A new way of allocating congestion revenues for EDAM

The California Independent System Operator’s (ISO) Board of Governors and the Western Energy Markets Governing Body have jointly approved changing how congestion revenues will be allocated across the Extended Day-Ahead Market (EDAM) footprint.

Ratified unanimously at their meeting on Thursday, the targeted and narrowly tailored change was proposed in an expedited stakeholder initiative following issues raised earlier this year by several participants in PacifiCorp’s Federal Energy Regulatory Commission (FERC) tariff filing for joining EDAM when it becomes operational next spring.

A number of Board and Governing Body members stressed that the approved change is transitional, and that additional analysis will be done with stakeholders to craft a more sustainable process of allocating congestion revenues long term. Much of that analysis, with various simulated scenarios studied, will be done before EDAM launches next spring, with more refinement as needed through the stakeholder process after the market is operational.

“The rigor and transparency of this analysis is in all of our self-interest,” said Elliot Mainzer, the ISO’s president and CEO. “We all want the most efficient, deepest, most equitable dispatch we can have. Those are the goals of EDAM and we are absolutely committed to that and looking forward to sharing that information on a disaggregated basis with stakeholders.”

Rebecca Wagner, incoming chair of the Western Energy Markets Governing Body, reiterated the commitment to additional analysis now that the transitional change is in place so EDAM can launch next May as planned.

“I appreciate the commitment to working toward a long-term solution, the commitment to monitoring. We have a top-notch Department of Market Monitoring as well as staff and outstanding stakeholders who will be keeping their eye on this as we move forward,” she said.

“We have a plan. We have a path. It’s a prudent path. It’s reasonable and I want us to turn this page so that we can start doing the analysis as proposed by MSC (the ISO’s independent Market Surveillance Committee) and our market expert, and really start to become laser focused on implementation.”

Congestion revenues are generated when transmission line congestion impacts energy prices. Under the EDAM design approved by FERC in December 2023, the market operator would allocate congestion revenues to the EDAM balancing area where the transmission constraint that is generating congestion revenue is located.

The EDAM balancing area would then distribute the revenues to other market participants within its balancing area under the terms of its tariff. That same method has been used in the Western Energy Imbalance Market (WEIM) since its inception in 2014.

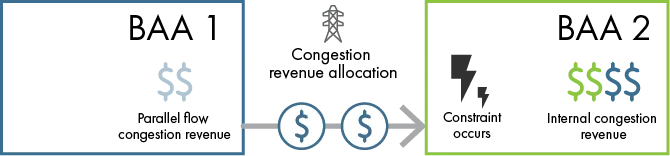

Current

All congestion revenue, including parallel flow resulting from a constraint, is allocated to BAA 2 where the constraint is located, even though BAA 1 is impacted.

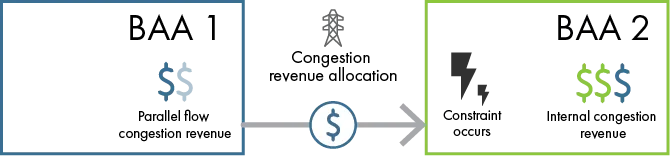

Transitional solution

Portion of parallel flow congestion revenue stays with BAA 1 due to transmission rights.

Due to the interconnected nature of transmission systems, market scheduled flows in one EDAM balancing area can contribute to congestion across transmission facilities in a neighboring EDAM balancing area, because of “parallel flows” as electricity takes the path of least resistance. These “parallel flows” can contribute to a rise in congestion prices at discrete affected generator and load locations.

With the approved change, a portion of the congestion revenues associated with parallel flows will be allocated to the EDAM balancing area where those revenues are collected rather than to the balancing area where the congestion occurs.

The proposal approved Thursday provides a commitment to, and a roadmap for, the continued analysis and evolution of near-term market design enhancements that can be implemented following additional stakeholder outreach and design efforts before and after EDAM is up and running. Any change must also be approved by FERC.

Overall, stakeholders have expressed support for the transitional design as a reasonable compromise to support EDAM’s timely launch, recognizing the need to continue to evolve the design informed by operational experience and additional analysis.

A number of stakeholders expressed appreciation for the ISO moving so quickly to address stakeholder concerns, with one commenting that it would prefer to see the longer-term design now rather than a transitional and evolutionary approach.

Kathy Anderson, senior manager for transmission and markets for Idaho Power, one of the utilities filing comments in the stakeholder initiative, voiced the utility’s support in a letter sent to the ISO Board of Governors and the Western Energy Markets Governing Body. Idaho Power has announced it is leaning toward joining EDAM.

“We appreciate the CAISO staff and stakeholders all coming together to look for a market design that is fair and equitable and look forward to the next phase as we move to a non-transitional long-term solution to this complex issue,” the Idaho Power letter says.

In its written comments, the Northwest & Intermountain Power Producers Coalition, (NIPPC), an organization that represents competitive electricity market participants in the Pacific Northwest and Intermountain region, called the new congestion revenue allocation process a “significant improvement.”

“While this ensures that customers with transmission rights on parallel paths impacted by a congestion constraint in a different (balancing authority area) will have an opportunity to share in congestion revenues collected from the market, NIPPC supports the proposal to pursue future enhancements . . .”

The ISO has committed to initiate the next phase of stakeholder processes ahead of EDAM’s launch next spring to explore near-term enhancements and a long-term design for congestion revenue allocation. The long-term discussion will take a more comprehensive look at how congestion revenues are allocated across the EDAM footprint, with the goal of delivering a recommendation within 12 to 24 months.