7 Cost Allocation Metrics

Bid Cost Recovery

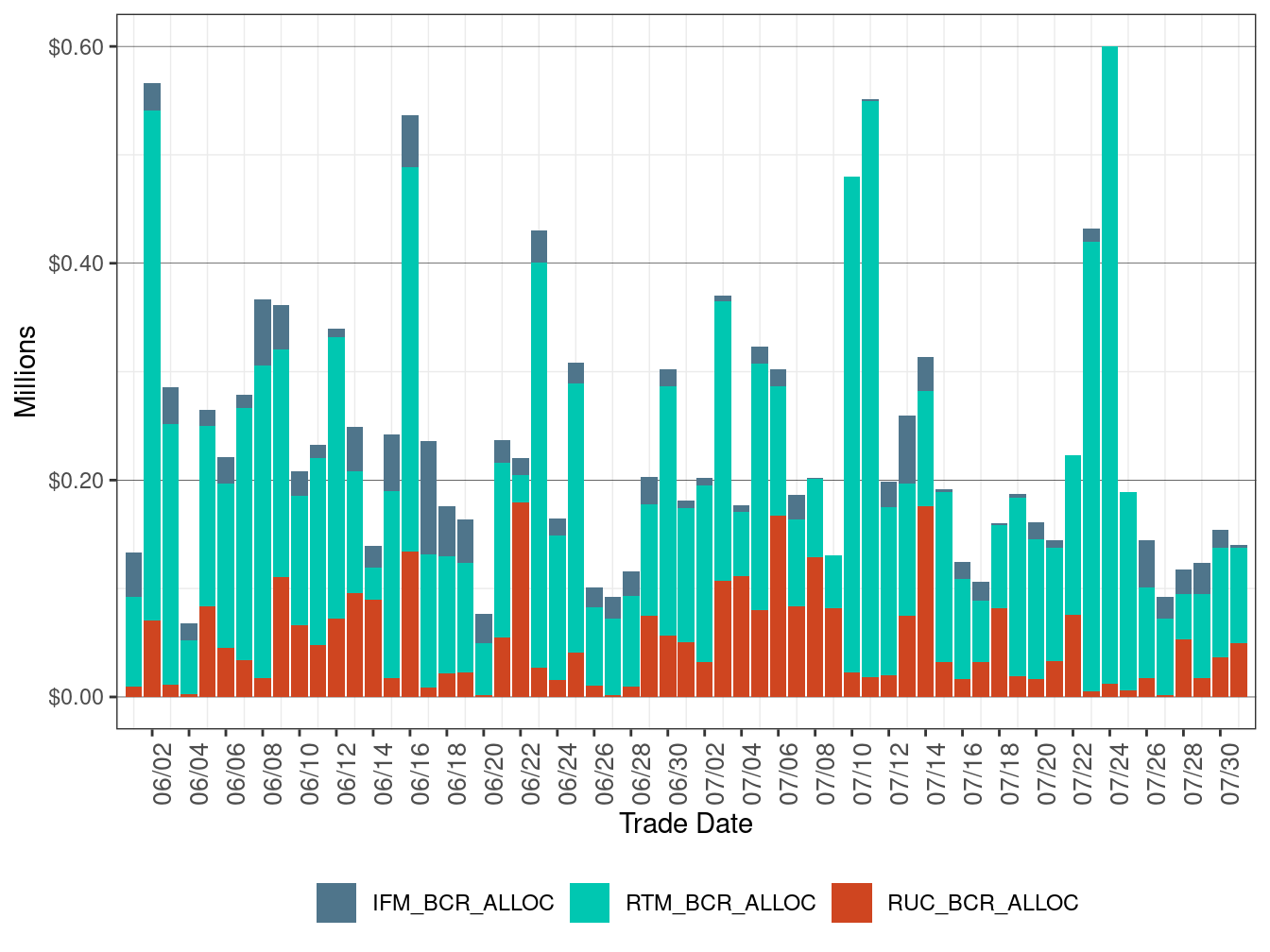

Figure 14 shows the allocation of bid cost recovery payment in the IFM, residual unit commitment (RUC) and RTM markets.

The total bid cost recovery for July edged down to $7.25 million from $7.32 million in the previous month. Out of the total monthly bid cost recovery payment for the three markets in July, the IFM market contributed 6 percent, RUC contributed 23 percent, and RTM contributed 71 percent of the total bid cost recovery payment.

Figure 14: Bid Cost Recovery Allocation by Market

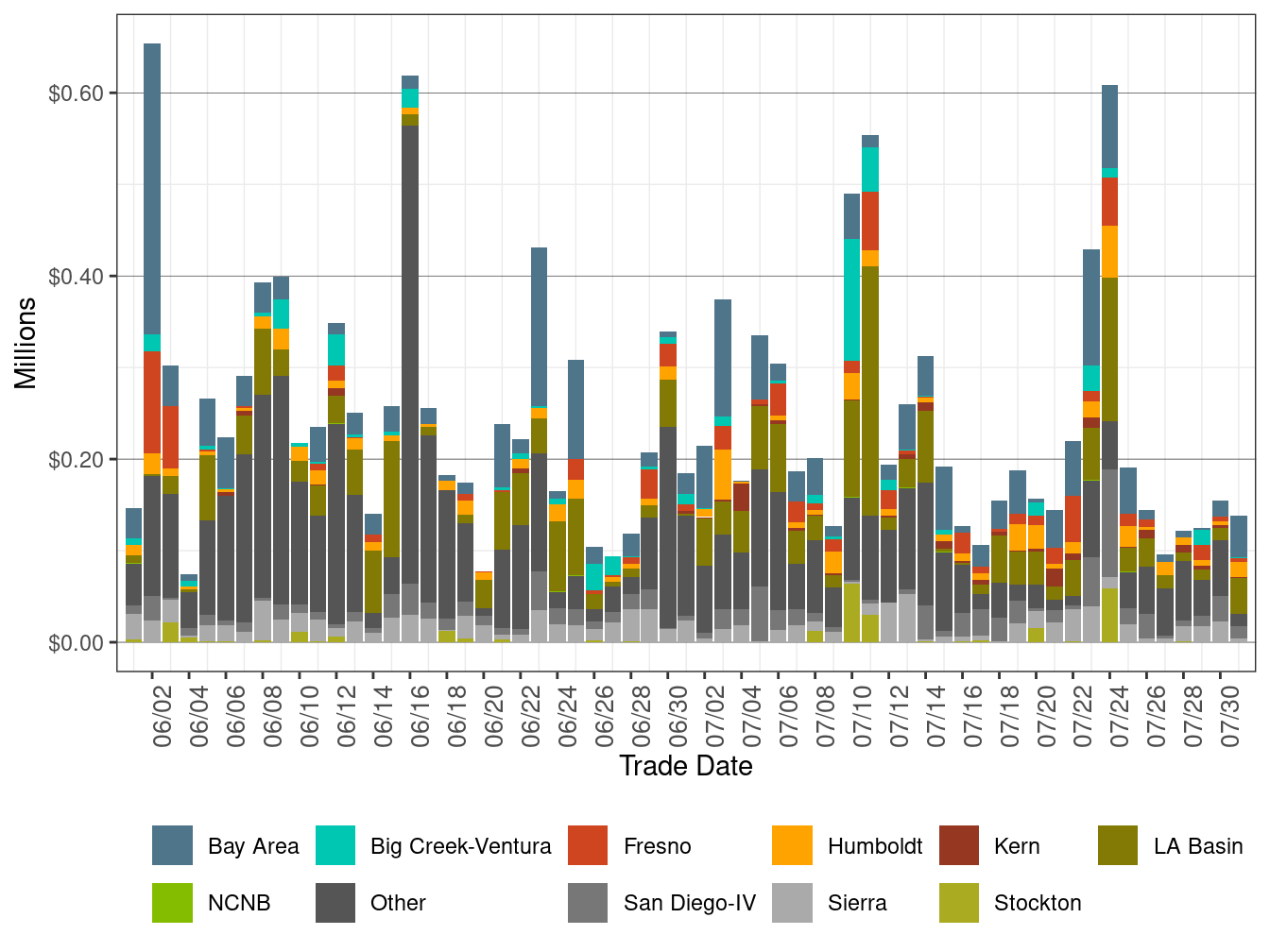

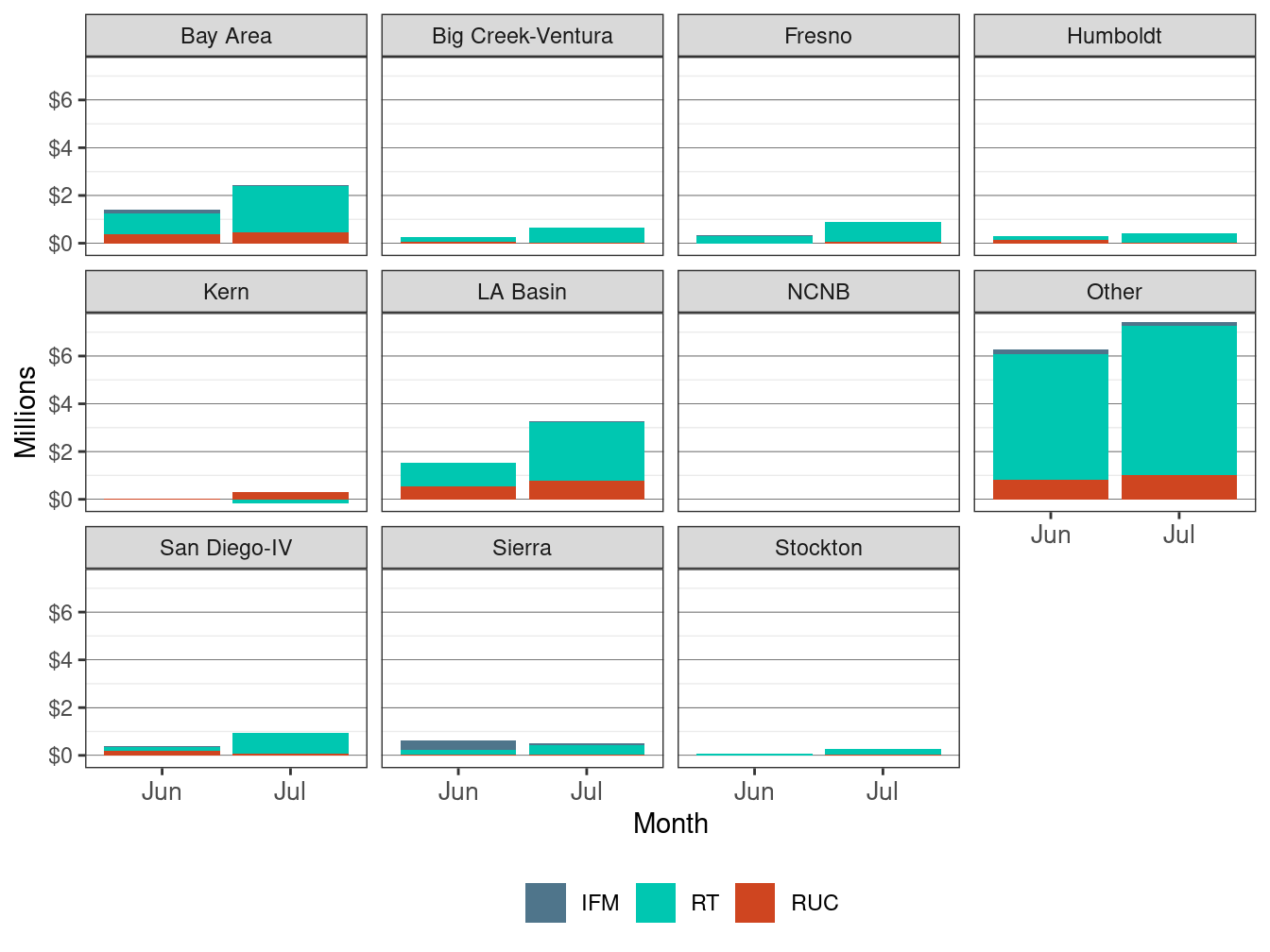

Figure 15 shows daily BCR allocation across the IFM, RUC and RTM markets by local capacity requirement area (LCR). Figure 16 shows monthly BCR allocation in each of the IFM, RUC and RTM markets by LCR.

