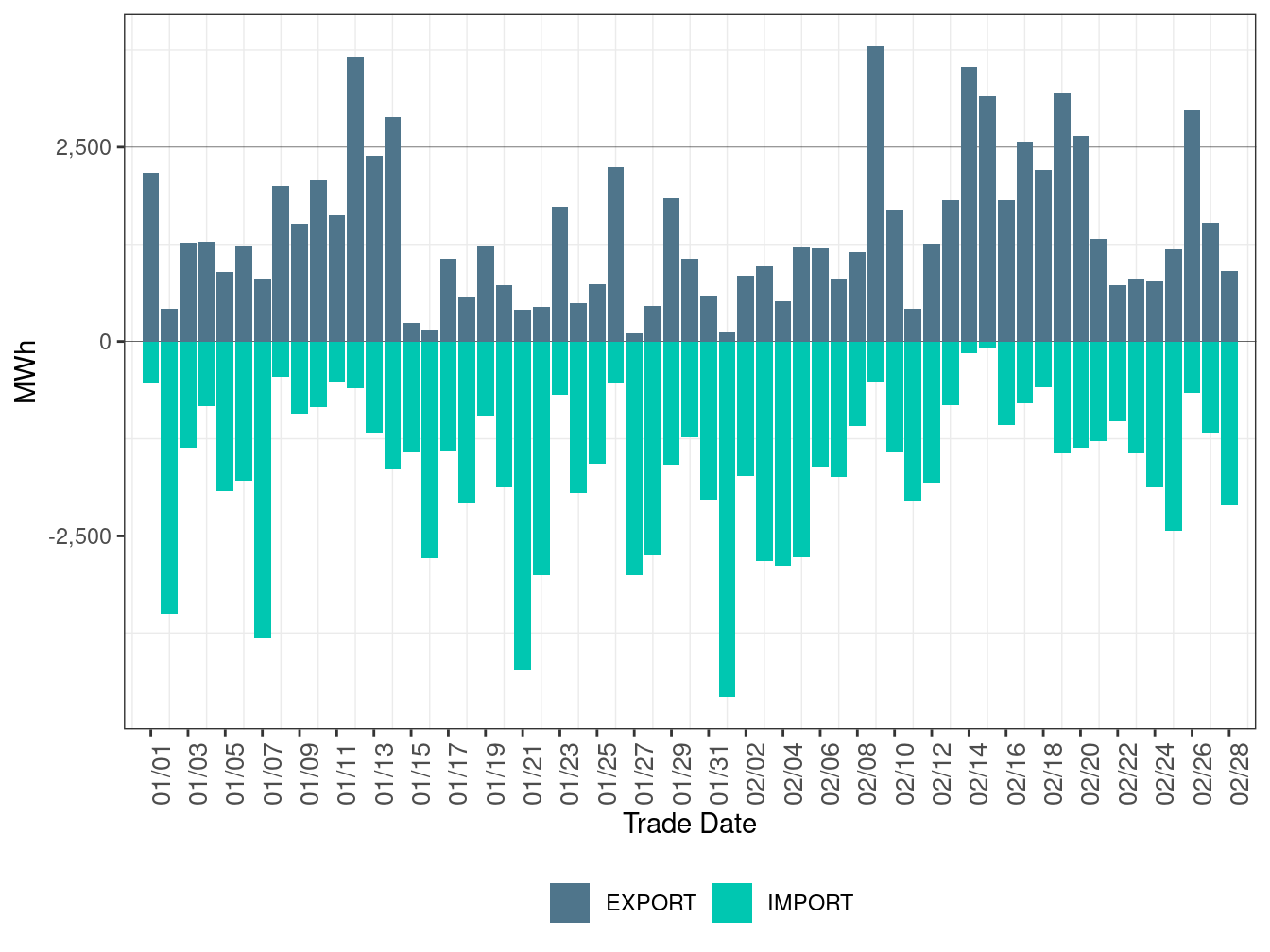

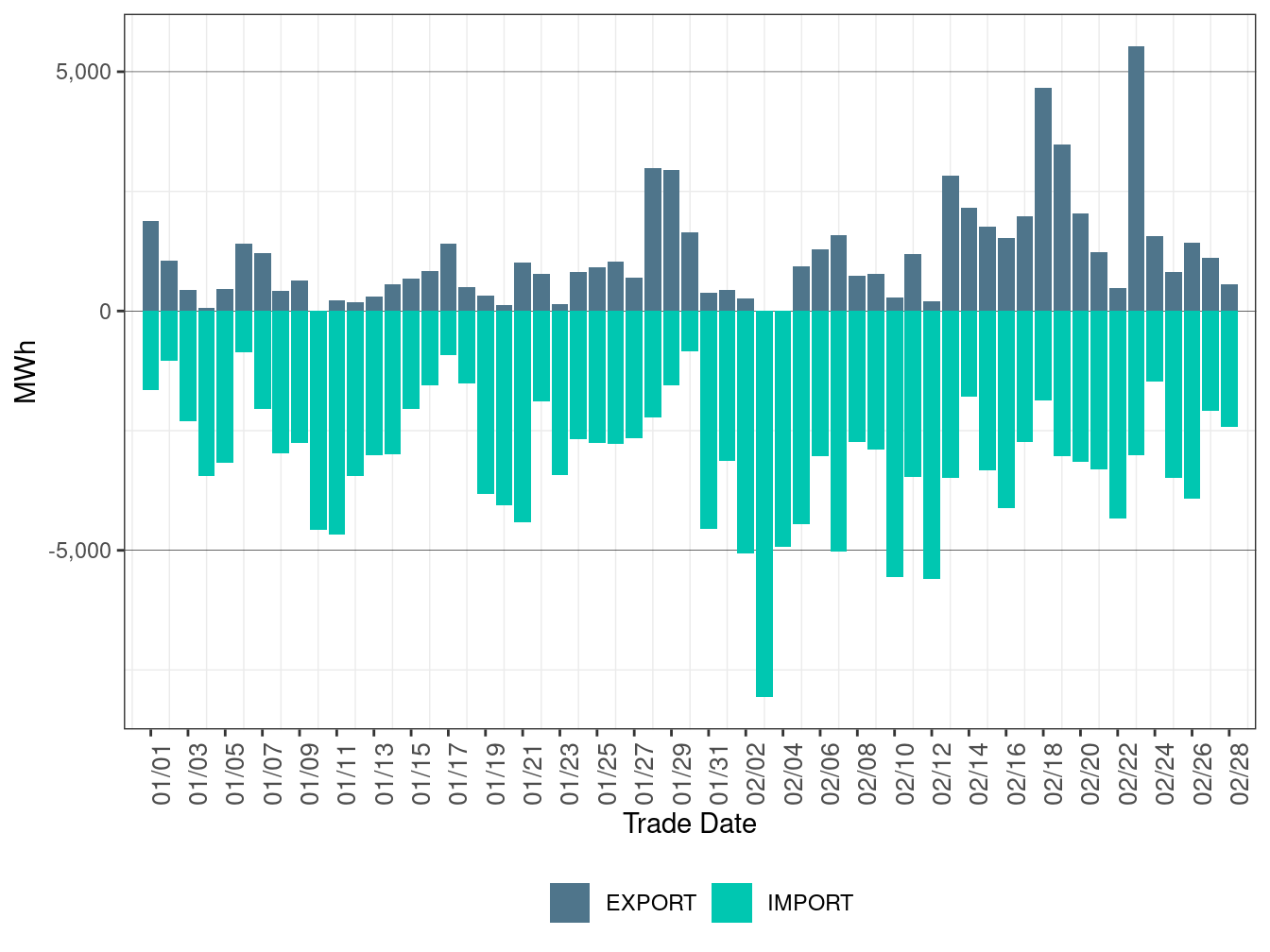

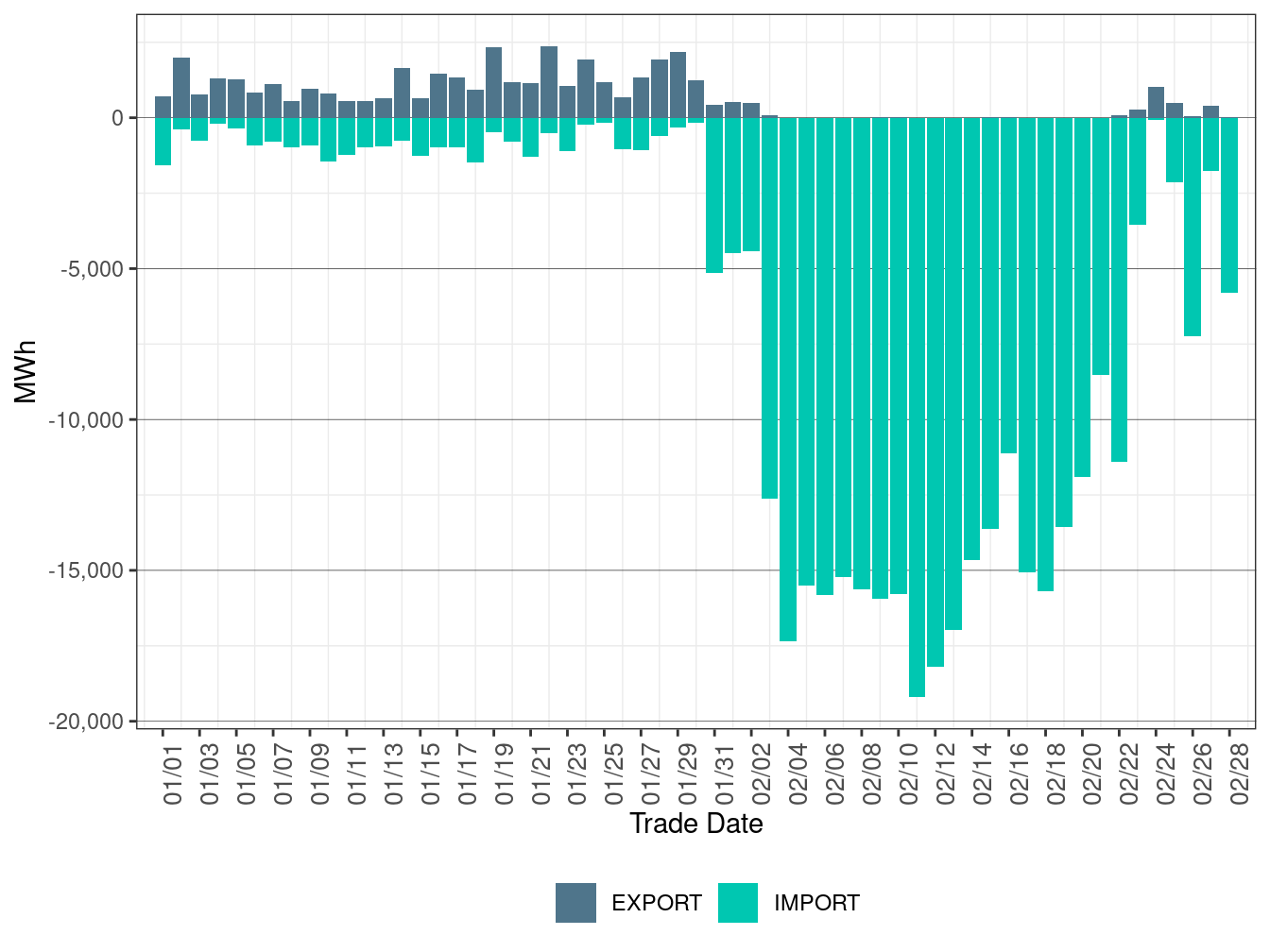

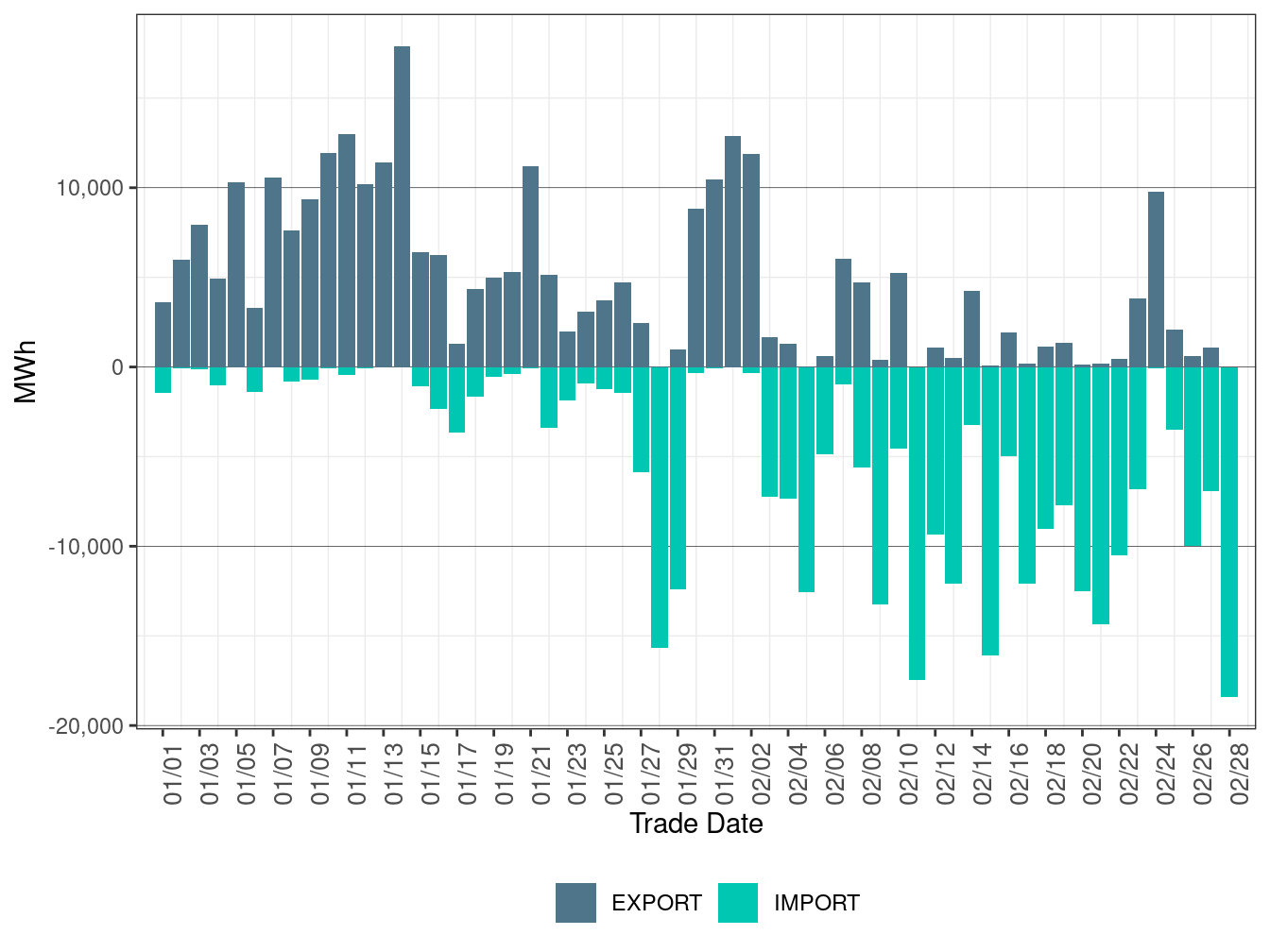

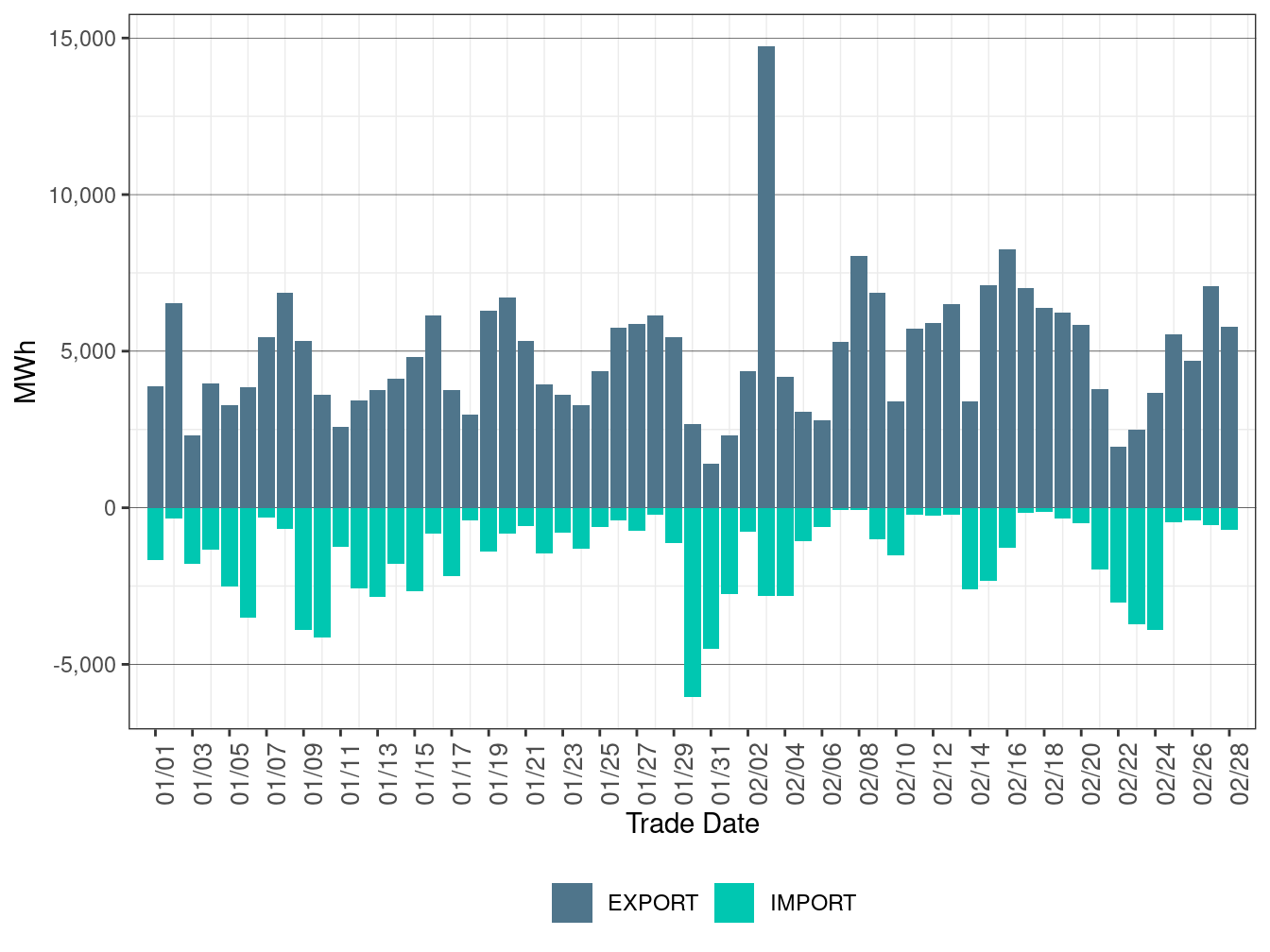

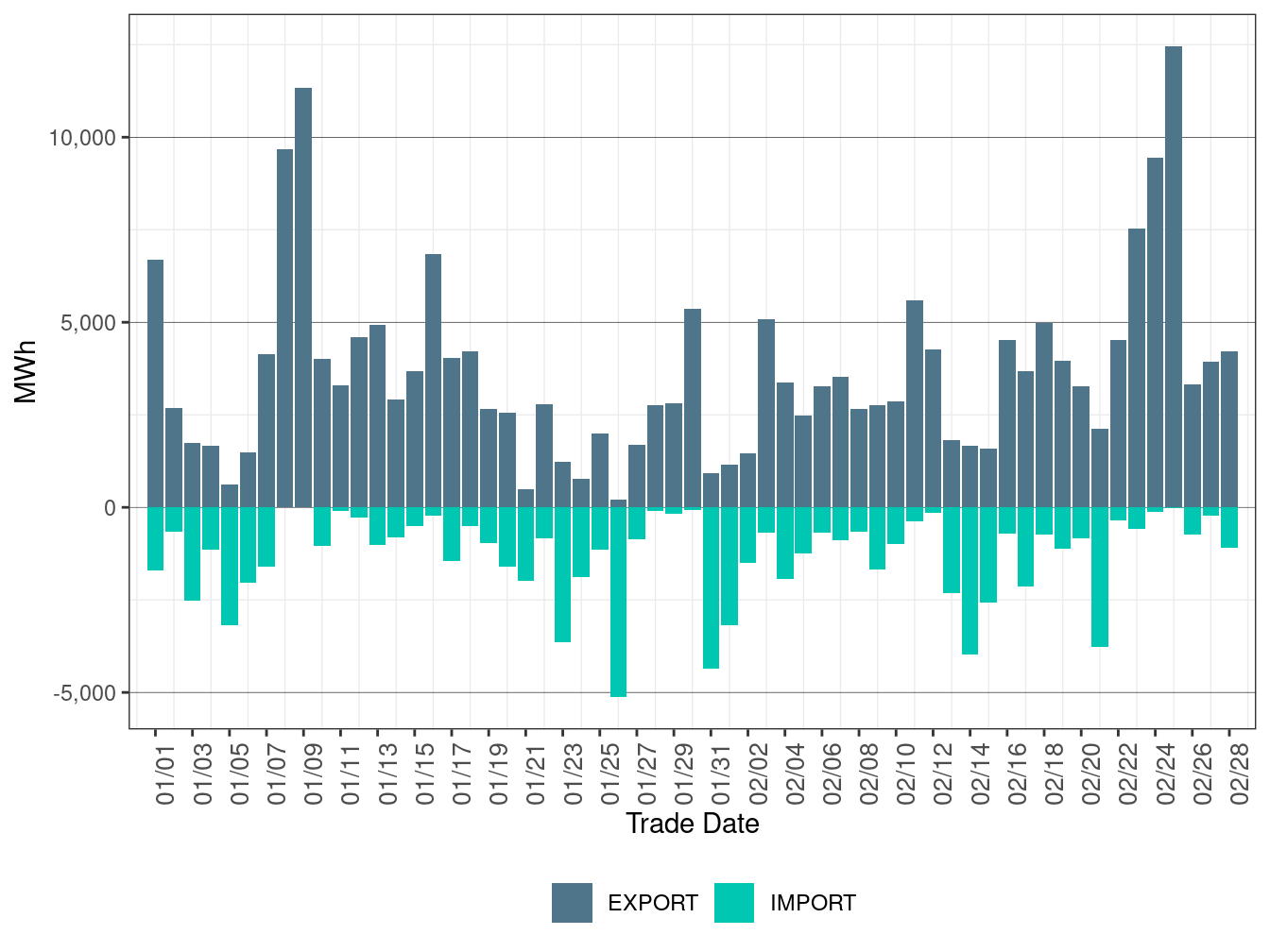

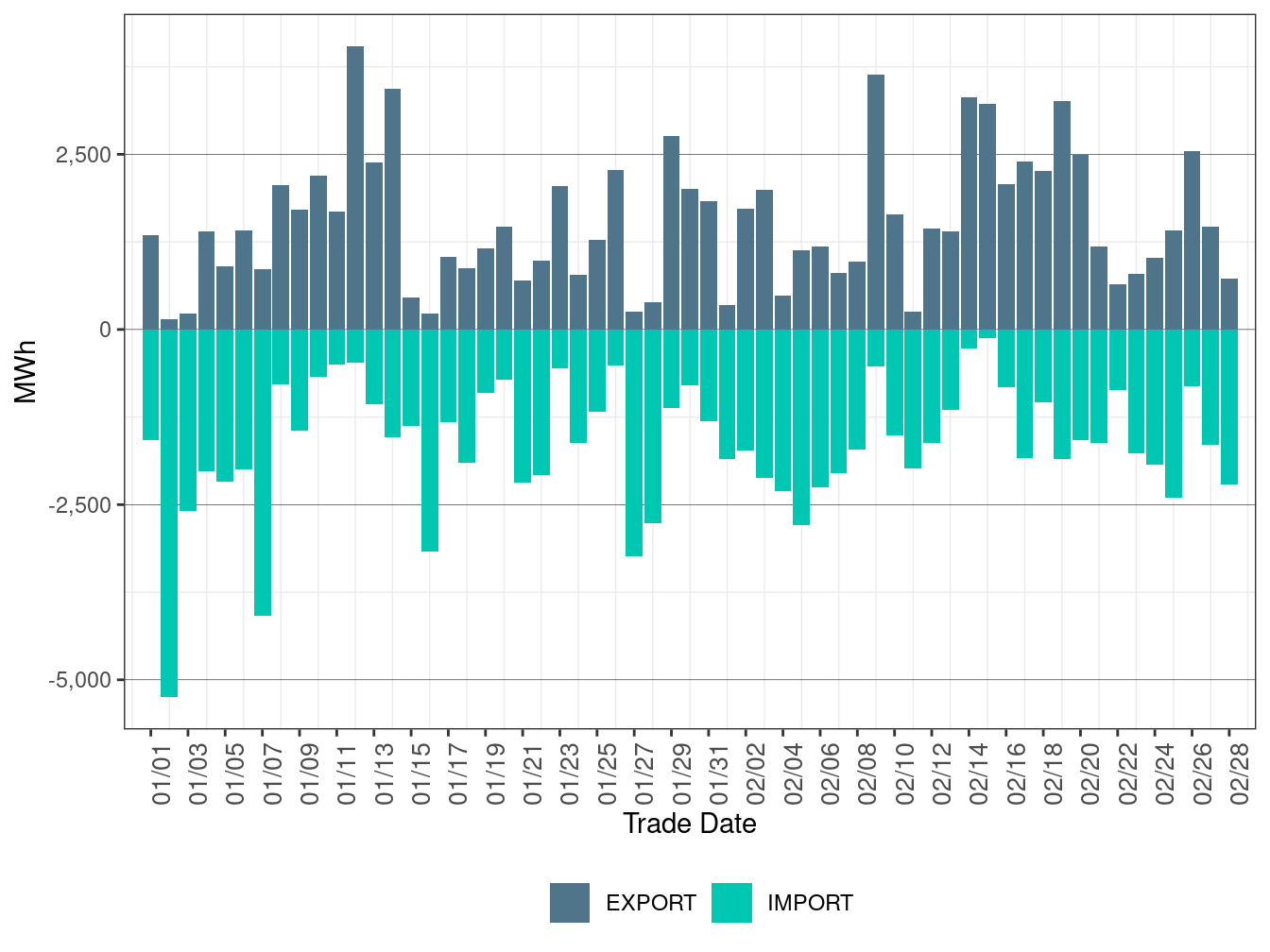

Figure 44 shows the daily volume of WEIM transfers for CAISO in FMM. IMPORT represents the total WEIM transfers from other BAAs. EXPORT represents the total WEIM transfers out to other BAAs in FMM. Figure 45 shows the daily volume of WEIM transfers for PACE in