5 Congestion Revenue Rights

Congestion Revenue Rights are a financial tool developed for the purpose of allowing load and exports to hedge against congestion charges paid when congestion occurs on a transmission line (aka congestion rents as was described in the previous section). If the congestion occurs in the same direction the CRR is held for the CRR holder is paid, but the CRR holder may have an obligation to pay if congestion occurs in the opposite direction.

Congestion revenue rights auction efficiency 1B became effective on January 1, 2019. It includes key changes related to the congestion revenue rights settlements process:

- Targeted reduction of congestion revenue rights payouts on a constraint by constraint basis.

- Distribute congestion revenues to the extent that CAISO collected the requisite revenue on the constraint over the month. That is, implement a pro-rata funding for CRRs.

- Allow surpluses on one constraint in one hour to offset deficits on the same constraint in another hour over the course of the month.

- Only distribute surpluses to congestion revenue rights if the surplus is collected on a constraint that the congestion revenue right accrued a deficit, and only up to the full target payment value of the congestion revenue right.

- Distribute remaining surplus revenue at the end of the month, which are associated with constraints that collect more surplus over the month than deficits, to measured demand.

Monthly CRR Revenue

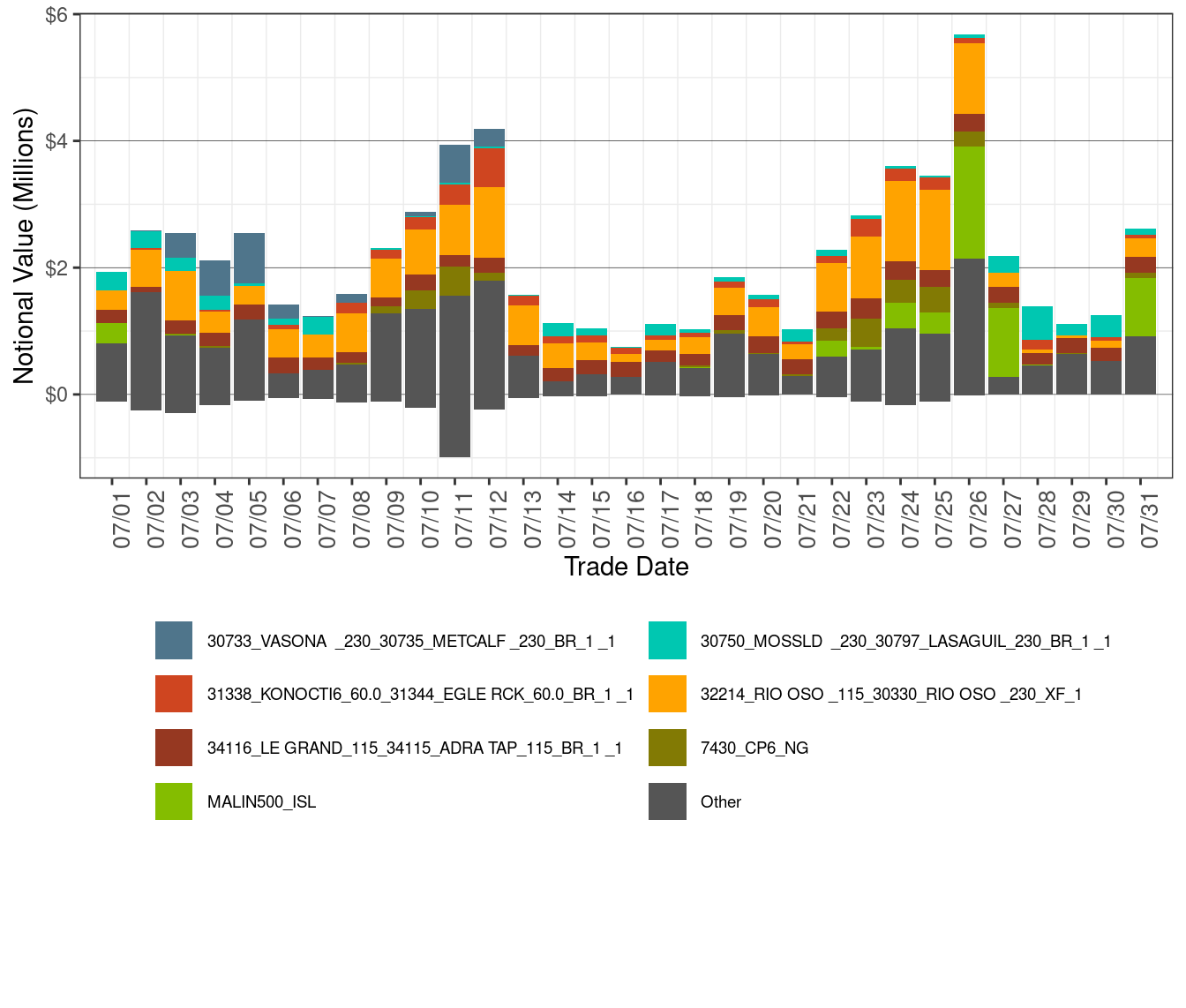

Figure 11 illustrates the daily CRR notional value in the corresponding month for the various transmission elements that experienced congestion during the month. CRR notional value is calculated as the product of CRR implied flow (MW) and constraint shadow price ($/MWh) in each hour per constraint and CRR.