Figure 15: Bid Cost Recovery Allocation by LCR

Figure 16: Monthly Bid Cost Recovery Allocation by LCR and Market

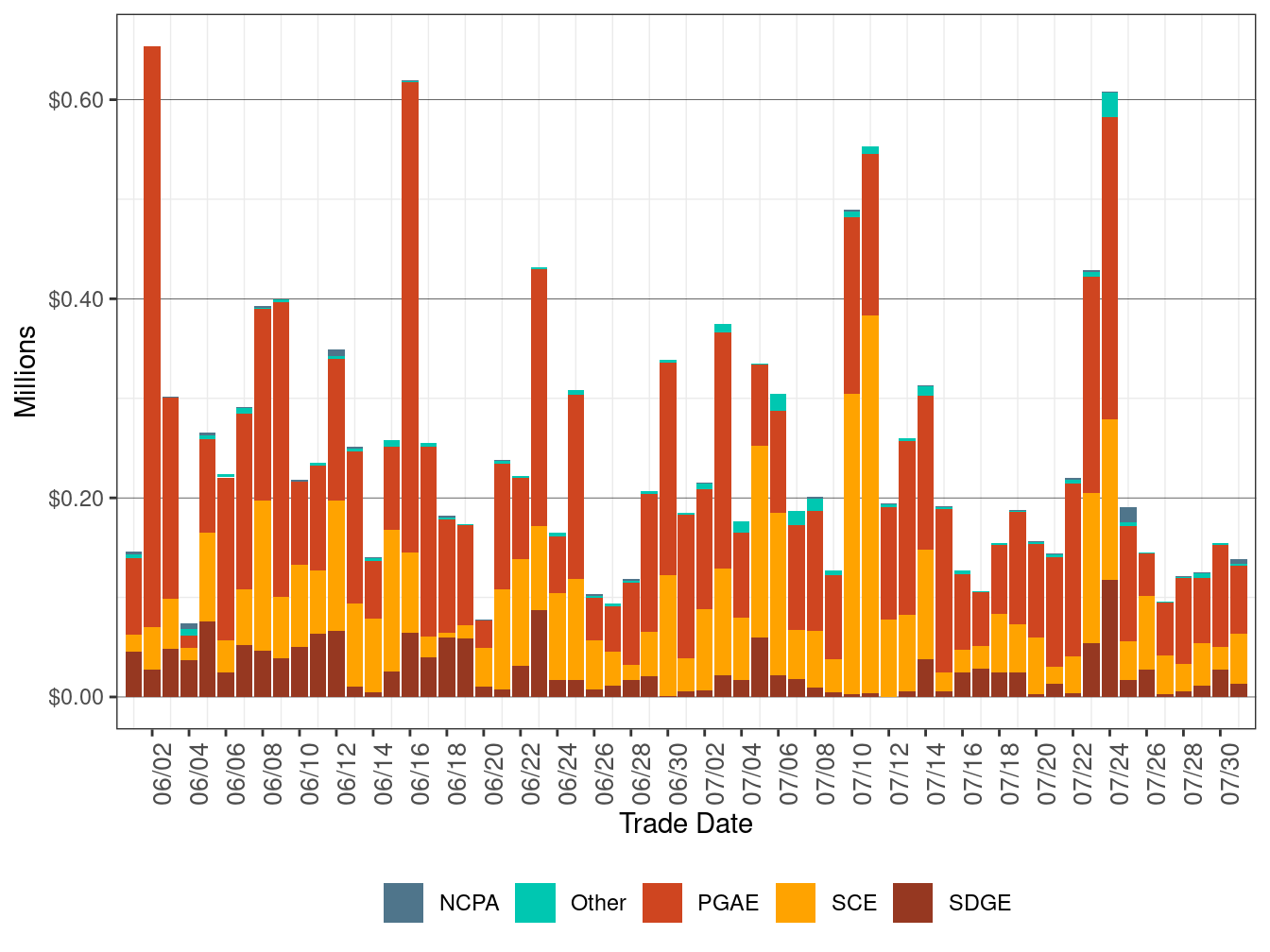

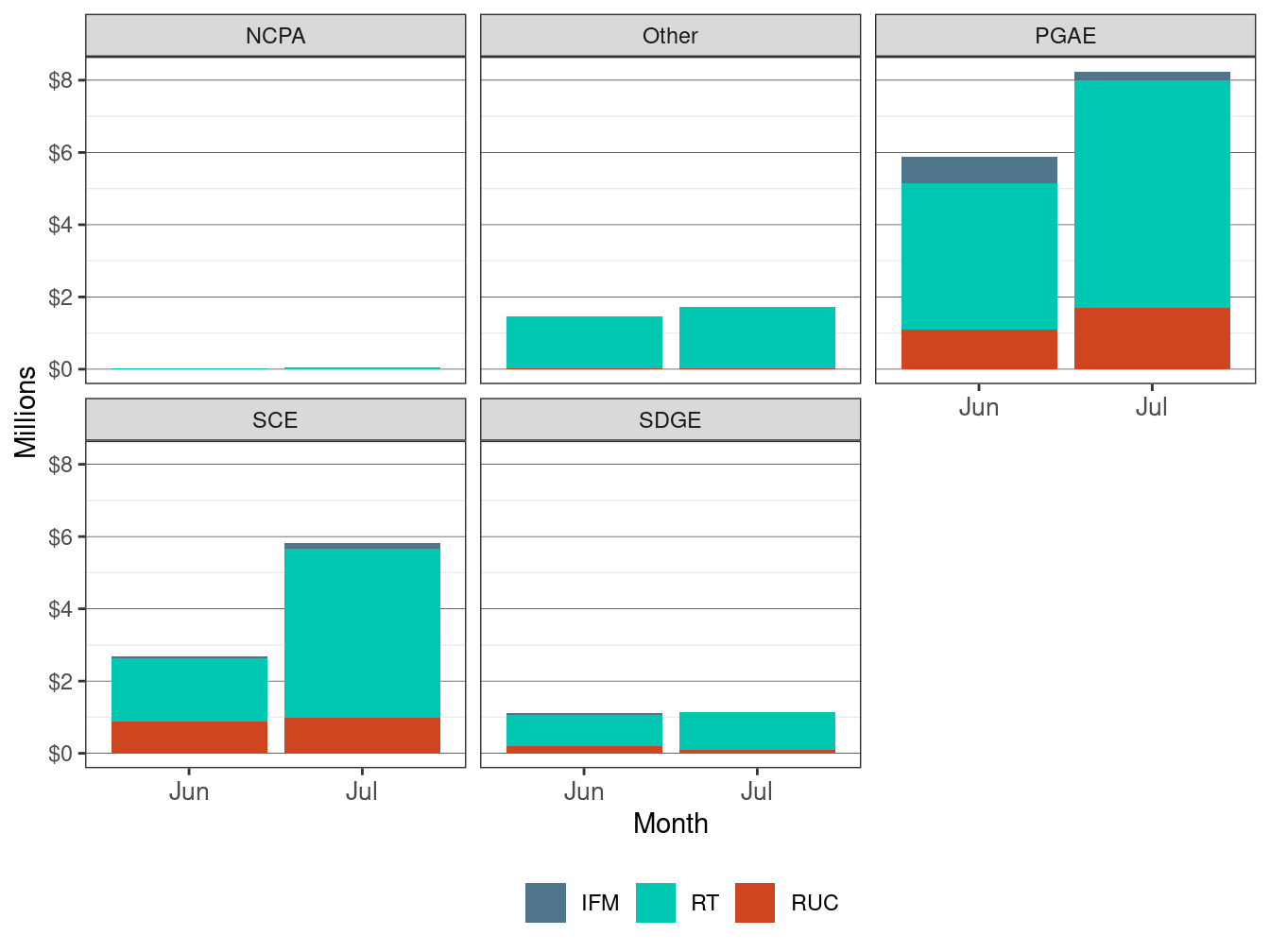

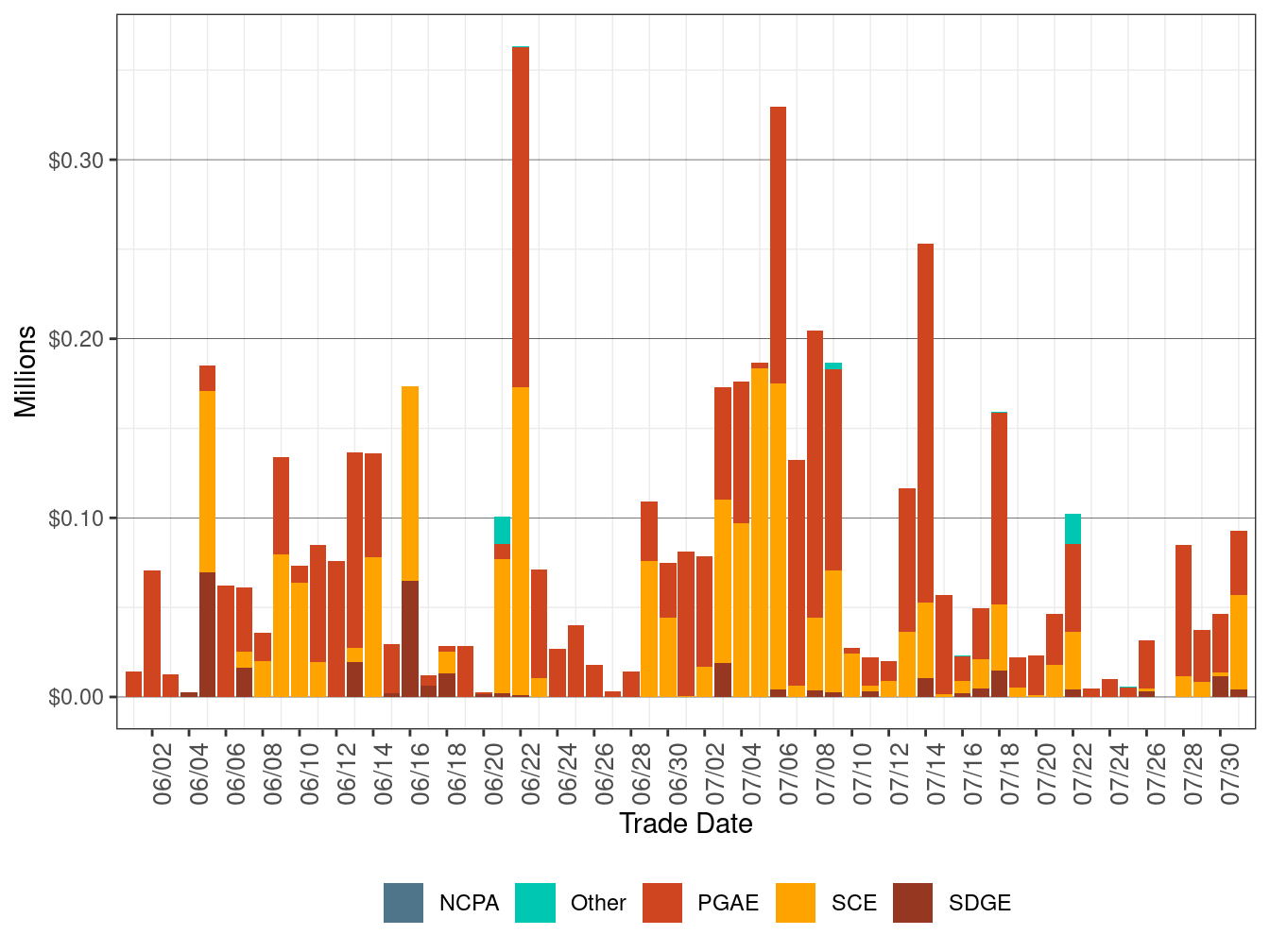

Figure 17 shows daily BCR allocation across the IFM, RUC and RTM markets by utility distribution company (UDC). Figure 18 shows monthly BCR allocation in each of the IFM, RUC and RTM markets by UDC.