FMM. Figure 46 shows the daily volume of WEIM transfers for PACW in FMM. Figure 47 shows the daily volume of WEIM transfers for NEVP in FMM. Figure 48 shows the daily volume of WEIM transfers for AZPS in FMM. Figure 49 shows the daily volume of WEIM transfers for PSEI in FMM. Figure 50 shows the daily volume of WEIM transfers for PGE in FMM. Figure 51 shows the daily volume of WEIM transfers for BCHA in FMM. Figure 52 shows the daily volume of WEIM transfers for IPCO in FMM. Figure 53 shows the daily volume of WEIM transfers for BANC in FMM.

Figure 44: WEIM Transfers for CAISO in FMM

Figure 45: WEIM Transfers for PACE in FMM

Figure 46: WEIM Transfers for PACW in FMM

Figure 47: WEIM Transfers for NEVP in FMM

Figure 48: WEIM Transfers for AZPS in FMM

Figure 49: WEIM Transfers for PSEI in FMM

Figure 50: WEIM Transfers for PGE in FMM

Figure 51: WEIM Transfers for BCHA in FMM

Figure 52: WEIM Transfers for IPCO in FMM

Figure 53: WEIM Transfers for BANC in FMM

Figure 54 shows the daily volume of WEIM transfers for CAISO in RTD. Figure 55 shows the daily volume of WEIM transfers for PACE in RTD. Figure 56 shows the daily volume of WEIM transfers for PACW in RTD. Figure 57 shows the daily volume of WEIM transfers for NEVP in RTD. Figure 58 shows the daily volume of WEIM transfers for AZPS in RTD. Figure 59 shows the daily volume of WEIM transfers for PSEI in RTD. Figure 60 shows the daily volume of WEIM transfers for PGE in RTD. Figure 61 shows the daily volume of WEIM transfers for BCHA in RTD. Figure 62 shows the daily volume of WEIM transfers for IPCO in RTD. Figure 63 shows the daily volume of WEIM transfers for BANC in RTD.