Figure 11: Daily CRR Notional Value by Transmission Element

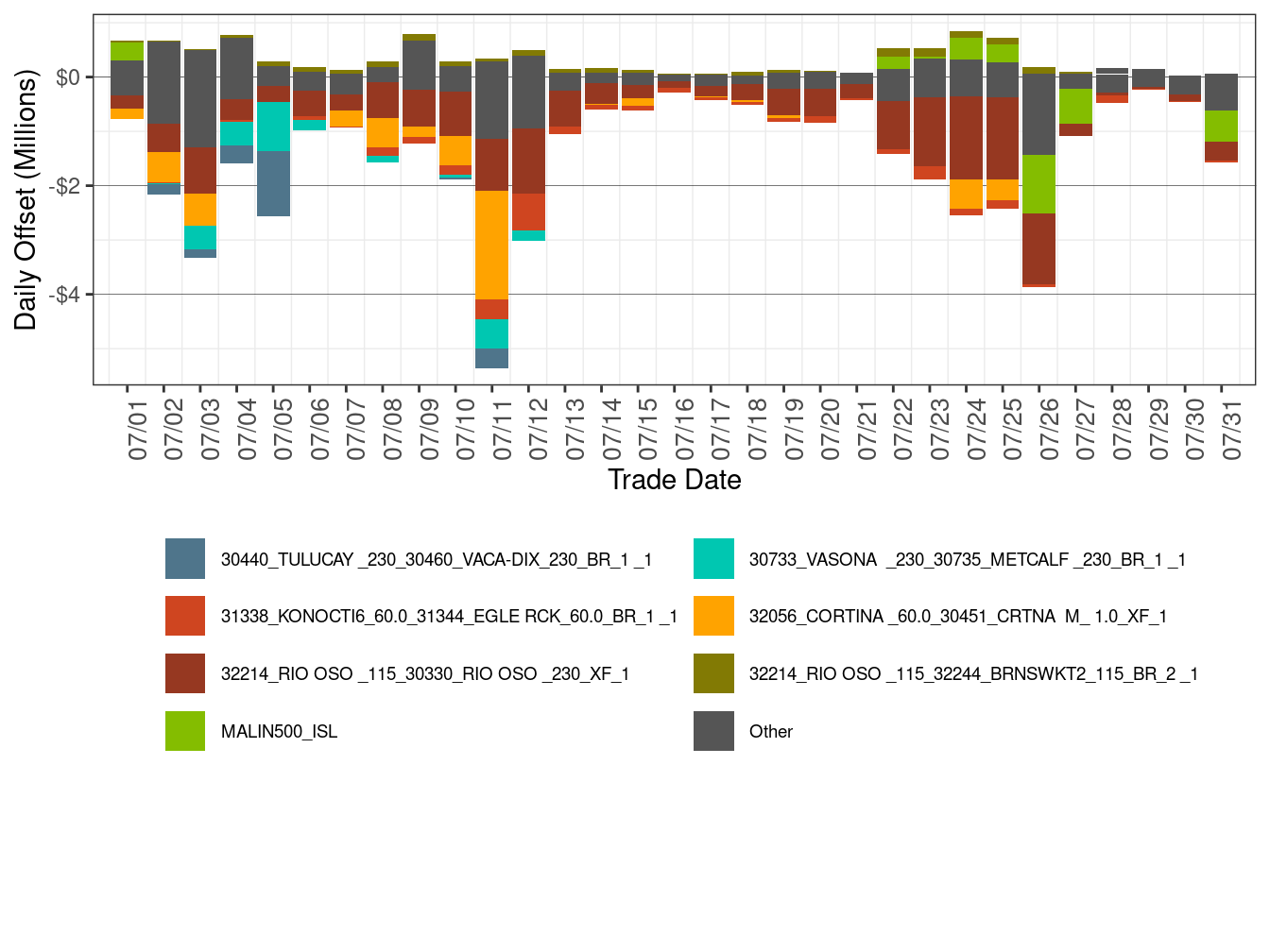

Figure 12 illustrates the daily CRR offset value in the corresponding month for the transmission elements that experienced congestion during the month. CRR offset value is the difference between the revenue collected from the congestion and the CRR notional value. A positive CRR offset value represents surplus and a negative CRR offset value represents shortfall.

As shown below, table 6 shows the percentage of monthly CRR deficit by transmission element and Table 7 shows the percentage of monthly CRR surplus by transmission element.