Figure 17: Bid Cost Recovery Allocation by UDC

Figure 18: Monthly Bid Cost Recovery Allocation by UDC and Market

Cost in Residual Unit Commitment

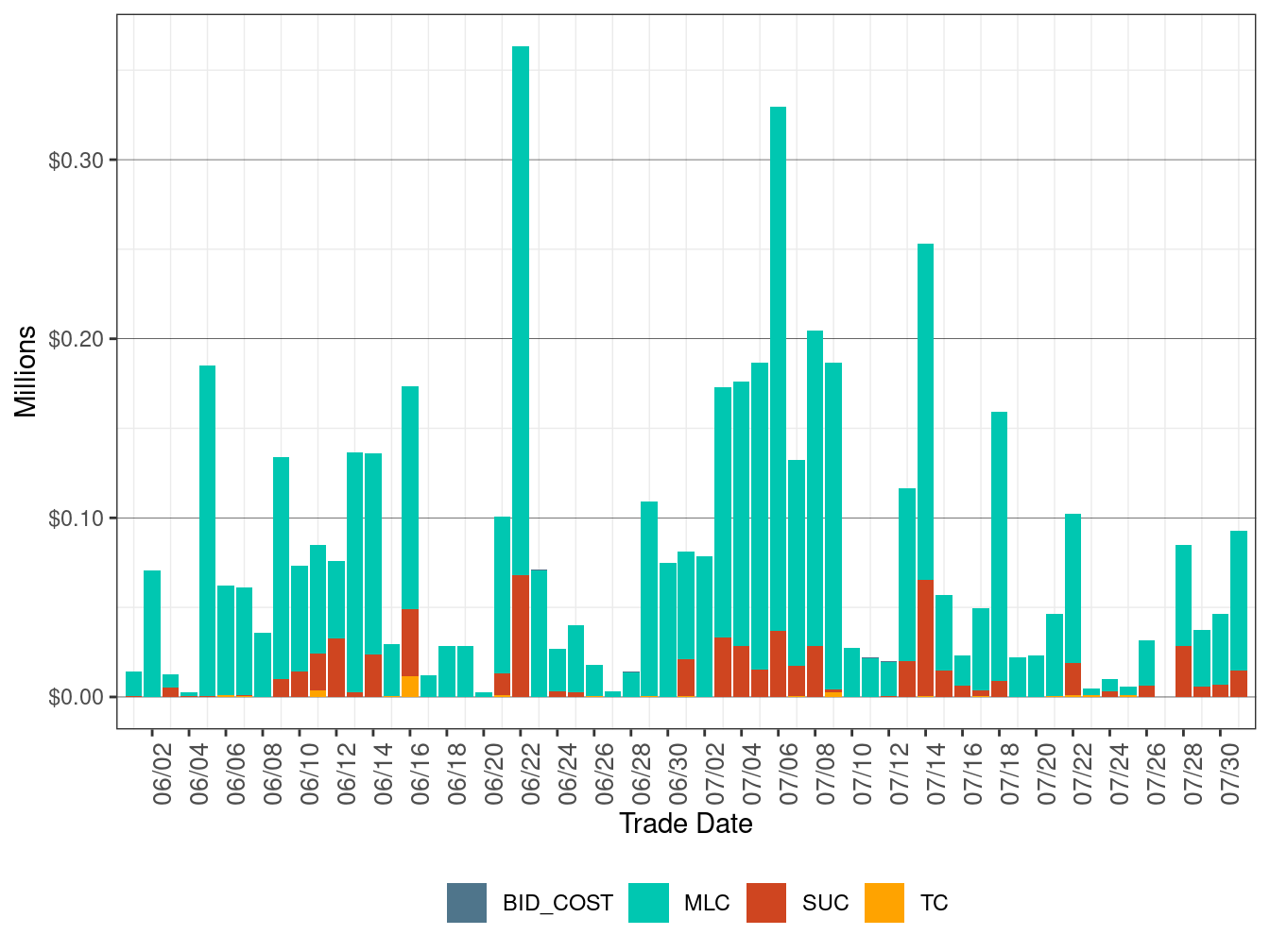

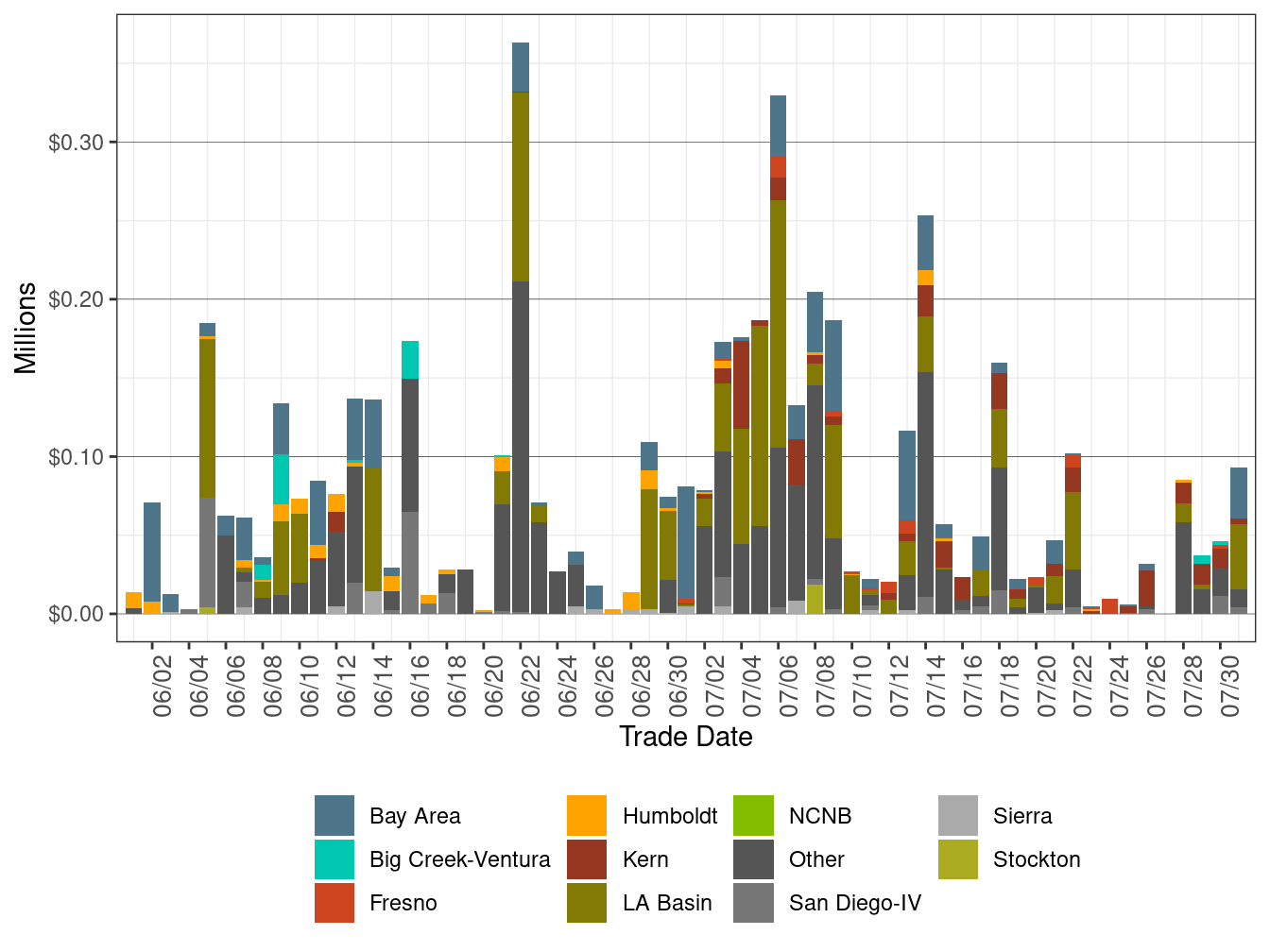

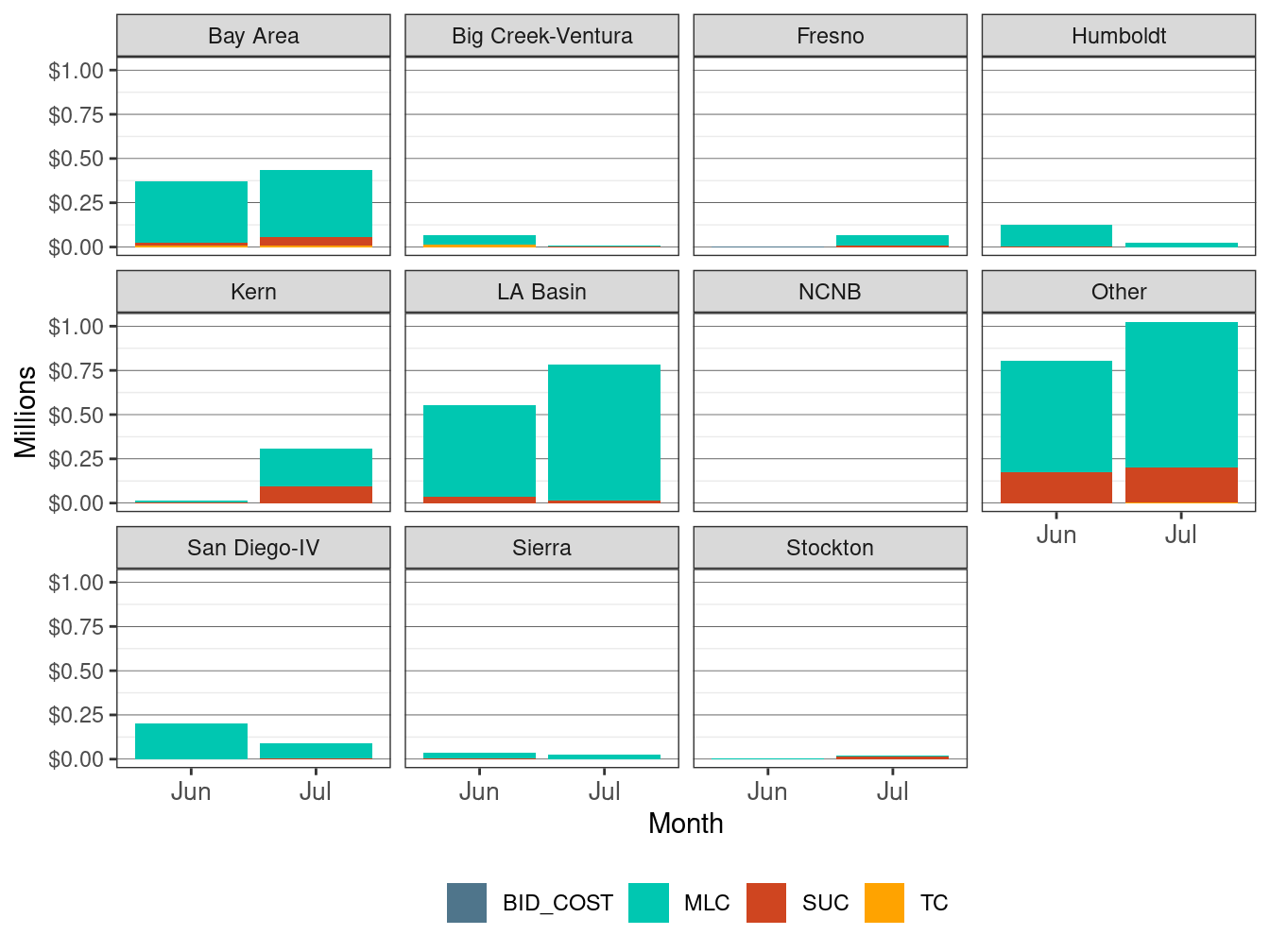

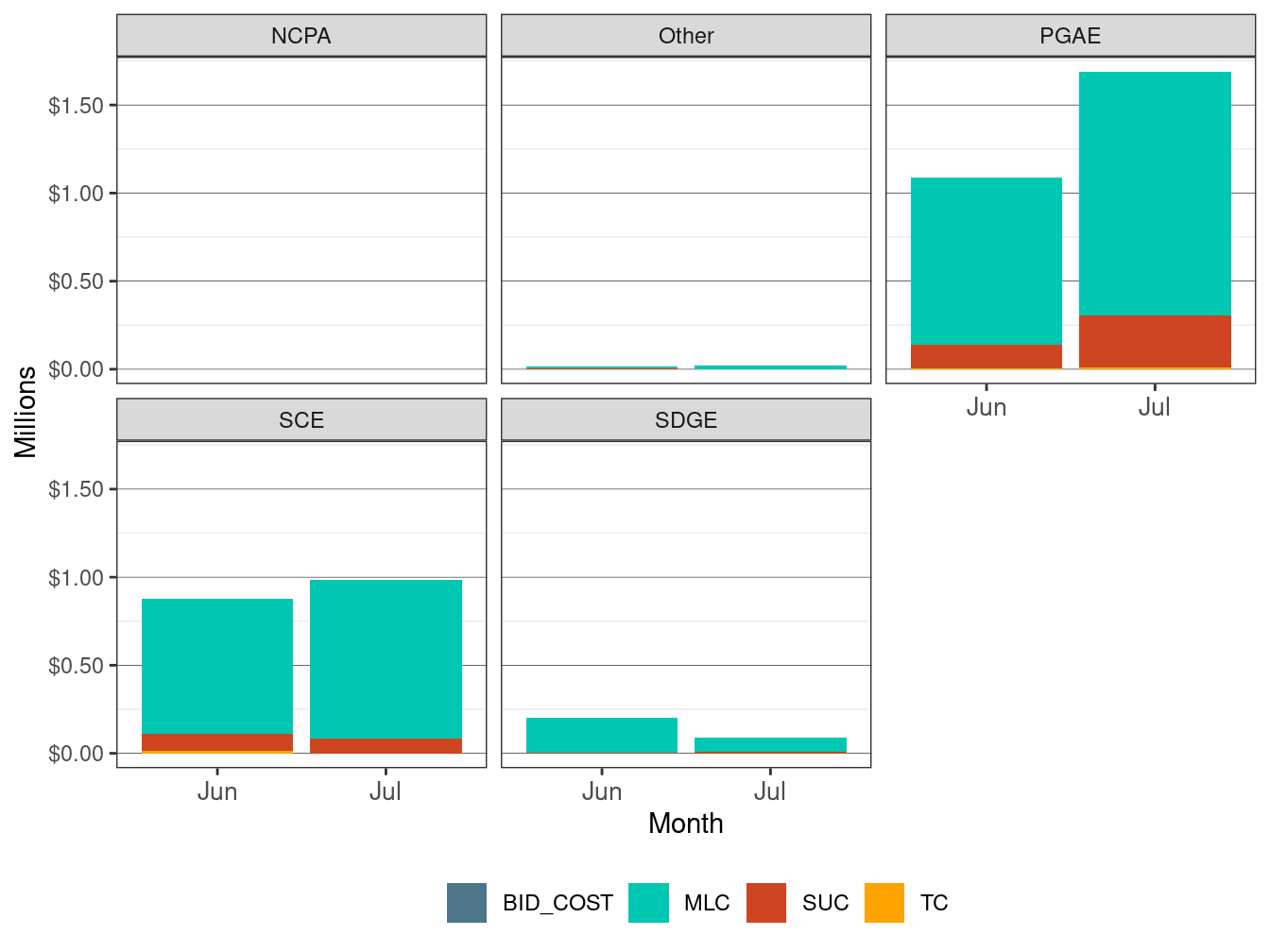

