Section 3 Market Performance Metrics

Day-Ahead Prices

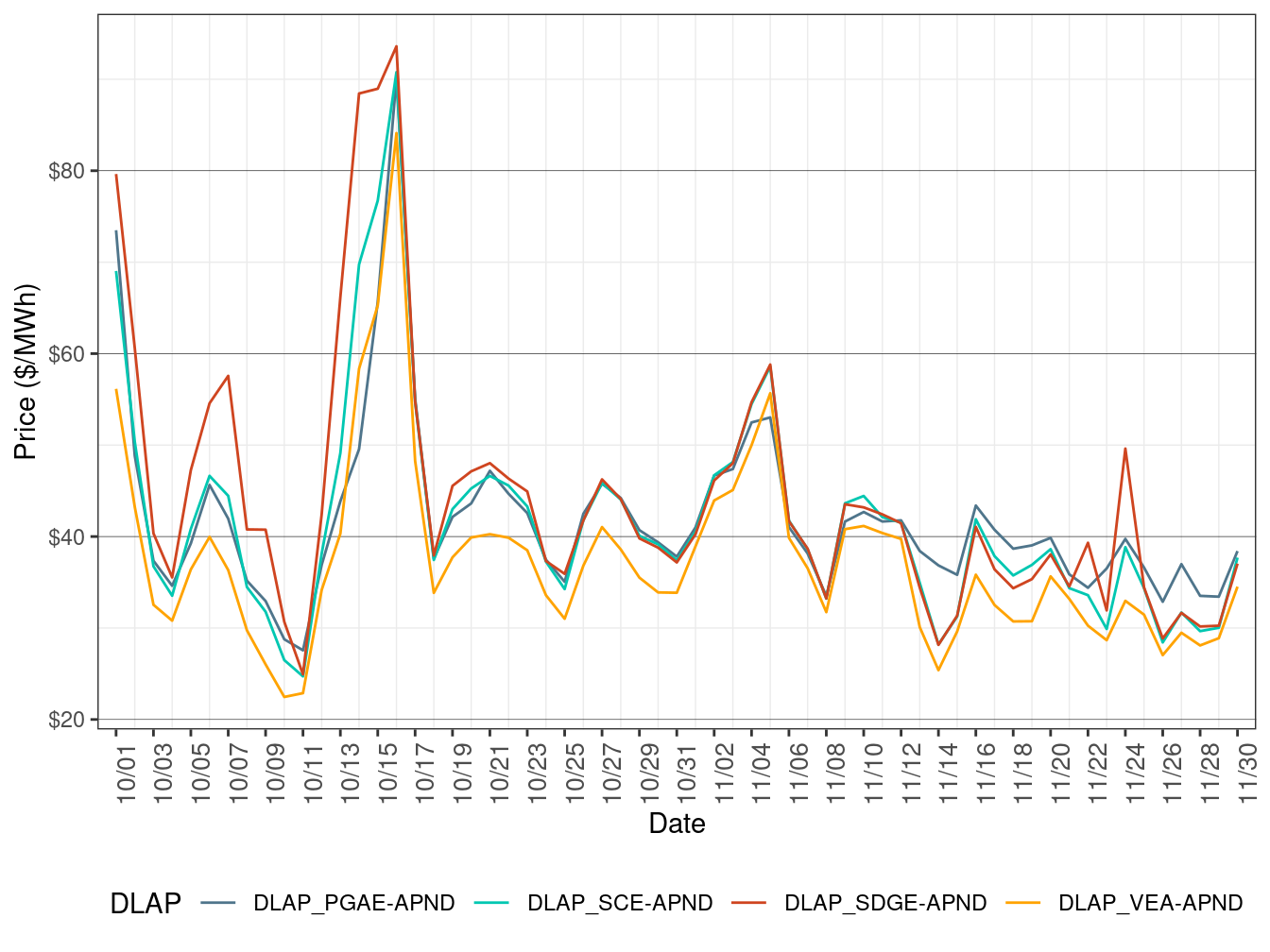

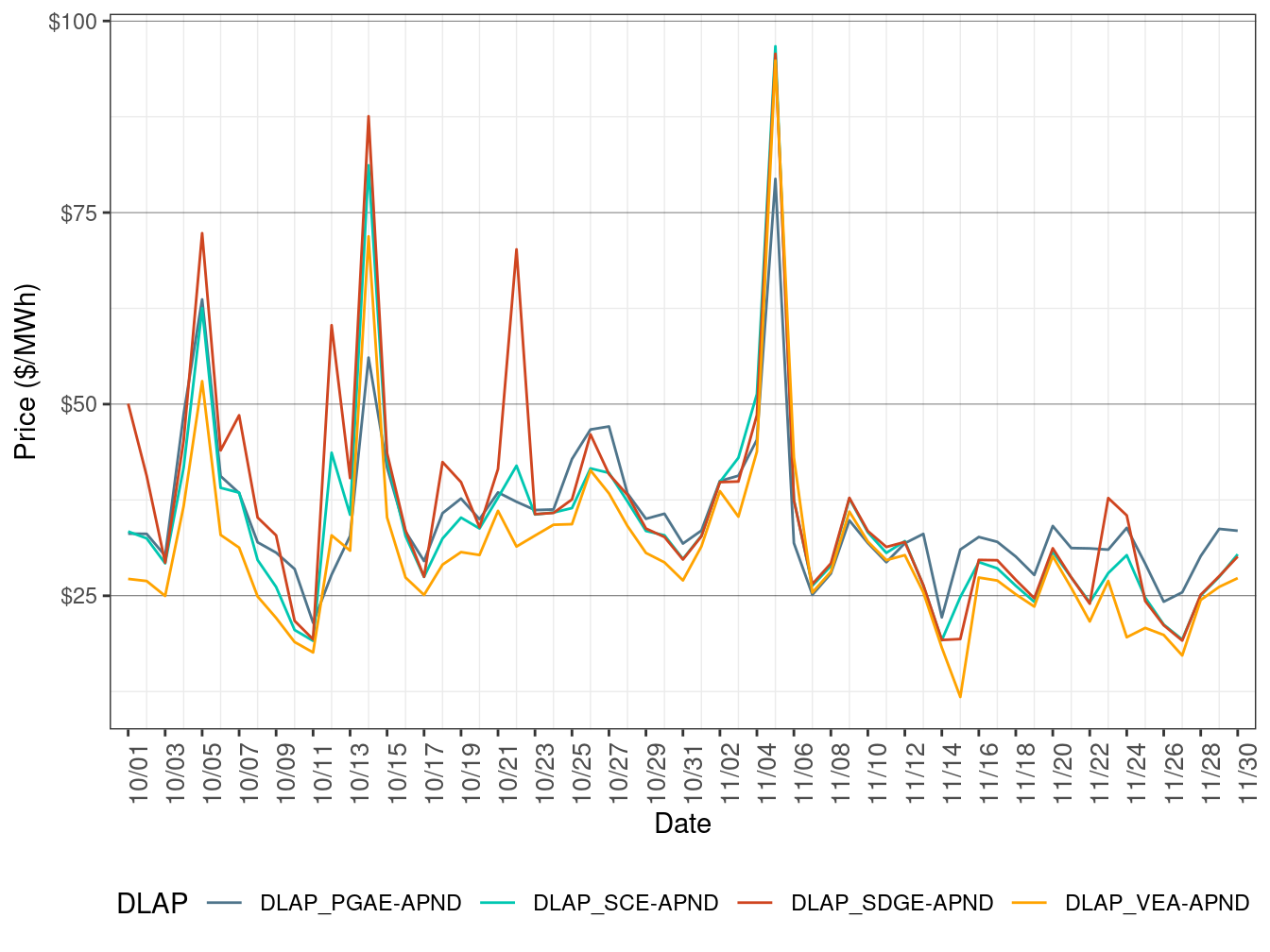

Figure 3.1 show the daily simple average load-aggregation points (LAP) prices for each of the four default LAPs (PG&E, SCE, SDG&E, and VEA) for all hours. TABLE 3.1 below lists the binding constraints along with the associated DLAP locations and the dates when the binding constraints resulted in relatively high or low DLAP prices. November 16 saw elevated prices for all four DLAPs due to tight supply.

Figure 3.1: Day-Ahead Simple Average LAP Prices (All Hours)