Figure 54: WEIM Transfers for CAISO in RTD

Figure 55: WEIM Transfers for PACE in RTD

Figure 56: WEIM Transfers for PACW in RTD

Figure 57: WEIM Transfers for NEVP in RTD

Figure 58: WEIM Transfers for AZPS in RTD

Figure 59: WEIM Transfers for PSEI in RTD

Figure 60: WEIM Transfers for PGE in RTD

Figure 61: WEIM Transfers for BCHA in RTD

Figure 62: WEIM Transfers for IPCO in RTD

Figure 63: WEIM Transfers for BANC in RTD

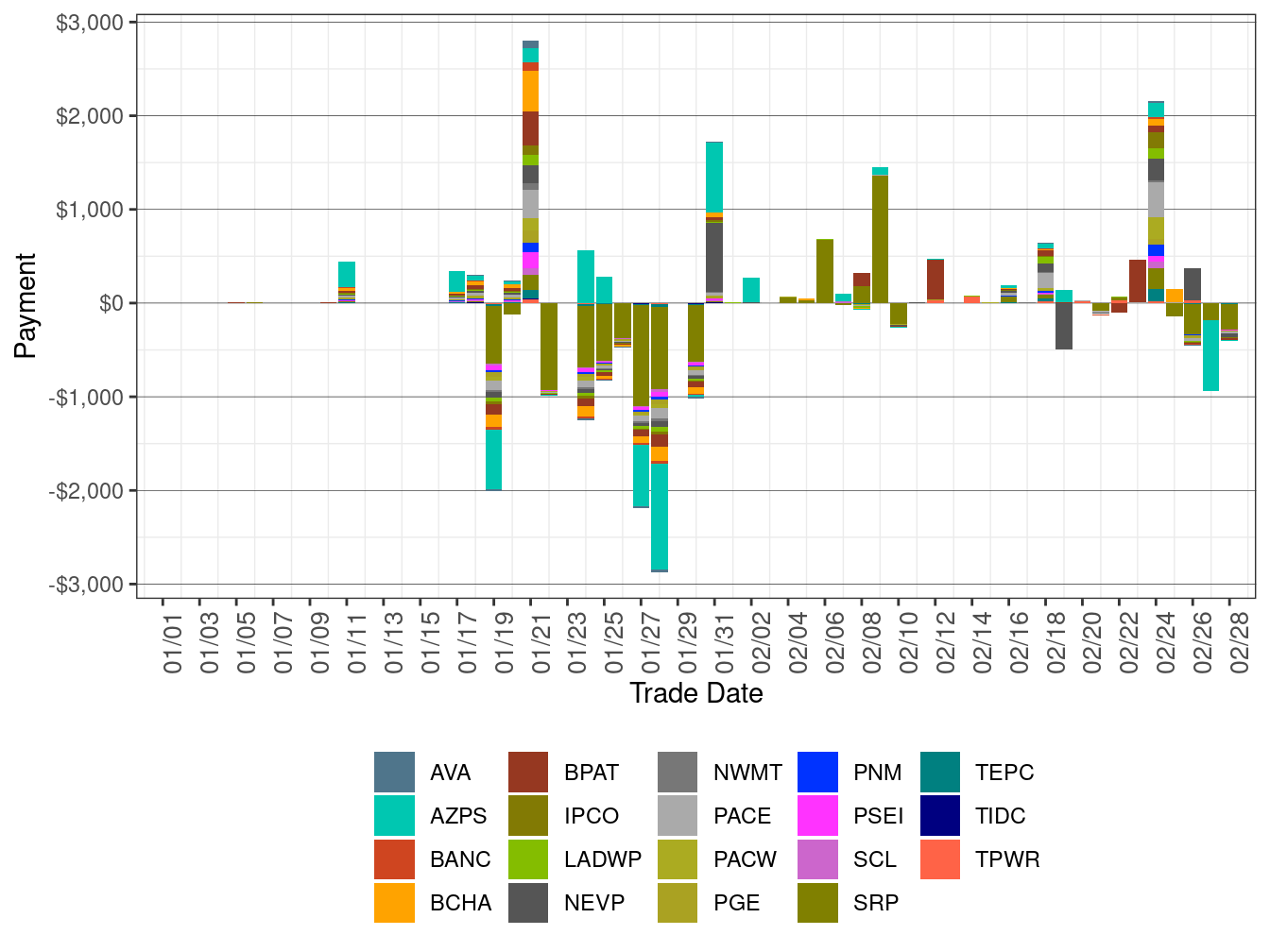

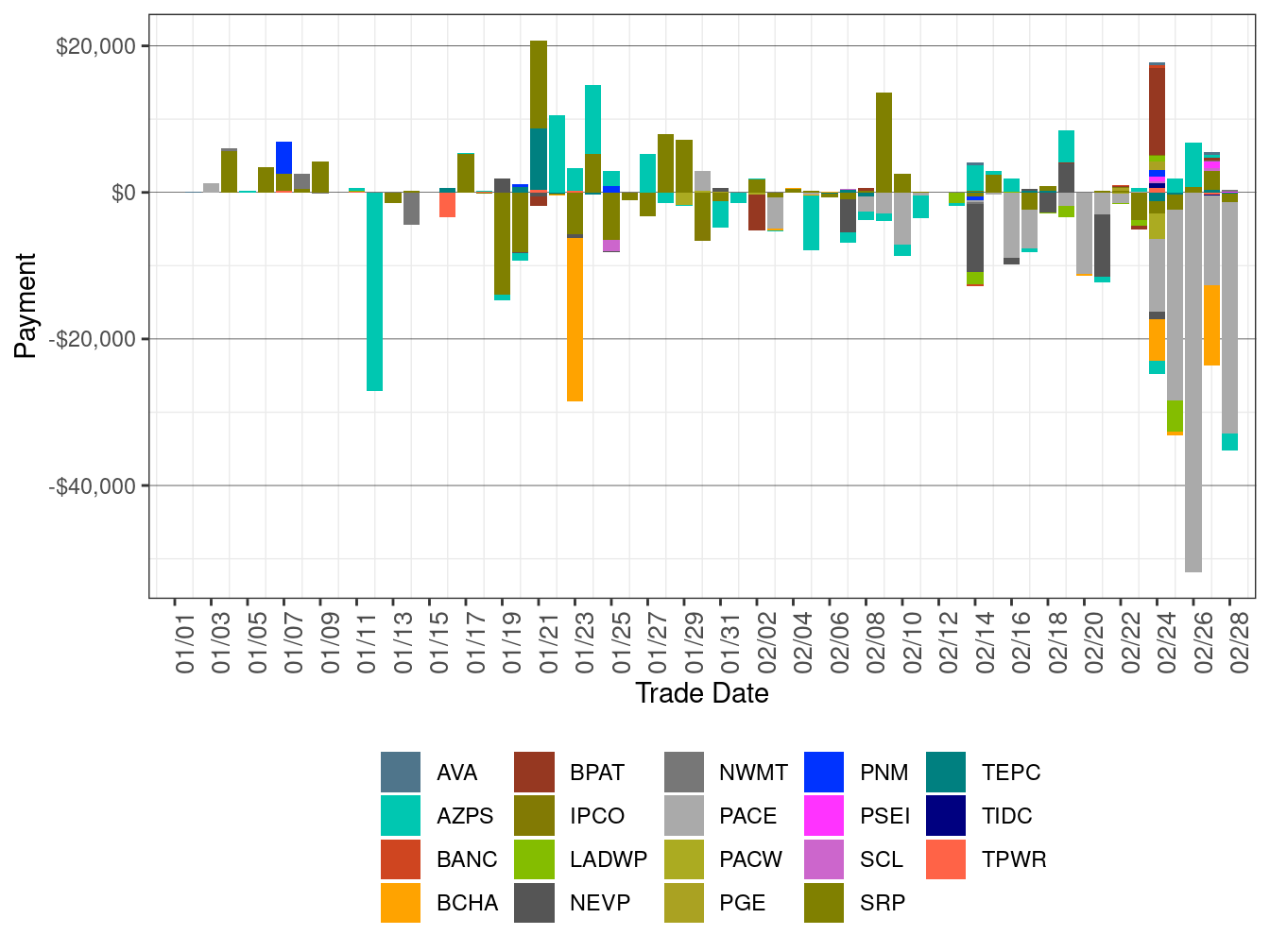

WEIM Cost Allocation

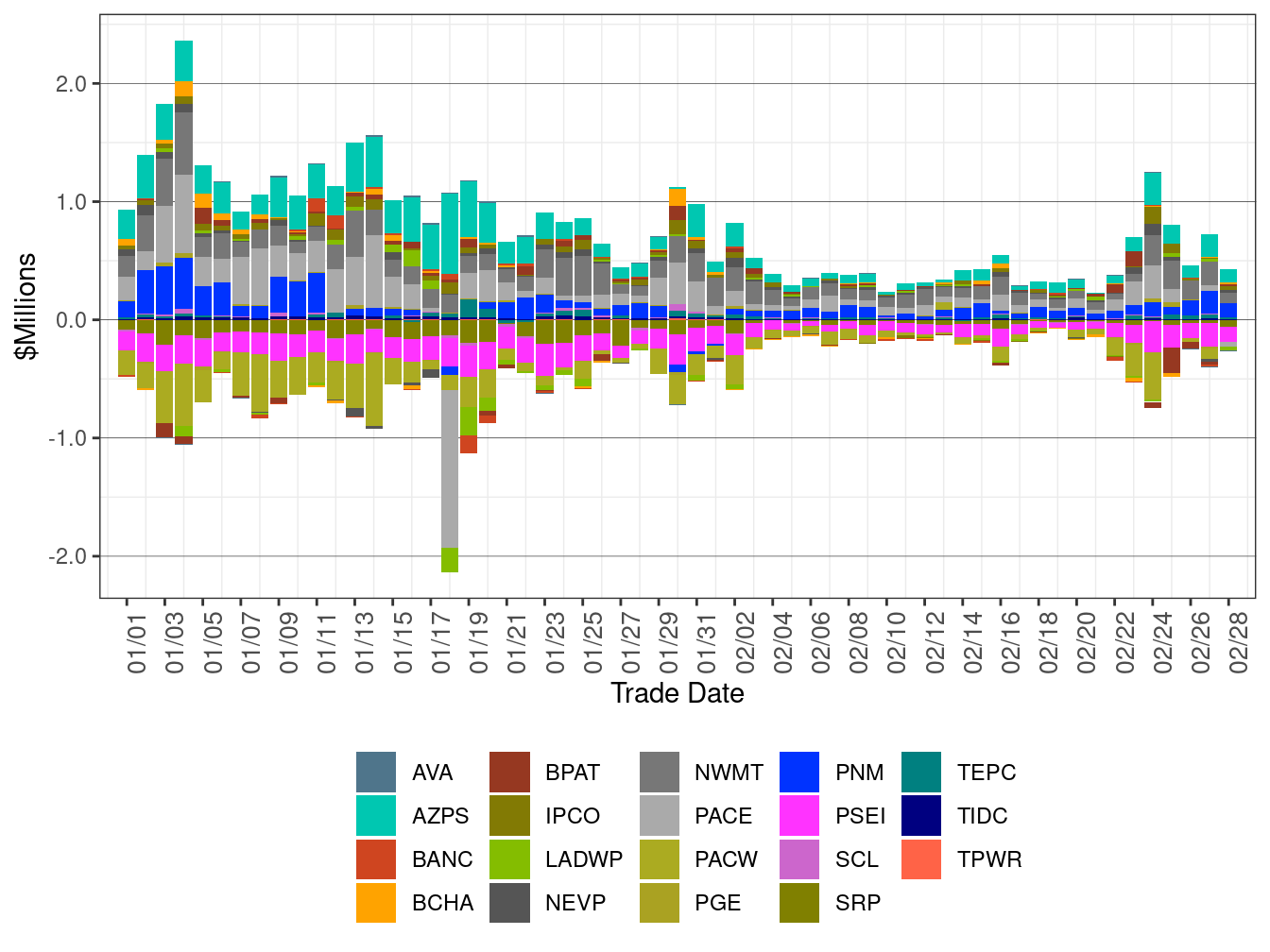

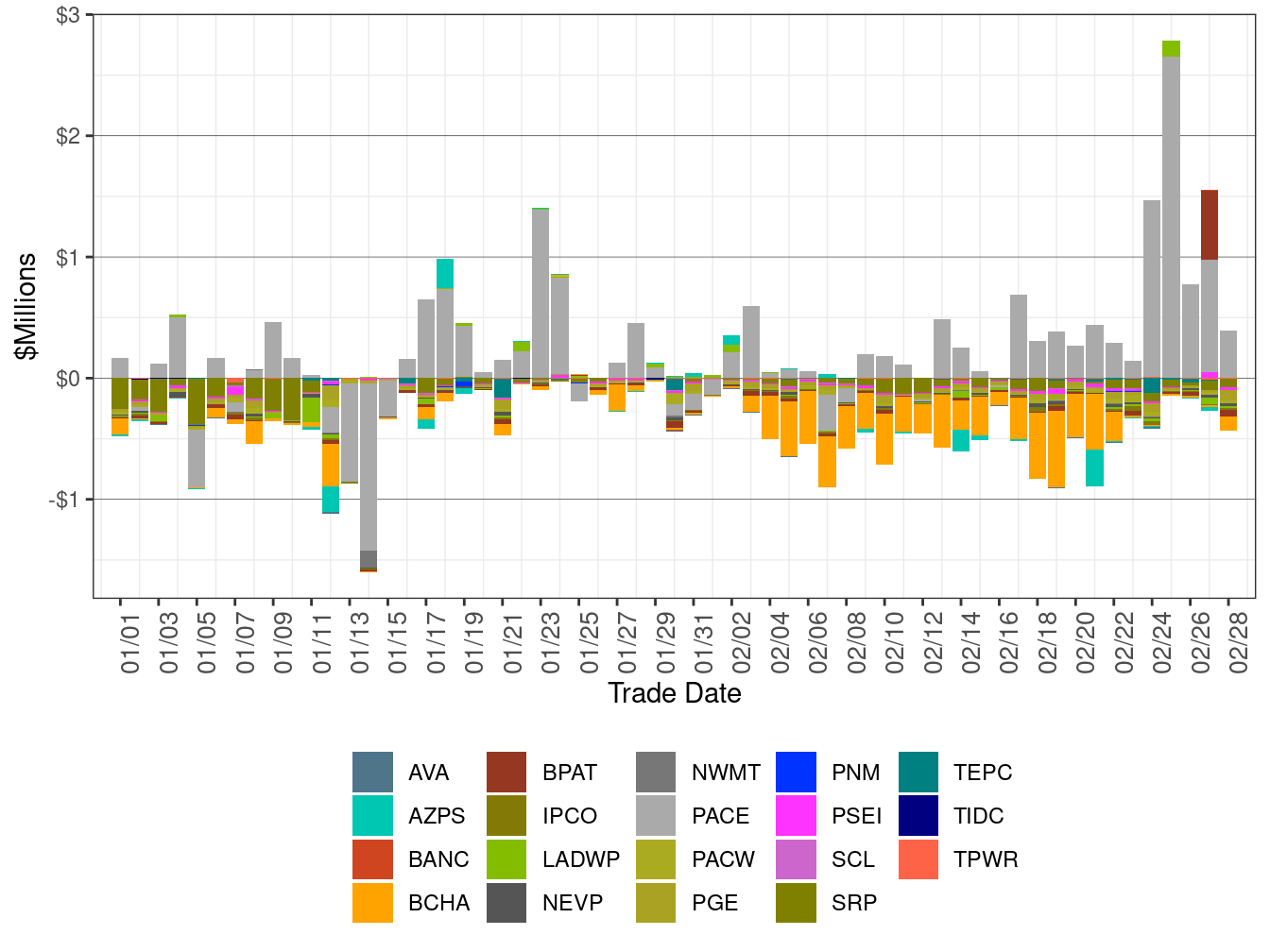

Figure 64 shows daily real-time imbalance energy offset (RTIEO) cost for each WEIM entity and Figure 65 shows daily real-time imbalance congestion offset (RTICO) cost for each WEIM entity. RTIEO and RTICO are calculated as per Tariff Section 11.5.4. Since the implementation of the new market, imbalance offset is a charge allocated to measured demand. A positive value indicates a charge to measured demand and a negative value indicates a payment to measured demand.

Total RTIEO in February decreased to $4.94 million from $13.91 million in January. Total RTICO charge increased to -$1.65 million in February from -$4.19 million in January.