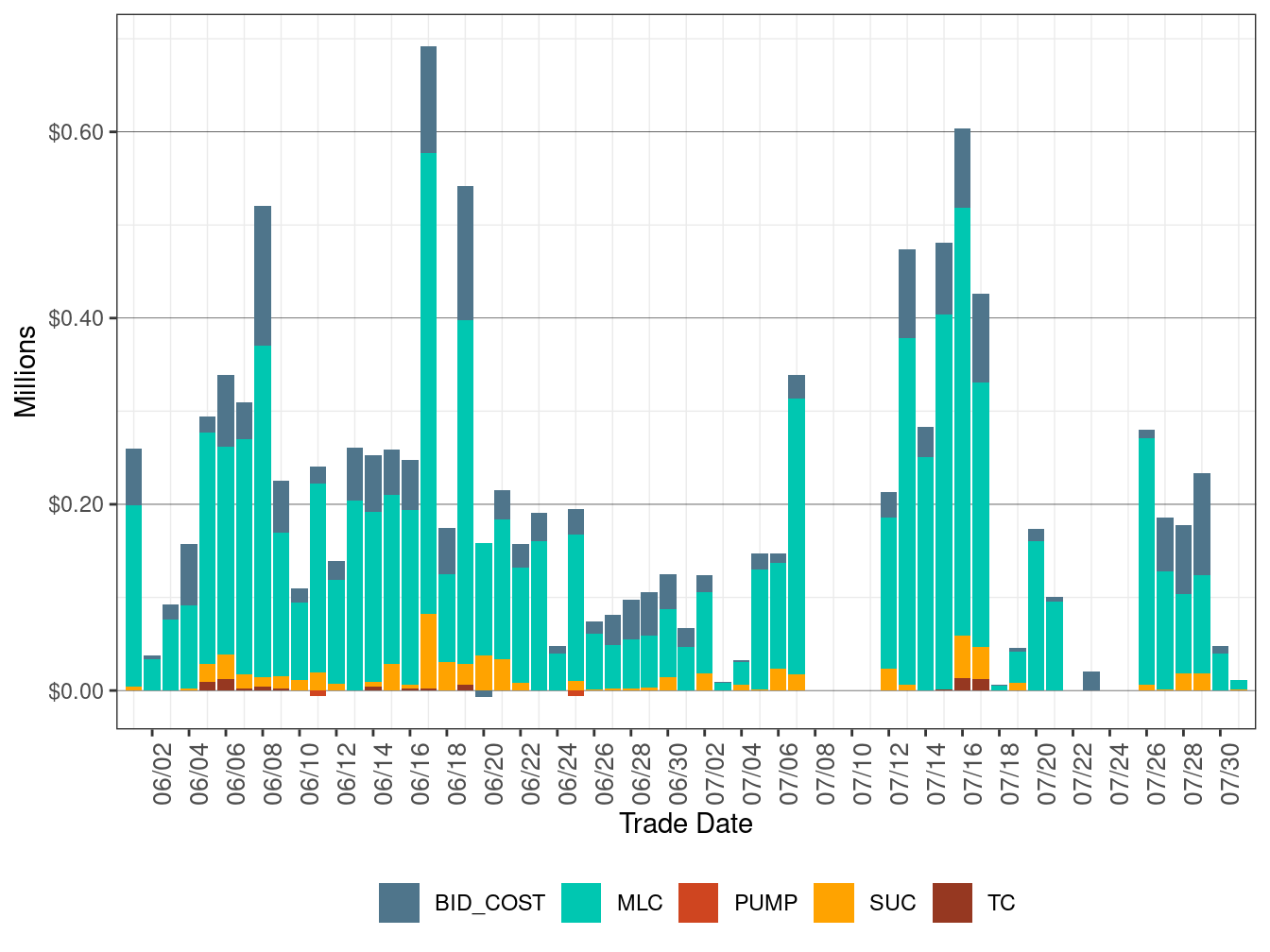

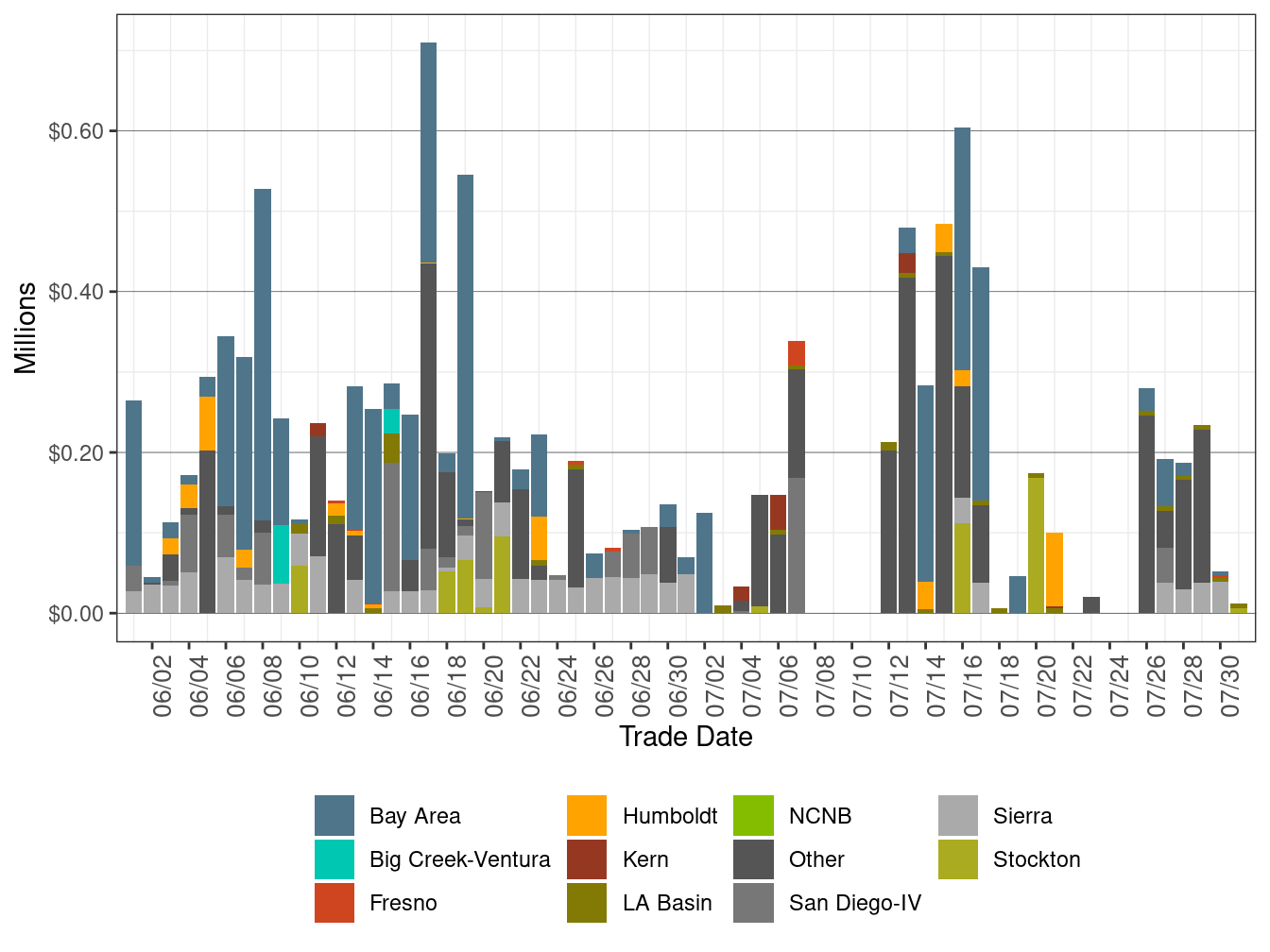

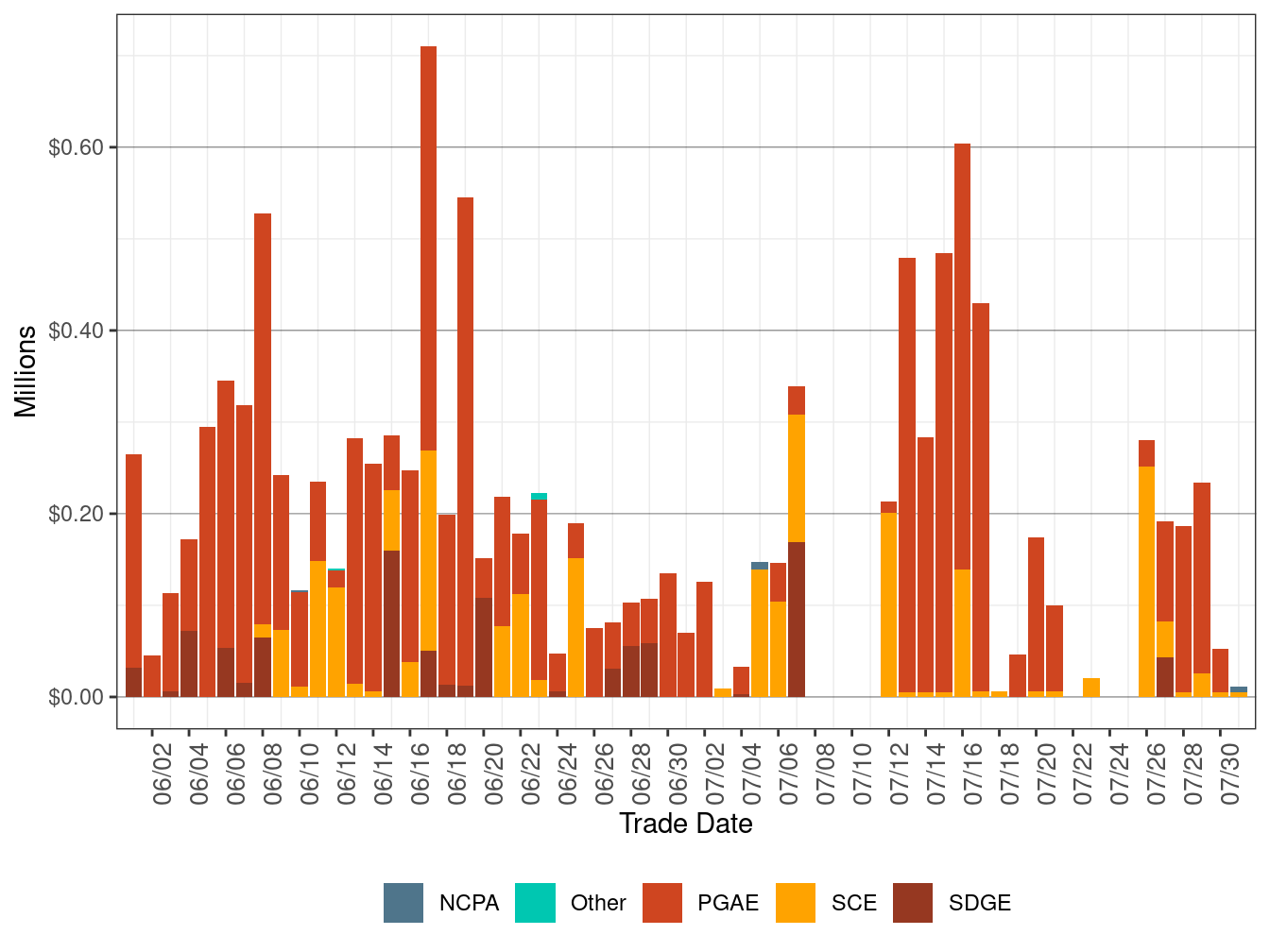

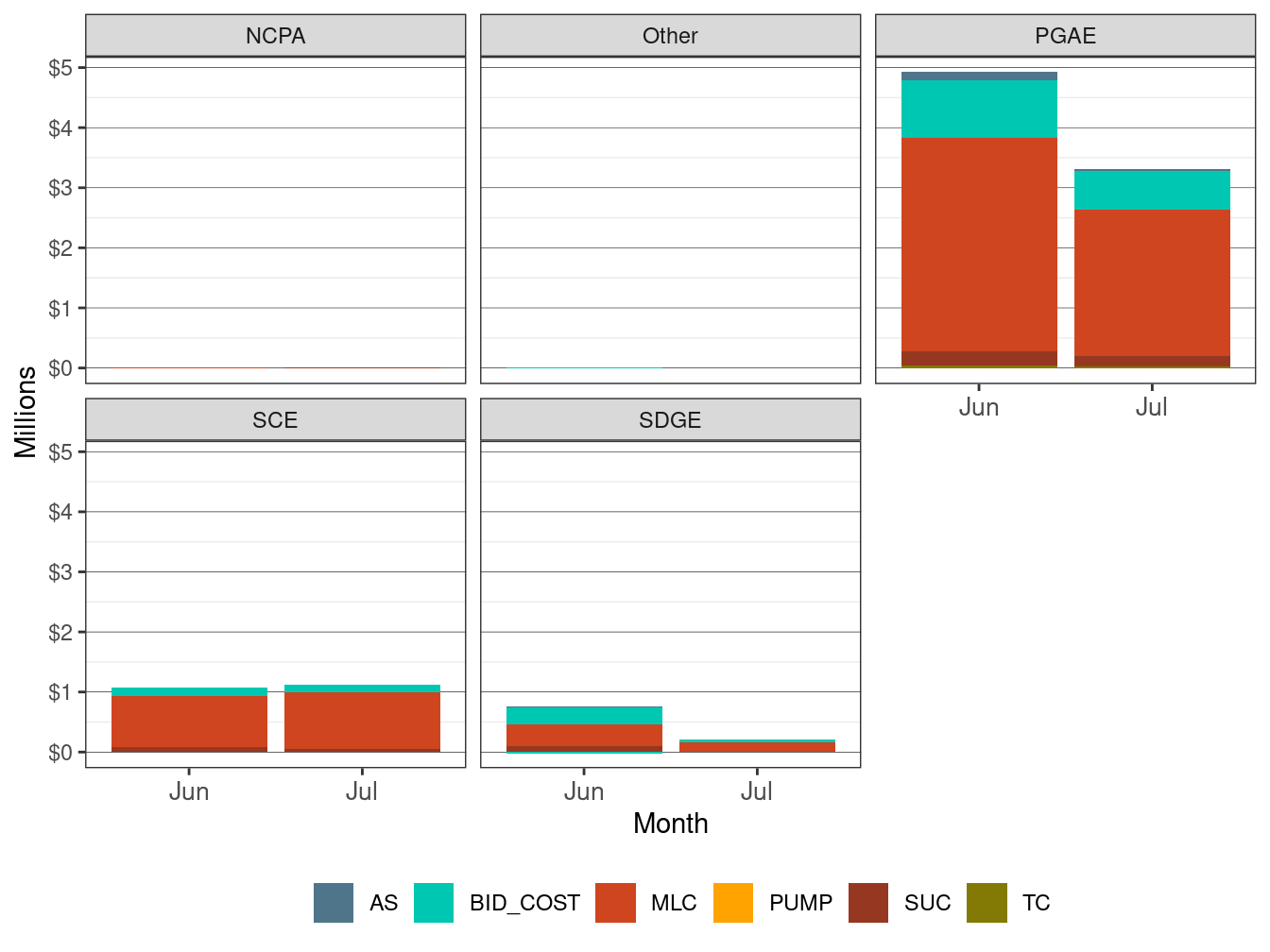

Figure 19 shows the daily bid cost recovery allocation in RUC by cost component: Bid Cost (BID_COST), Minimum Load Cost (MLC), Startup Cost (SUC), and Transition Cost (TC). Figure 20 shows daily BCR allocation in RUC by LCR. Figure 21 shows monthly BCR allocation in RUC by cost components and LCR. Figure 22 shows daily BCR allocation in RUC by UDC. Figure 23 shows monthly BCR allocation in RUC by cost components and UDC.