| DLAP | Dates | Transmission Constraint |

|---|---|---|

| PGAE | November 13-15 | 6410_CP10_NG |

| SDGE | November 24 | OMS-9300871_50001_OOS_NG |

Real-Time Price

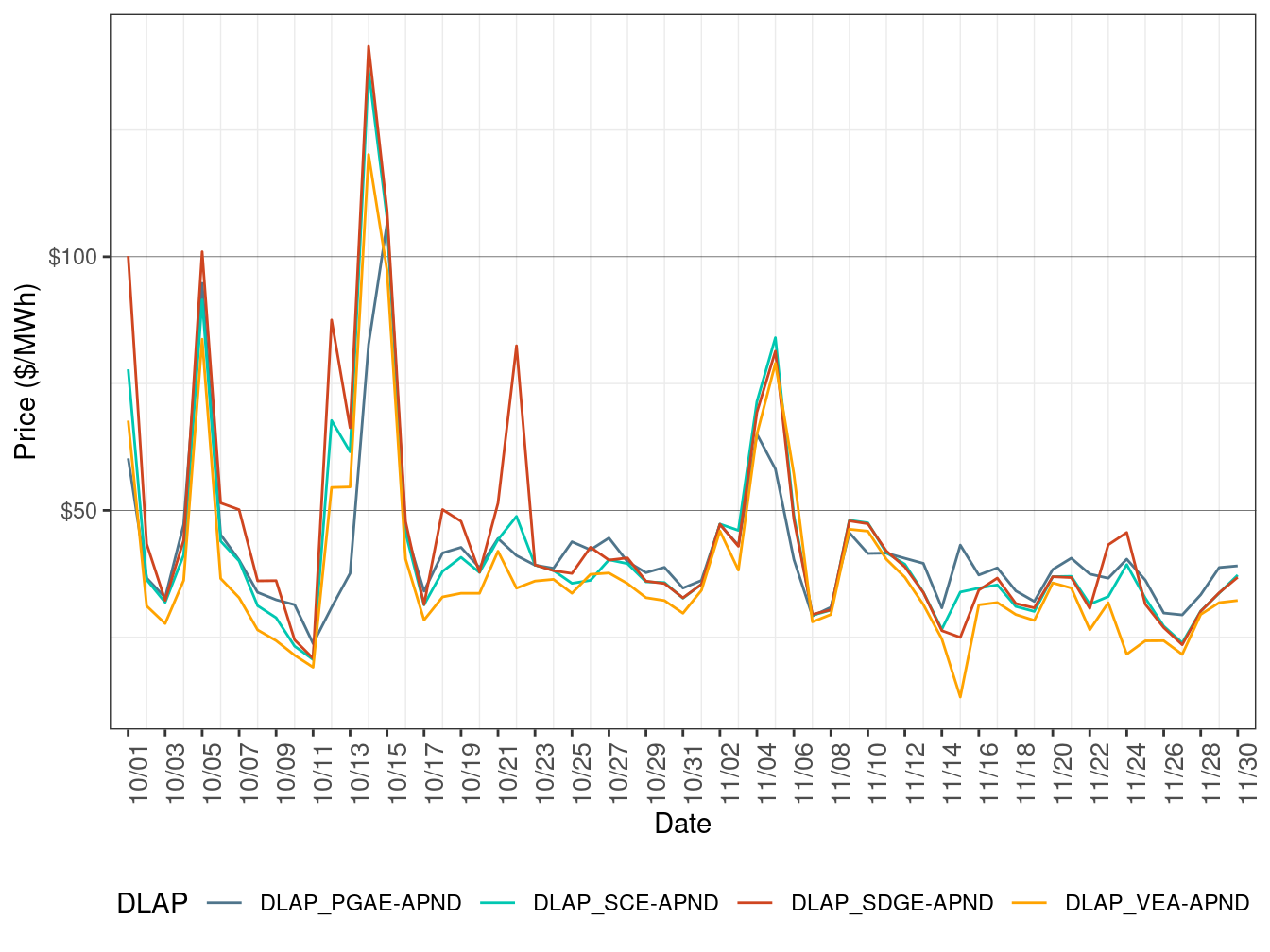

Figure 3.2 show daily simple average LAP prices for all the default LAPs (PG&E, SCE, SDG&E, and VEA) for all hours respectively in FMM. TABLE 3.2 lists the binding constraints along with the associated DLAP locations and the dates when the binding constraints resulted in relatively high or low DLAP prices. All four DLAP prices were elevated on November 15 due to upward load adjustment, generation outages, and renewable deviation.