Figure 64: WEIM Real-Time Imbalance Energy Offset by Area

Figure 65: WEIM Real-Time Congestion Imbalance Offset by Area

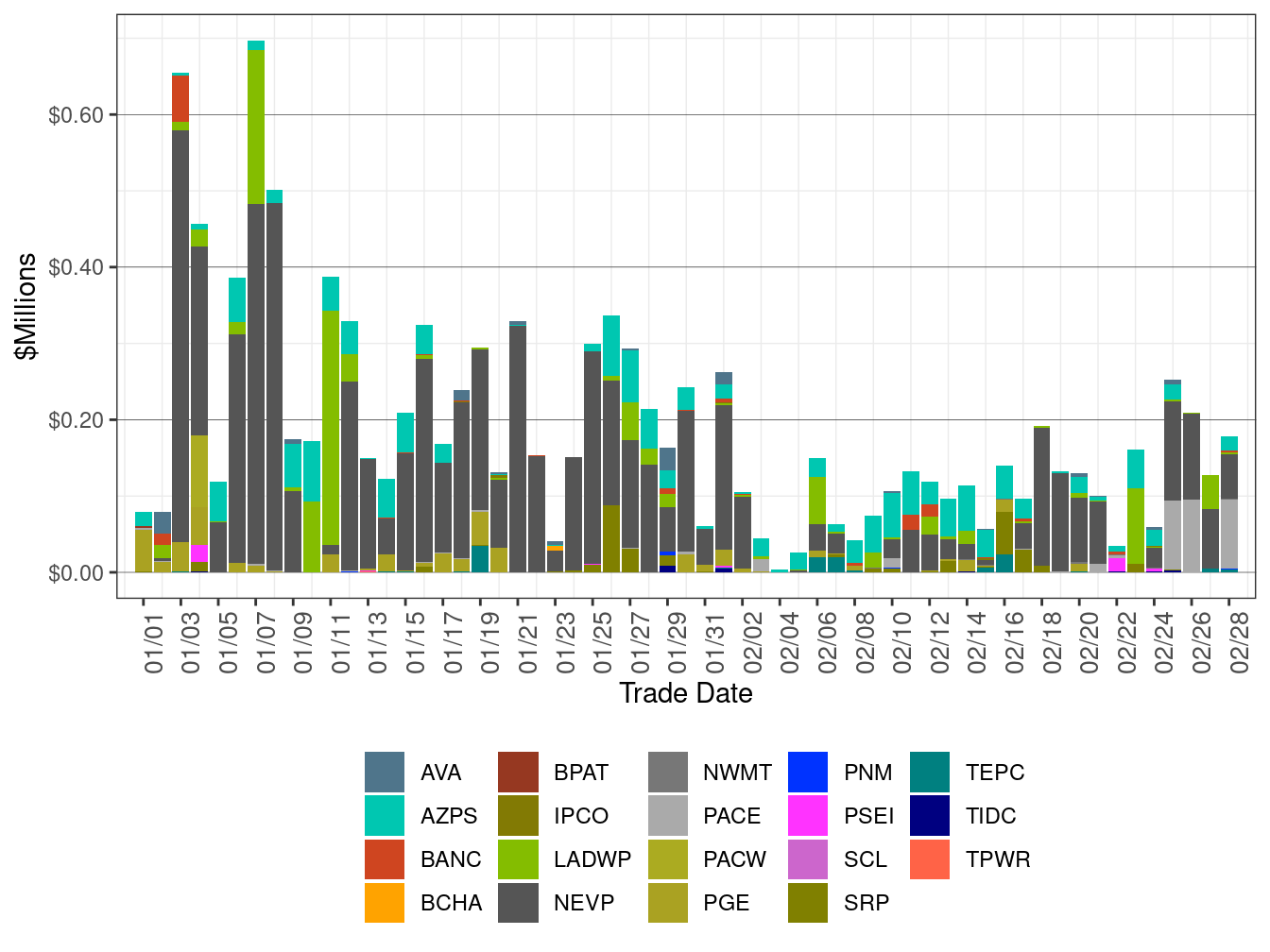

Figure 66 shows daily bid cost recovery for each WEIM entity. Total BCR declined to $3.21 million in February from $7.96 million in January.

Figure 66: WEIM Bid Cost Recovery by Area

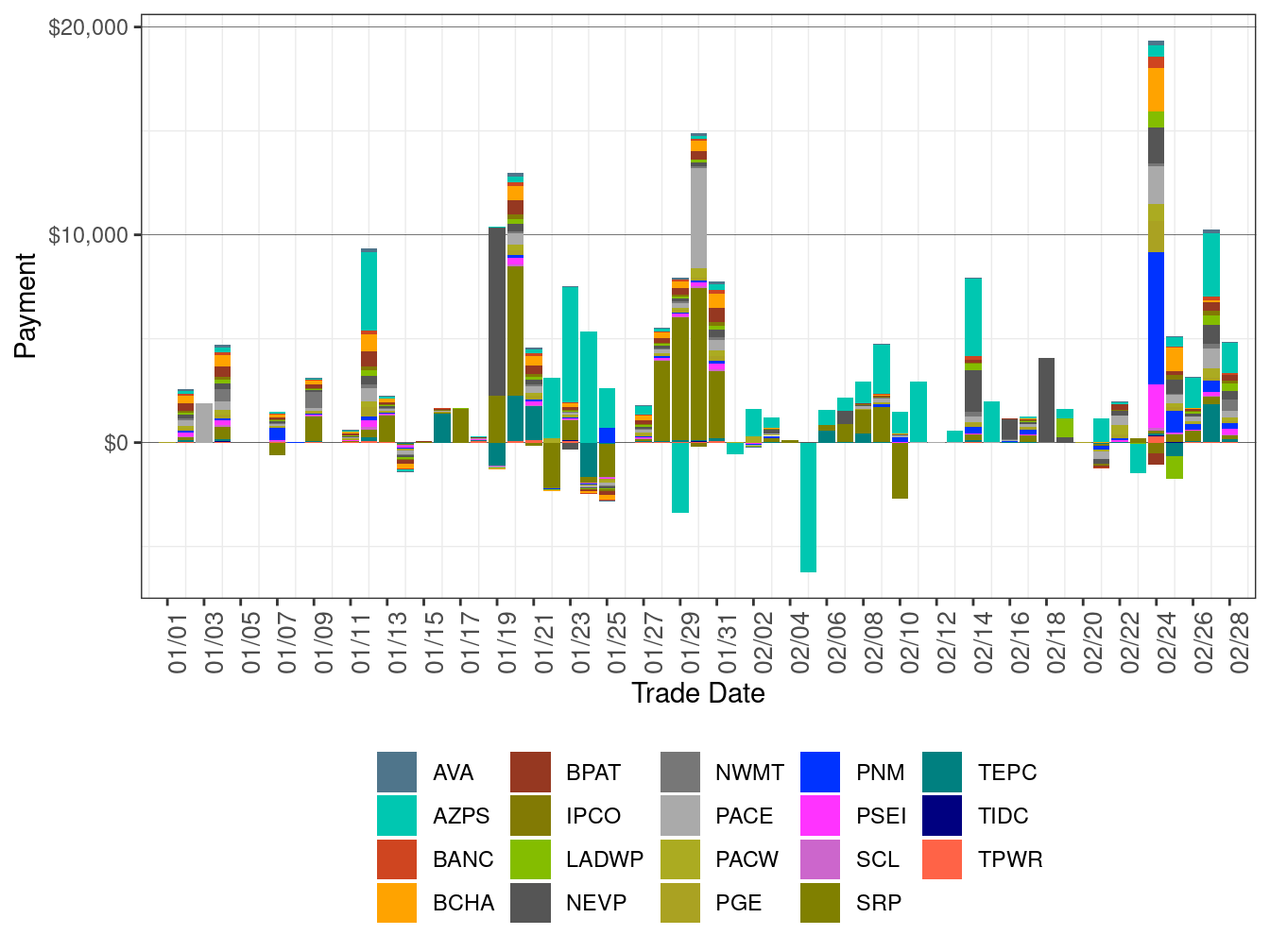

Figure 67 shows the flexible ramping up uncertainty payment for each WEIM entity. Total flexible ramping up uncertainty payment in February decreased to $70,100 from $99,300 in January.

Figure 68 shows the flexible ramping down uncertainty payment for each WEIM entity. Total flexible ramping down uncertainty payment in February rose to $4,830 from -$4,970 in January.

Figure 69 shows the flexible ramping forecast payment for each WEIM entity. Total forecast payment in February slid to -$0.21 million from -$7,950 in January.