Figure 19: BCR Allocation in RUC by Cost Component

Figure 20: BCR Allocation in RUC by LCR

Figure 21: Monthly BCR Allocation in RUC by LCR and Cost Component

Figure 22: BCR Allocation in RUC by UDC

Figure 23: Monthly BCR Allocation in RUC by UDC and Cost Component

Cost in Real-Time

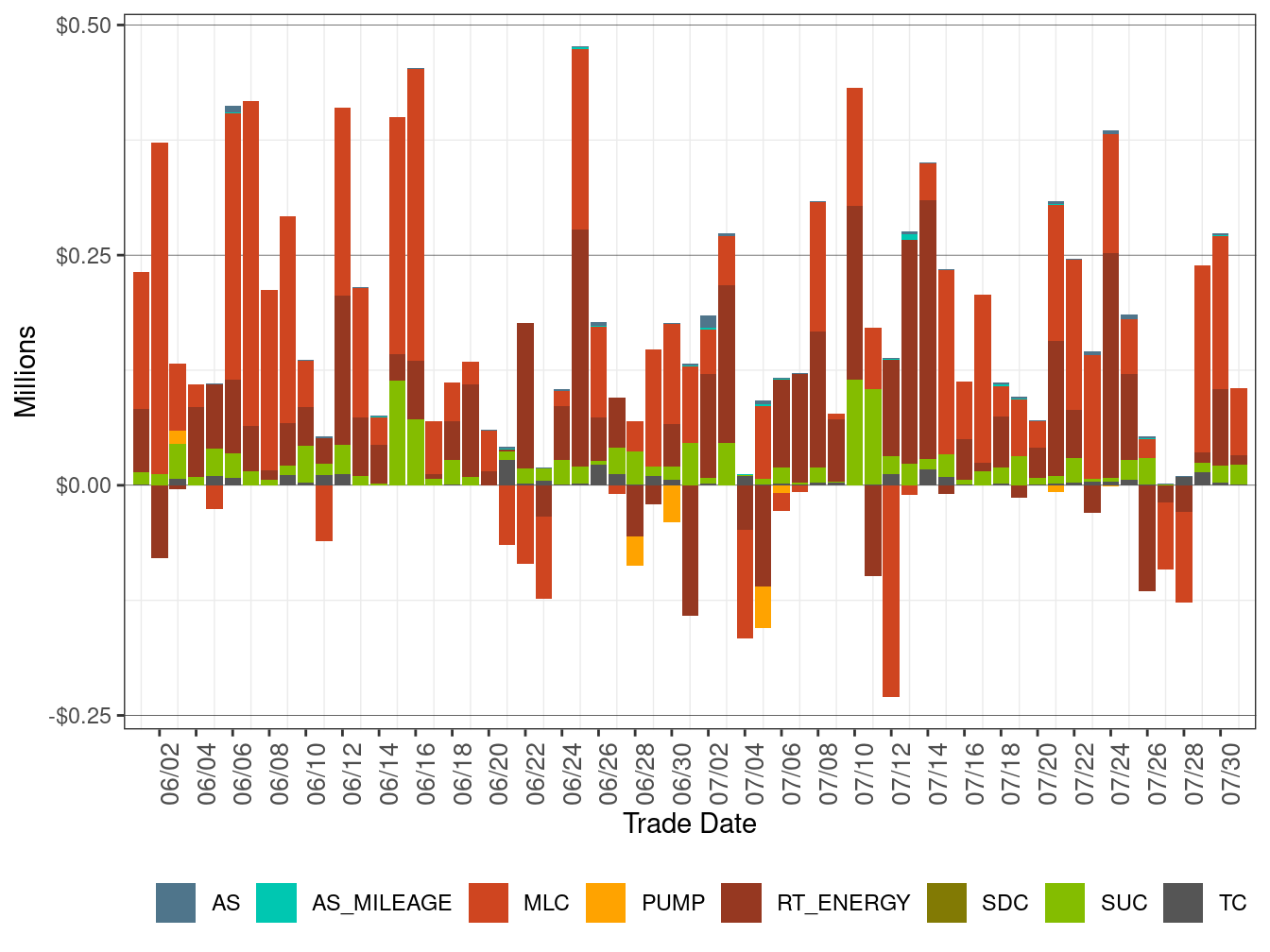

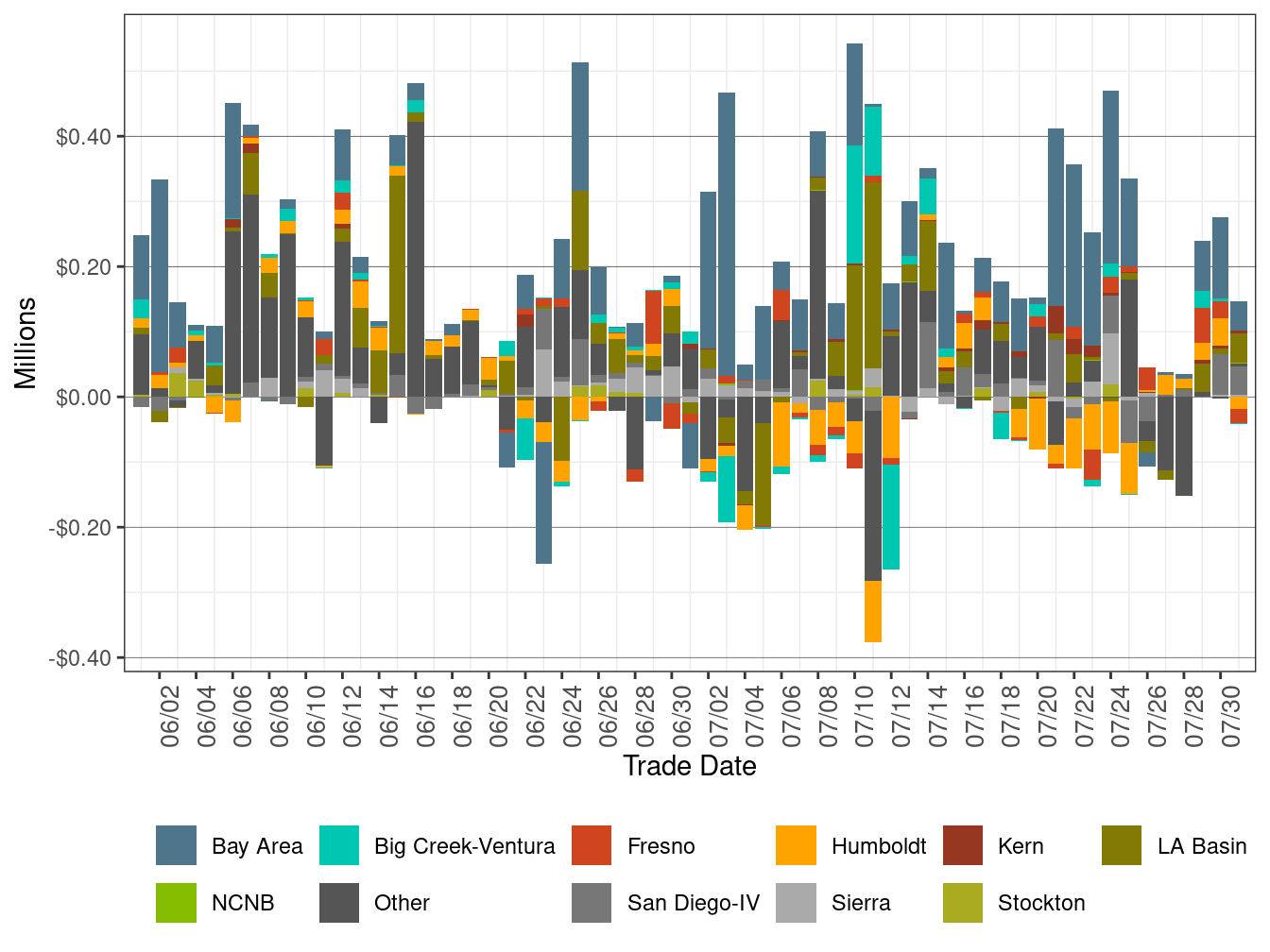

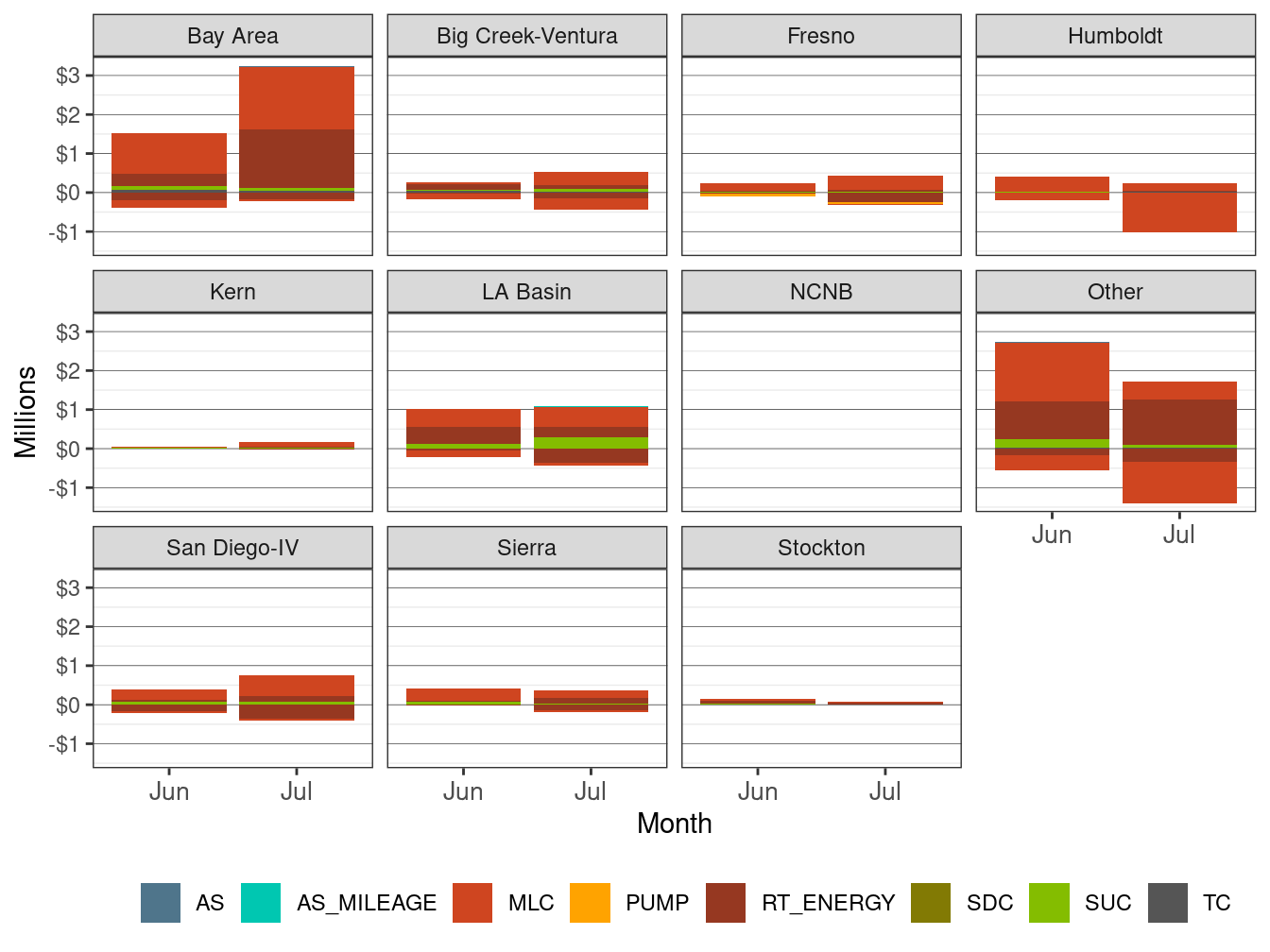

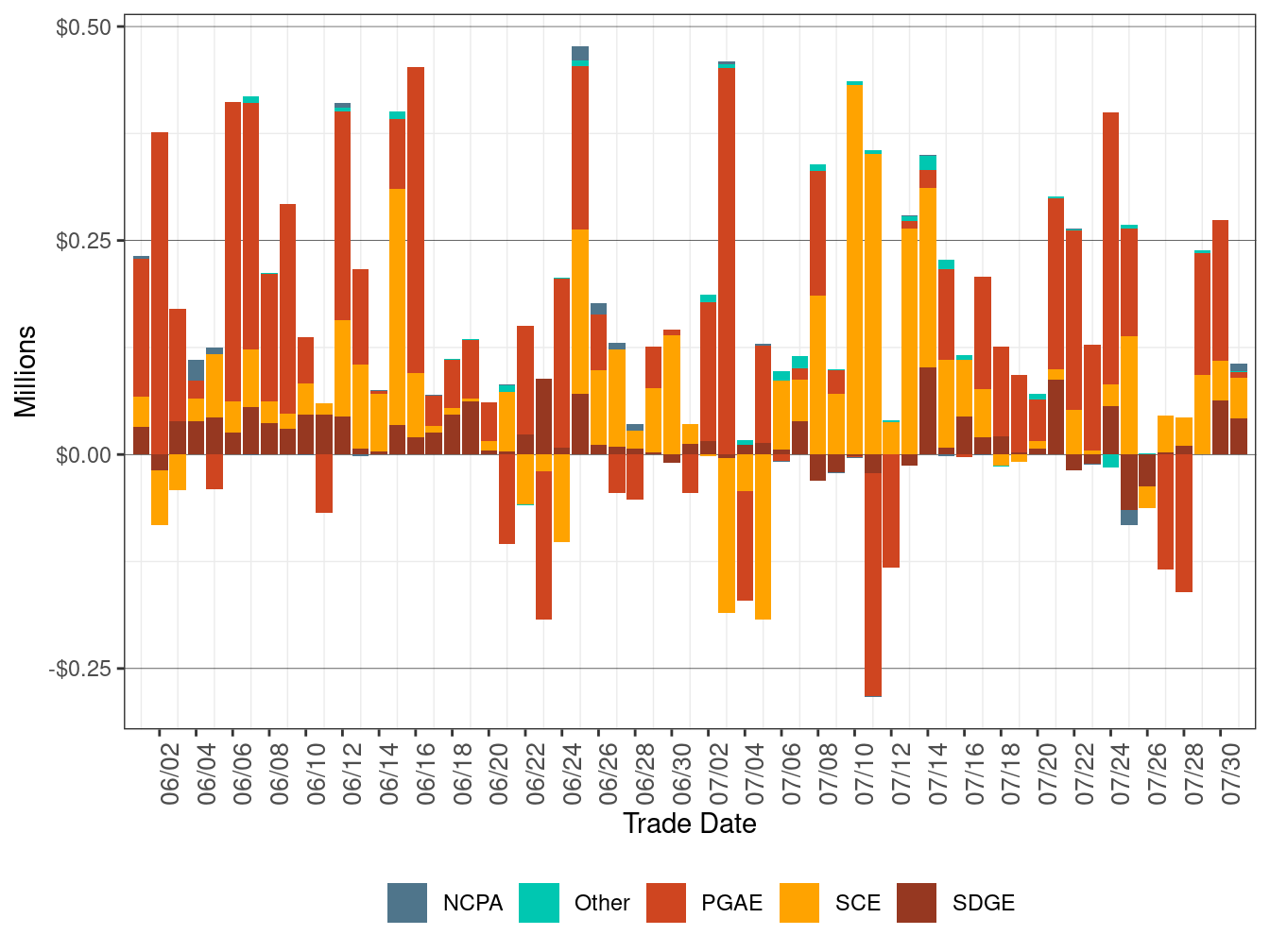

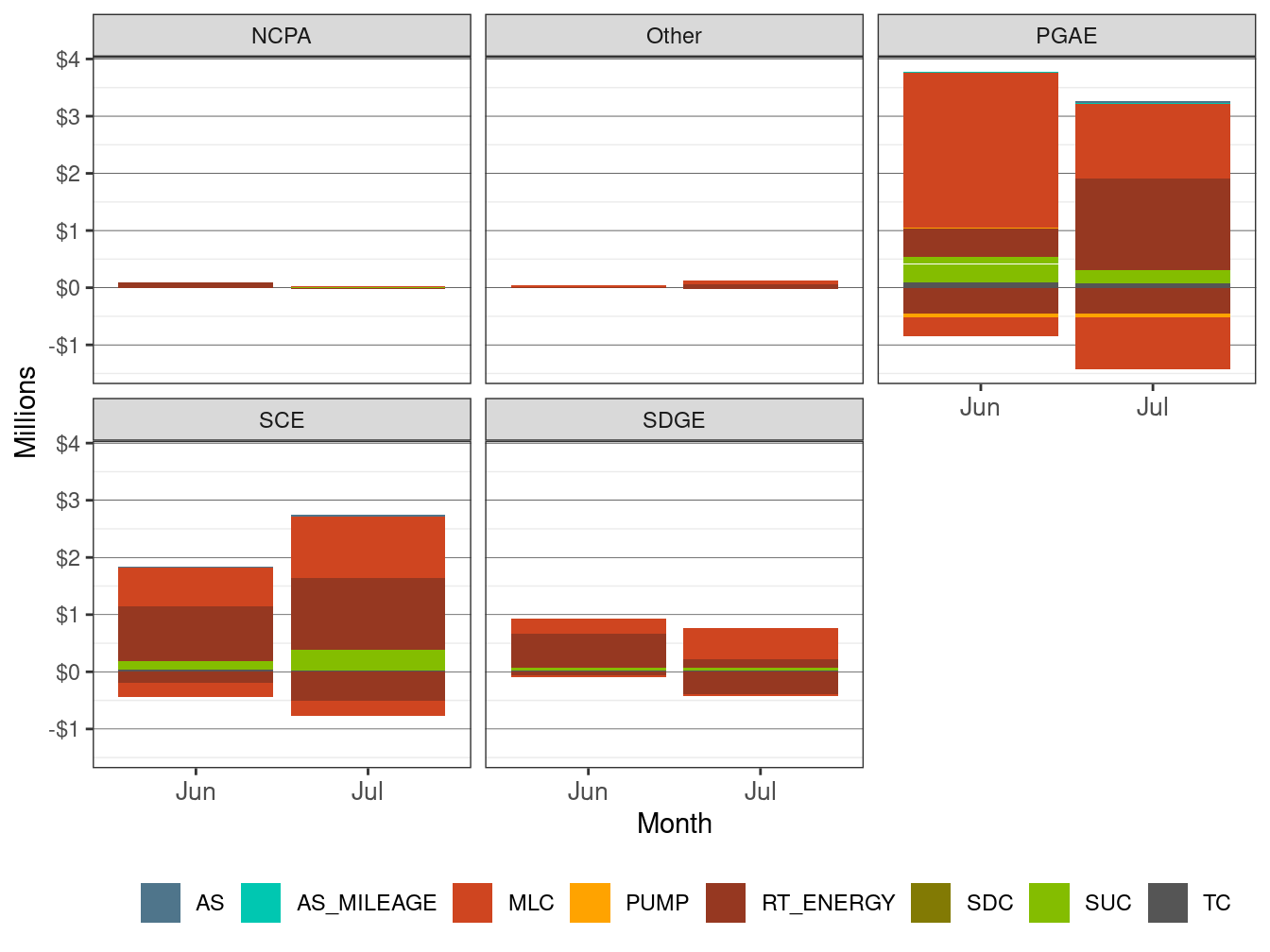

Figure 24 shows the daily bid cost recovery allocation in Real-Time (RT) by cost component: Ancillary Service (AS and AS_MILEAGE), Minimum Load Cost (MLC), Pumping Cost (PUMP), Energy (RT_ENERGY), Shutdown Cost (SDC), Startup cost (SUC) and Transition Cost (TC). Figure 25 shows daily BCR allocation in RT by LCR. Figure 26 shows monthly BCR allocation in RT by cost components and LCR. Figure 27 shows daily BCR allocation in RT by UDC. Figure 28 shows monthly BCR allocation in RT by cost components and UDC.

Figure 24: BCR Allocation in RT by Cost Component

Figure 25: BCR Allocation in RT by LCR

Figure 26: Monthly BCR Allocation in RT by LCR and Cost Component

Figure 27: BCR Allocation in RT by UDC

Figure 28: Monthly BCR Allocation in RT by UDC and Cost Component

Cost in Integrated Forward Market

Figure 29 shows the daily bid cost recovery allocation in IFM by cost component: Ancillary Service (AS), Bid Cost (BID_COST), Pump Cost (PUMP), Minimum Load Cost (MLC), Startup Cost (SUC), and Transition Cost (TC). Figure 30 shows daily BCR allocation in IFM by LCR. Figure 31 shows monthly BCR allocation in IFM by cost components and LCR. Figure 32 shows daily BCR allocation in IFM by UDC. Figure 33 shows monthly BCR allocation in IFM by cost components and UDC.