Figure 3.2: FMM Simple Average LAP Prices (All Hours)

| DLAP | Dates | Transmission Constraint |

|---|---|---|

| PGAE | November 5, 6 | MIDWAY-VINCENT-500kV line |

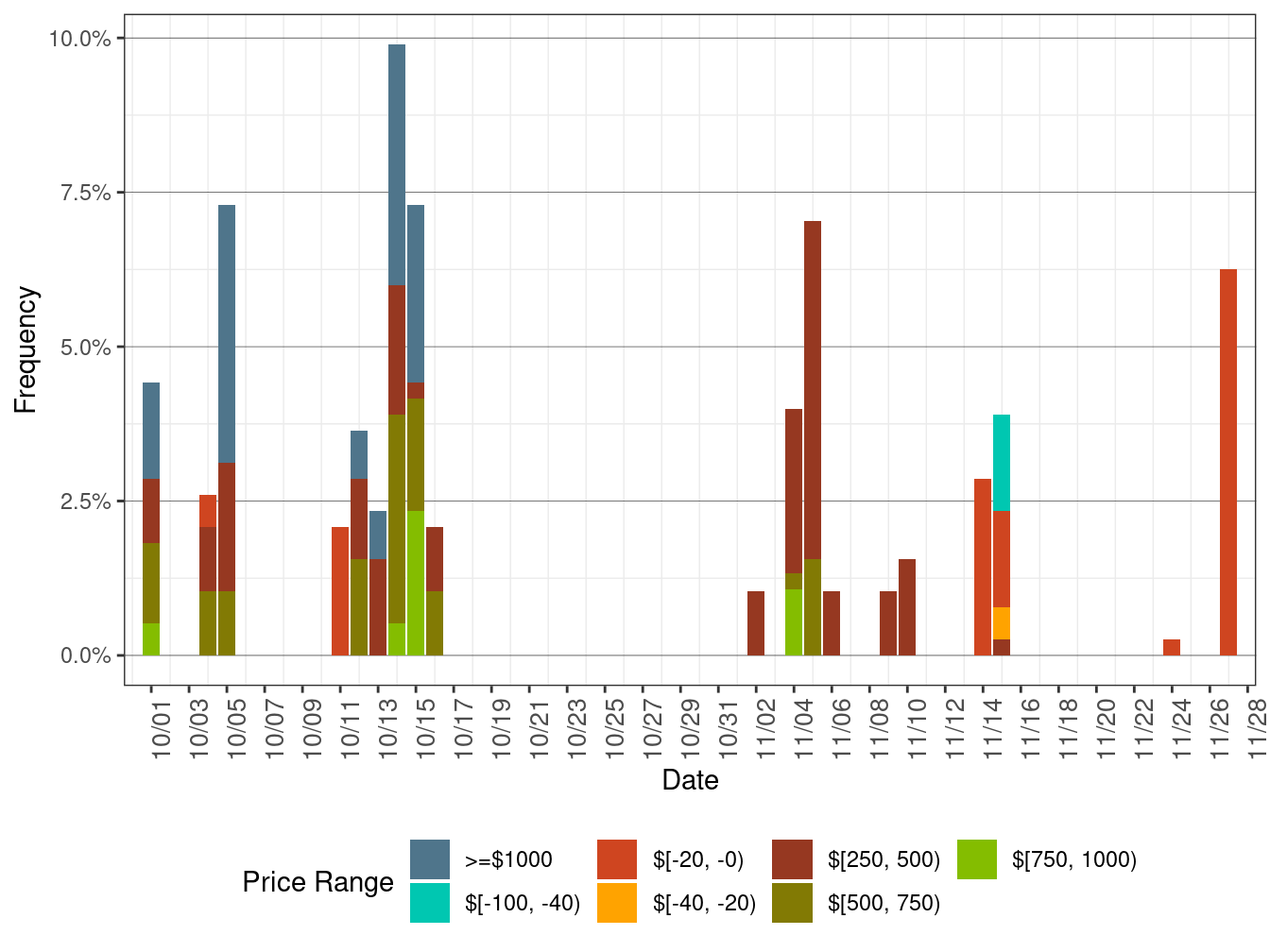

Figure 3.3 below shows the daily frequency of positive price spikes and negative prices by price range for the default LAPs in the FMM. The cumulative frequency of prices above $250/MWh decreased to 0.52 percent in November from 1.26 percent in October. The cumulative frequency of negative prices increased to 0.43 percent in November from 0.08 percent in October.

Figure 3.3: Daily Frequency of FMM LAP Positive Price Spikes and Negative Prices

Figure 3.4 show daily simple average LAP prices for all the default LAPs (PG&E, SCE, SDG&E, and VEA) for all hours respectively in RTD. TABLE 3.3 lists the binding constraints along with the associated DLAP locations and the dates when the binding constraints resulted in relatively high or low DLAP prices. On November 5, all four DLAP LMPs were elevated due to renewable deviation, generation outage, and upward load adjustment.