Figure 67: Flexible Ramping Up Uncertainty Payment

Figure 68: Flexible Ramping Down Uncertainty Payment

Figure 69: Flexible Ramping Forecast Payment

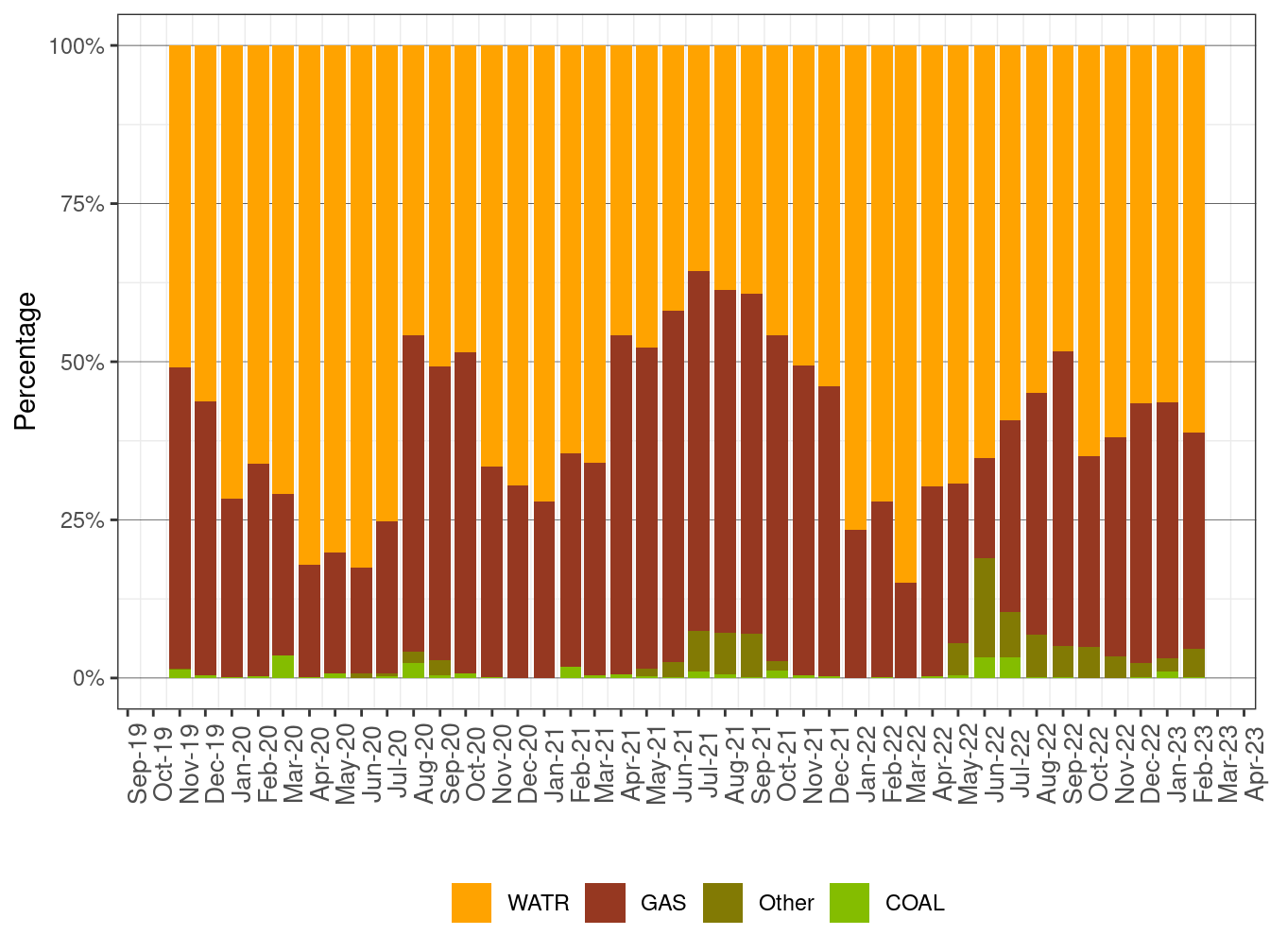

The ISO’s Western Energy Imbalance Market Business Practice Manual describes the methodology for determining whether a WEIM participating resource is dispatched to support transfers to serve California load. The methodology ensures that the dispatch considers the combined energy and associated marginal greenhouse gas (GHG) compliance cost based on submitted bids. The WEIM dispatches to support transfers into the ISO are documented below in Figure 70 and Table 13.

Figure 70: WEIM Transfer into ISO by Fuel Type

| Month-Year | Coal (%) | Gas (%) | Water (%) | Other Non-Emitting (%) |

|---|---|---|---|---|

| Nov-2019 | 50.9% | 47.7% | 0.0% | 1.4% |

| Dec-2019 | 56.3% | 43.3% | 0.0% | 0.5% |

| Jan-2020 | 71.6% | 28.2% | 0.0% | 0.2% |

| Feb-2020 | 66.2% | 33.5% | 0 | 0.3% |

| Mar-2020 | 70.9% | 25.5% | 0.0% | 3.6% |

| Apr-2020 | 82.0% | 17.8% | 0 | 0.2% |

| May-2020 | 80.2% | 19.1% | 0 | 0.7% |

| Jun-2020 | 82.5% | 16.7% | 0.7% | 0.0% |

| Jul-2020 | 75.2% | 24.1% | 0.4% | 0.4% |

| Aug-2020 | 45.9% | 49.9% | 1.8% | 2.4% |

| Sep-2020 | 50.7% | 46.5% | 2.4% | 0.4% |

| Oct-2020 | 48.5% | 50.8% | 0 | 0.7% |

| Nov-2020 | 66.5% | 33.4% | 0 | 0.1% |

| Dec-2020 | 69.5% | 30.5% | 0 | 0.0% |

| Jan-2021 | 72.1% | 27.8% | 0 | 0.0% |

| Feb-2021 | 64.5% | 33.7% | 0.0% | 1.8% |

| Mar-2021 | 65.9% | 33.7% | 0 | 0.4% |

| Apr-2021 | 45.8% | 53.5% | 0 | 0.7% |

| May-2021 | 47.8% | 50.7% | 1.2% | 0.3% |

| Jun-2021 | 41.9% | 55.7% | 2.3% | 0.1% |

| Jul-2021 | 35.7% | 56.9% | 6.3% | 1.1% |

| Aug-2021 | 38.6% | 54.1% | 6.7% | 0.5% |

| Sep-2021 | 39.3% | 53.7% | 6.9% | 0.2% |

| Oct-2021 | 45.8% | 51.6% | 1.5% | 1.2% |

| Nov-2021 | 50.5% | 49.0% | 0 | 0.5% |

| Dec-2021 | 53.9% | 45.9% | 0 | 0.3% |

| Jan-2022 | 76.6% | 23.4% | 0 | 0.0% |

| Feb-2022 | 72.0% | 27.8% | 0 | 0.1% |

| Mar-2022 | 84.9% | 15.1% | 0 | 0 |

| Apr-2022 | 69.7% | 30.1% | 0 | 0.2% |

| May-2022 | 69.3% | 25.3% | 5.0% | 0.5% |

| Jun-2022 | 65.2% | 15.9% | 15.6% | 3.3% |

| Jul-2022 | 59.2% | 30.4% | 7.1% | 3.3% |

| Aug-2022 | 54.9% | 38.3% | 6.6% | 0.2% |

| Sep-2022 | 48.4% | 46.5% | 5.0% | 0.1% |

| Oct-2022 | 64.9% | 30.2% | 4.9% | 0.0% |

| Nov-2022 | 61.9% | 34.6% | 3.4% | 0.0% |

| Dec-2022 | 56.5% | 41.2% | 2.2% | 0.1% |

| Jan-2023 | 56.4% | 40.5% | 2.1% | 1.1% |

| Feb-2023 | 61.2% | 34.3% | 4.4% | 0.1% |