Figure 29: BCR Allocation in IFM by Cost Component

Figure 30: BCR Allocation in IFM by LCR

Figure 31: Monthly BCR Allocation in IFM by LCR and Cost Component

Figure 32: BCR Allocation in IFM by UDC

Figure 33: Monthly BCR Allocation in IFM by UDC and Cost Component

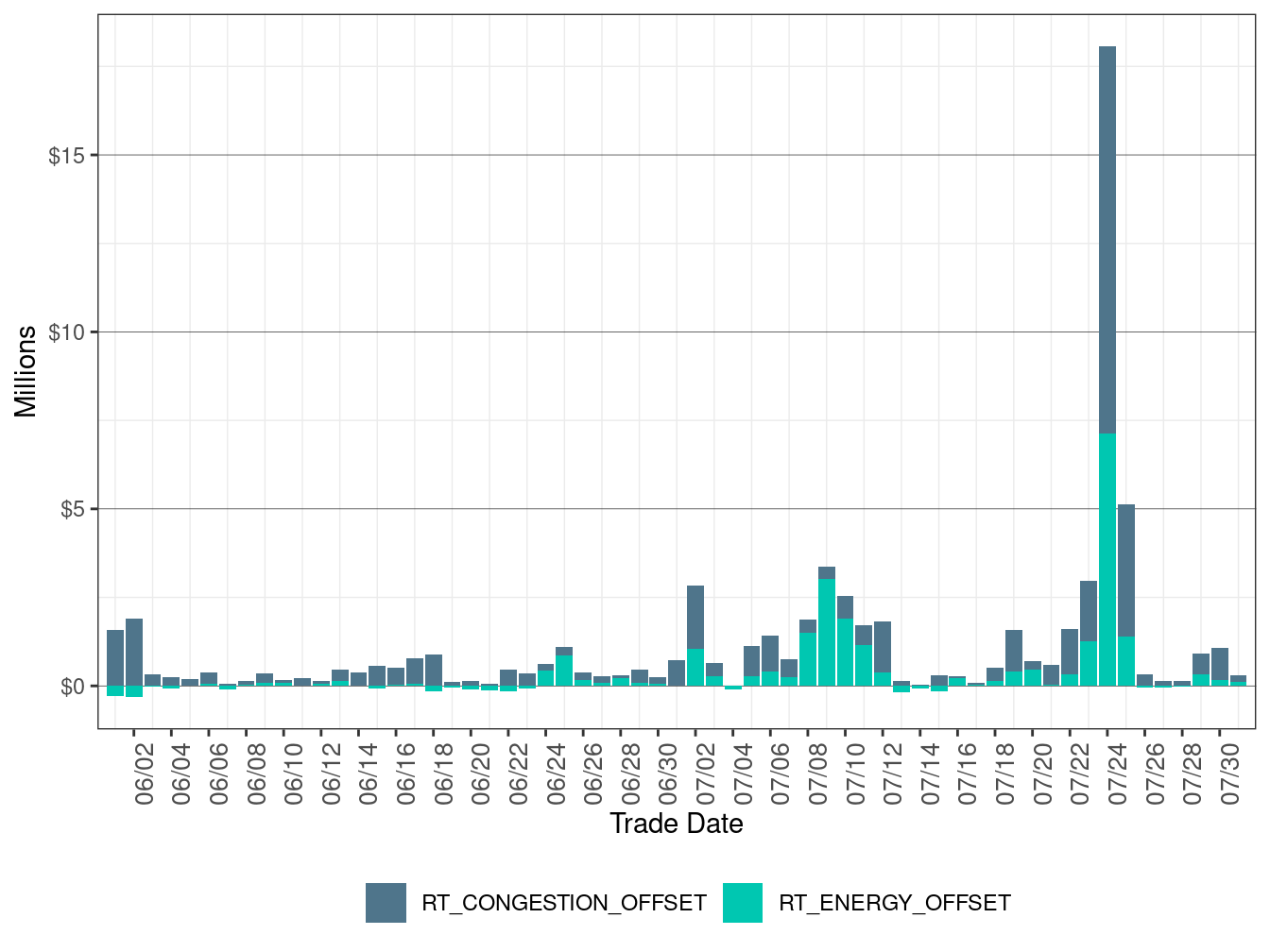

Real-Time Imbalance Offset Costs

The real-time imbalance offset cost is the difference between the total money paid by the CAISO and the total money collected by the CAISO for energy settled at real-time prices. Imbalance is driven by changes from the day-ahead market to the 15-minute market, or from the 15-minute market to the 5-minute market. The imbalance offset amounts can either be a net charge or a net payment to demand. Since the implementation of the new market within the California ISO system, the imbalance offset amount has been a charge to measured demand (physical load and exports) and is based on measured system demand. This settlement amount is mainly driven by the price divergence between the FMM and the RTD market and the use of average hourly price for the RT demand imbalance energy settlement.

Real-time imbalance offset costs consist of three elements, namely: the real-time congestion imbalance offset, real-time loss imbalance offset and the real-time imbalance energy offset.

The real-time congestion imbalance offset charge (RTCIO) is defined as the real-time congestion fund net of the real-time congestion credit calculated as provided in tariff section 11.5.4. In other words, the real-time congestion offset amount is the difference between the total congestion revenue paid out in the real-time market and the total congestion revenue collected from the real-time market for both energy and ancillary services. The real-time market includes both the hour-ahead scheduling process (HASP) and RTD market. The real-time congestion offset (CC 6774) is allocated to all scheduling coordinators based on measured demand, excluding demand associated with existing transmission rights (ETC), transmission ownership rights (TOR) or converted rights (CVR) self-schedules for which IFM and RTM congestion credits were provided.

The real-time loss imbalance offset is the difference between loss revenue paid out in the real-time market and the loss revenue collected in the real-time market. This real-time loss offset is allocated to all scheduling coordinators based on measured demand, excluding demand associated with TOR self-schedules. The imbalance loss offset is captured as part of the imbalance energy offset.

The real-time imbalance energy offset (RTIEO) is a residual calculation. The settlement amounts for the instructed imbalance energy (IIE), uninstructed imbalance energy (UIE), and unaccounted for energy (UFE) are summed up; this value represents the real-time imbalance revenue. The real-time congestion offset and the real-time loss offset are both subtracted from the real-time imbalance revenue; and the resultant residual value is known as the RTEIO. The RTIEO is allocated to all scheduling coordinators based on a pro-rata share of their measured demand, excluding demand quantity for the valid and balanced portion of TOR contracts and self-schedules in real-time. The real-time imbalance energy offset allocation is the same as the real-time loss offset allocation.

Figure 34 shows the daily RTIEO and RTCIO for CAISO. A positive value indicates a charge to measured demand and a negative value indicates a payment to measured demand.

RTIEO rose to $21.56 million in July from $0.87 million in the previous month. RTICO in July increased to $31.44 million from $11.29 million in the previous month.

Figure 34: ISO RTCO And RTIEO

Exceptional Dispatch Uplift Costs

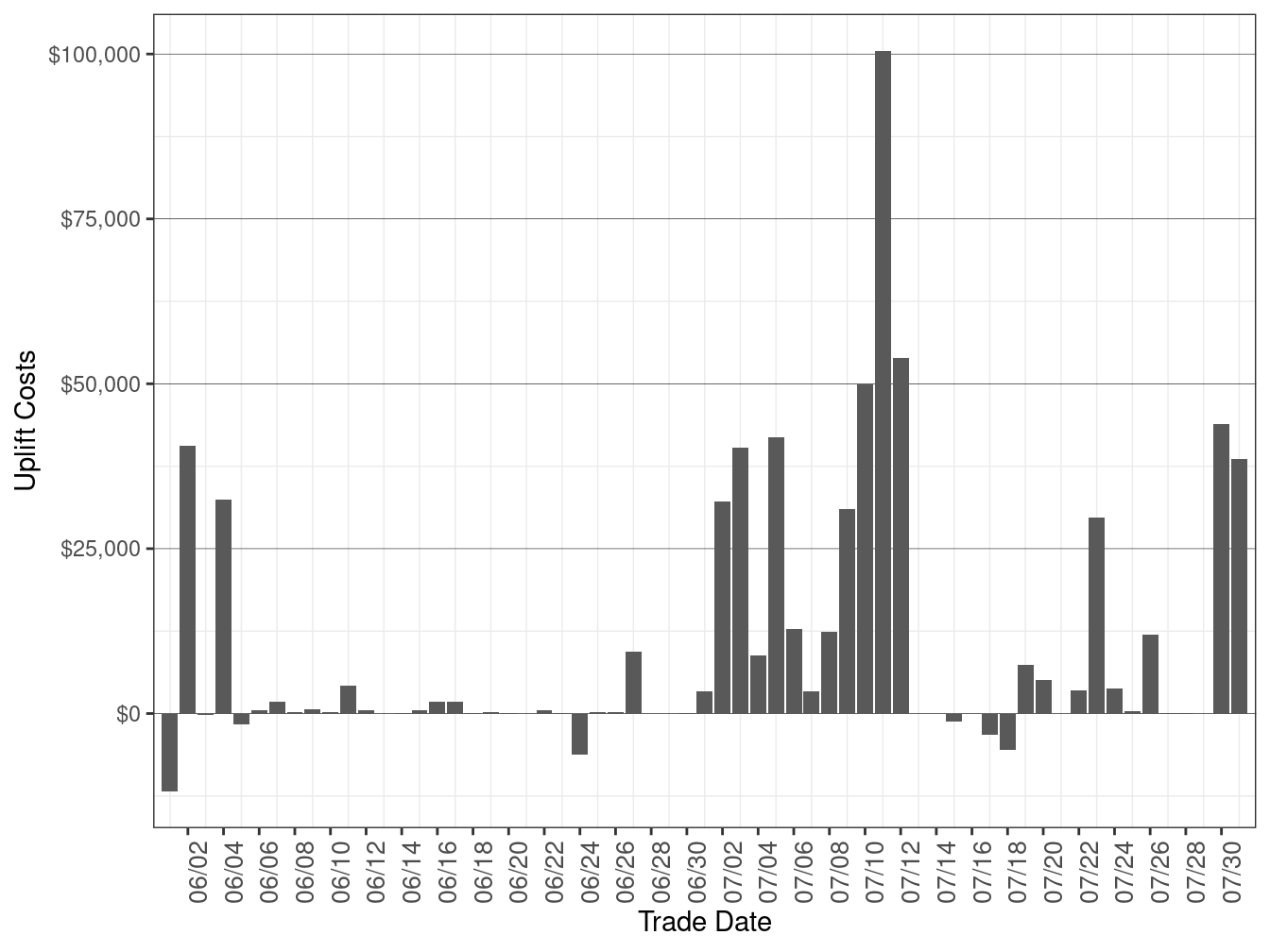

Figure 35 shows the daily exceptional dispatch uplift payments which include the sum of the charge codes 6482, 6488, and 6470.

The monthly uplift payments in July increased to $525,040 from $75,682 in the previous month.

Figure 35: Daily Exceptional Dispatch Uplift Costs