Figure 3.4: RTD Simple Average LAP Prices (All Hours)

| DLAP | Dates | Transmission Constraint |

|---|---|---|

| PGAE | November 05 | MIDWAY-VINCENT-500 kV line |

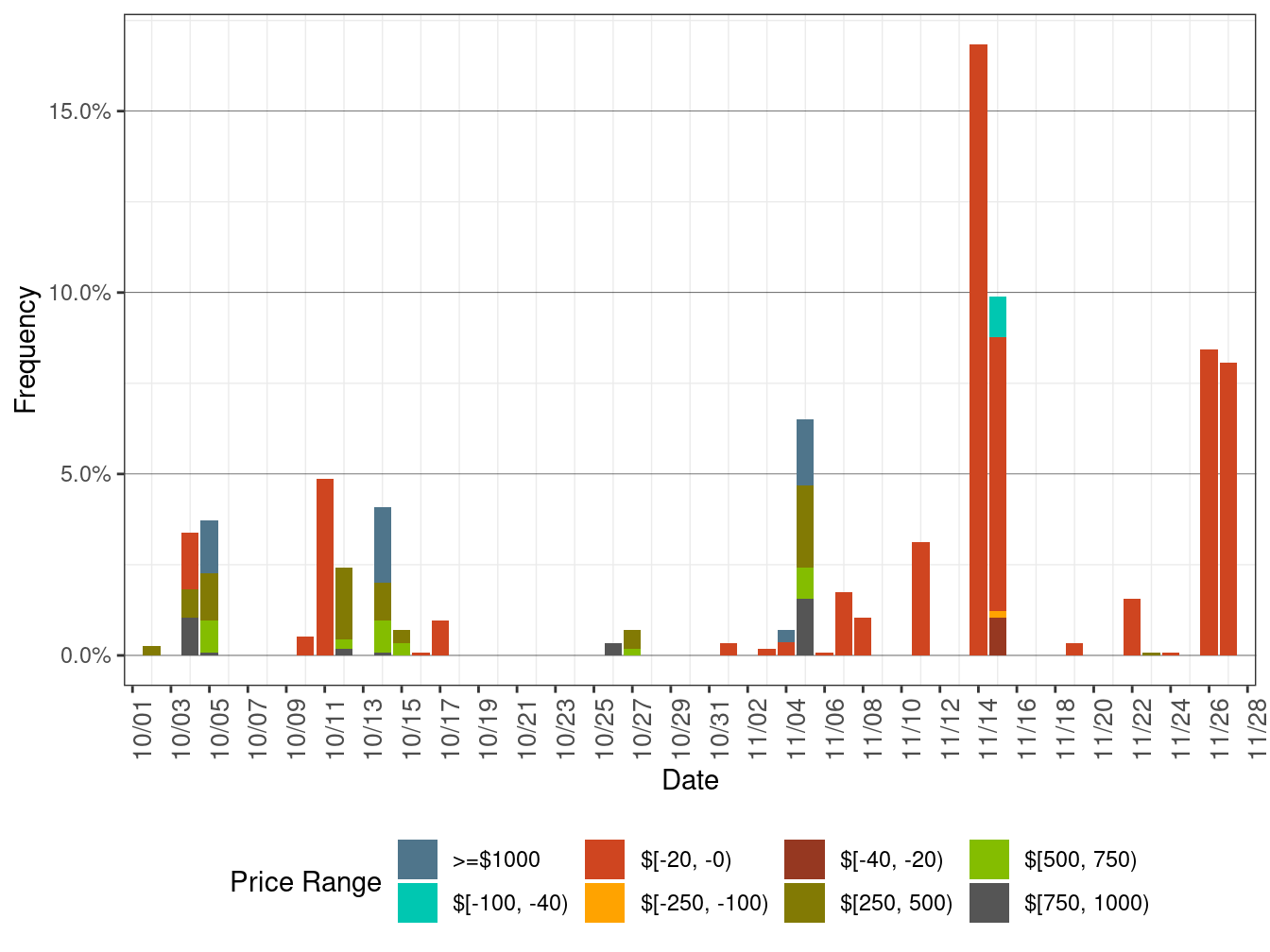

Figure 3.3 below shows the daily frequency of positive price spikes and negative prices by price range for the default LAPs in RTD. The cumulative frequency of prices above $250/MWh fell to 0.22 percent in November from 0.45 percent in October. The cumulative frequency of negative prices rose to 1.74 percent in November from 0.26 percent in October.

Figure 3.5: Daily Frequency of FMM LAP Positive Price Spikes and Negative Prices