Figure 12: Daily CRR Offset Value by Transmission Element

| Constraint | Percent |

|---|---|

| 32214_RIO OSO _115_30330_RIO OSO _230_XF_1 | 39.24 |

| Other | 13.70 |

| 32056_CORTINA 60.0_30451_CRTNA M 1.0_XF_1 | 13.52 |

| 31338_KONOCTI6_60.0_31344_EGLE RCK_60.0_BR_1 _1 | 7.05 |

| 30733_VASONA _230_30735_METCALF _230_BR_1 _1 | 6.34 |

| 30440_TULUCAY _230_30460_VACA-DIX_230_BR_1 _1 | 4.97 |

| 30750_MOSSLD _230_30797_LASAGUIL_230_BR_1 _1 | 4.15 |

| 34366_SANGER _115_34370_MC CALL _115_BR_3 _1 | 3.40 |

| 36851_NORTHERN_115_36852_SCOTT _115_BR_2 _1 | 2.63 |

| OMS IV-SX OUTAGE_NG | 2.59 |

| MALIN500_ISL | 2.41 |

| Constraint | Percent |

|---|---|

| Other | 33.79 |

| 32214_RIO OSO _115_32244_BRNSWKT2_115_BR_2 _1 | 22.94 |

| 30055_GATES1 _500_30900_GATES _230_XF_11_P | 8.95 |

| NOB_ITC | 6.94 |

| MONAIPPDC_ITC | 6.90 |

| 34002_SALADO _60.0_34008_STNSLSRP_60.0_BR_1 _1 | 4.94 |

| 31336_HPLND JT_60.0_31370_CLVRDLJT_60.0_BR_1 _1 | 4.84 |

| 33724_LOCKEFRD_60.0_33736_LODI JCT_60.0_BR_1 _1 | 3.29 |

| 24701_KRAMER _230_24601_VICTOR _230_BR_1 _1 | 2.71 |

| 7320_CP6_NG | 2.42 |

| 30060_MIDWAY _500_24156_VINCENT _500_BR_2 _3 | 2.28 |

The main reasons for CRR offset shortfall were

- *The line 32214_RIO OSO _115_30330_RIO OSO _230_XF_1 was binding in all days of this month, resulting in offset shortfall of $17.81 million.*

- The line 32056_CORTINA 60.0_30451_CRTNA M 1.0_XF_1 was binding in 21 days of this month, resulting in offset shortfall of $6.13 million.

The main reasons for CRR offset surplus were

- The line 32214_RIO OSO_115_32244_BRNSWKT2_115_BR_2_1 was binding in 28 days of this month, resulting in offset surplus of $1.89 million.

Table 8 shows the percentage of monthly CRR payment by transmission element.

| Constraint | Percent |

|---|---|

| 34116_LE GRAND_115_34115_ADRA TAP_115_BR_1 _1 | 33.04 |

| Other | 27.65 |

| MALIN500_ISL | 22.35 |

| 7430_CP6_NG | 16.63 |

| 30750_MOSSLD _230_30797_LASAGUIL_230_BR_1 _1 | 12.51 |

| 30060_MIDWAY _500_24156_VINCENT _500_BR_2 _3 | 11.20 |

| NOB_ITC | 8.36 |

| 7430_KTTLM_GATES_70_1 | 7.06 |

| 31336_HPLND JT_60.0_31370_CLVRDLJT_60.0_BR_1 _1 | 6.74 |

| 30114_DELEVAN _230_30450_CORTINA _230_BR_1 _1 | 5.56 |

| 30055_GATES1 _500_30900_GATES _230_XF_11_P | 4.20 |

Table 9 shows the monthly CRR statistics. The Net Monthly Balancing Surplus calculates as CRR Surplus plus CRR Daily Balancing Account minus total auction revenue. The total auction revenue is the sum of Monthly Auction Revenue and Annual Auction Revenue. The Allocation to Measured demand is calculated as sum of total auction revenue and Net Monthly Balancing Surplus.

Net Monthly Balancing Surplus in July was -$2.87 million. The auction revenues credited to the balancing account for July were $6.39 million. As a result, the balancing account had a surplus of approximately $3.52 million in July compared to $10.43 million in the previous month, which was allocated to measured demand.

| Description | JULY -2024 | JUNE -2024 |

|---|---|---|

| CRR Notional Value | $63,369,622 | $44,956,767 |

| CRR Deficit | -$45,371,274 | -$16,265,002 |

| CRR Settlement Rule | -$75,752 | -$13,825 |

| CRR Adjusted Payment | $17,922,596 | $28,677,941 |

| CRR Surplus | $8,243,007 | $8,223,557 |

| Monthly Auction Revenue | $3,127,749 | $3,376,012 |

| Annual Auction Revenue | $3,267,781 | $2,924,175 |

| CRR Daily Balancing Account | -$4,718,327 | $2,209,413 |

| Net Monthly Balancing Surplus | -$2,870,851 | $4,132,783 |

| Allocation to Measured Demand | $3,524,680 | $10,432,970 |